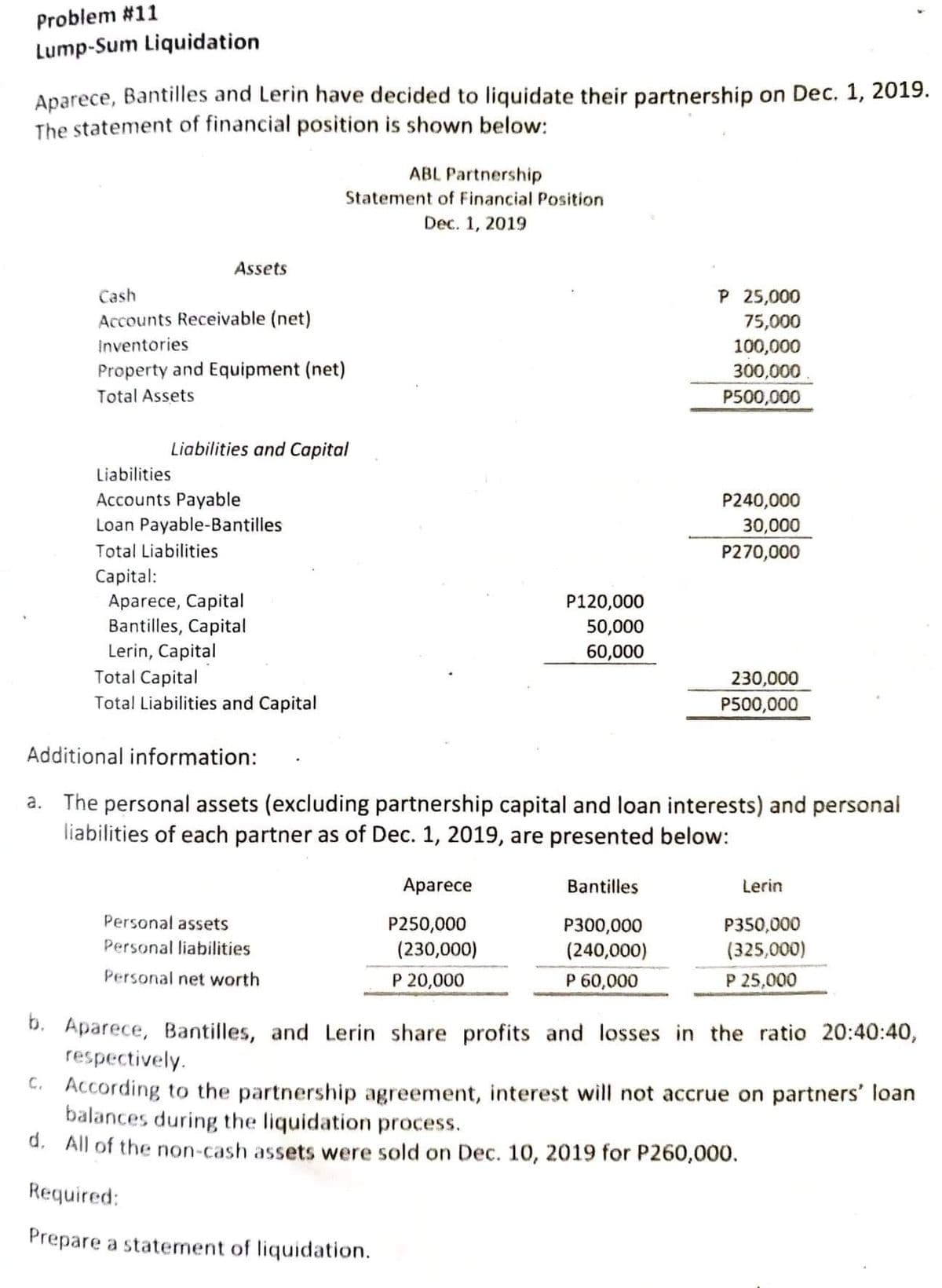

Problem #11 Lump-Sum Liquidation Aparece, Bantilles and Lerin have decided to liquidate their partnership on Dec. 1, 2019. The statement of financial position is shown below: ABL Partnership Statement of Financial Position Dec. 1, 2019 Assets Cash P 25,000 Accounts Receivable (net) 75,000 Inventories 100,000 300,000 Property and Equipment (net) Total Assets P500,000 Liabilities and Capital Liabilities Accounts Payable Loan Payable-Bantilles P240,000 30,000 Total Liabilities P270,000 Capital: Aparece, Capital Bantilles, Capital Lerin, Capital Total Capital Total Liabilities and Capital P120,000 50,000 60,000 230,000 P500,000 Additional information: a. The personal assets (excluding partnership capital and loan interests) and personal liabilities of each partner as of Dec. 1, 2019, are presented below: Aparece Bantilles Lerin Personal assets P250,000 (230,000) P300,000 P350,000 Personal liabilities (240,000) (325,000) Personal net worth P 20,000 P 60,000 P 25,000 D. Aparece, Bantilles, and Lerin share profits and losses in the ratio 20:40:40, respectively. C. According to the partnership agreement, interest will not accrue on partners' loan balances during the liquidation process. d. All of the non-cash assets were sold on Dec. 10, 2019 for P260,000. Required: Prepare a statement of liquidation.

Problem #11 Lump-Sum Liquidation Aparece, Bantilles and Lerin have decided to liquidate their partnership on Dec. 1, 2019. The statement of financial position is shown below: ABL Partnership Statement of Financial Position Dec. 1, 2019 Assets Cash P 25,000 Accounts Receivable (net) 75,000 Inventories 100,000 300,000 Property and Equipment (net) Total Assets P500,000 Liabilities and Capital Liabilities Accounts Payable Loan Payable-Bantilles P240,000 30,000 Total Liabilities P270,000 Capital: Aparece, Capital Bantilles, Capital Lerin, Capital Total Capital Total Liabilities and Capital P120,000 50,000 60,000 230,000 P500,000 Additional information: a. The personal assets (excluding partnership capital and loan interests) and personal liabilities of each partner as of Dec. 1, 2019, are presented below: Aparece Bantilles Lerin Personal assets P250,000 (230,000) P300,000 P350,000 Personal liabilities (240,000) (325,000) Personal net worth P 20,000 P 60,000 P 25,000 D. Aparece, Bantilles, and Lerin share profits and losses in the ratio 20:40:40, respectively. C. According to the partnership agreement, interest will not accrue on partners' loan balances during the liquidation process. d. All of the non-cash assets were sold on Dec. 10, 2019 for P260,000. Required: Prepare a statement of liquidation.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 14E

Related questions

Question

Sagot din po dito?

Transcribed Image Text:Problem #11

Lump-Sum Liquidation

Aparece, Bantilles and Lerin have decided to liquidate their partnership on Dec. 1, 2019.

The statement of financial position is shown below:

ABL Partnership

Statement of Financial Position

Dec. 1, 2019

Assets

P 25,000

75,000

100,000

300,000

P500,000

Cash

Accounts Receivable (net)

Inventories

Property and Equipment (net)

Total Assets

Liabilities and Capital

Liabilities

Accounts Payable

P240,000

Loan Payable-Bantilles

30,000

Total Liabilities

P270,000

Capital:

Aparece, Capital

Bantilles, Capital

Lerin, Capital

Total Capital

Total Liabilities and Capital

P120,000

50,000

60,000

230,000

P500,000

Additional information:

a. The personal assets (excluding partnership capital and loan interests) and personal

liabilities of each partner as of Dec. 1, 2019, are presented below:

Aparece

Bantilles

Lerin

Personal assets

P250,000

P300,000

P350,000

Personal liabilities

(230,000)

(240,000)

(325,000)

Personal net worth

P 20,000

P 60,000

P 25,000

D. Aparece, Bantilles, and Lerin share profits and losses in the ratio 20:40:40,

respectively.

C. According to the partnership agreement, interest will not accrue on partners' loan

balances during the liquidation process.

a. All of the non-cash assets were sold on Dec. 10, 2019 for P260,000.

Required:

Prepare a statement of liquidation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning