Problem 12-3 Analyzing a Source Document Use this partially completed payroll check stub to answer the questions. Th single and claims one allowance. Employee Pay Statement Detach and retain this statement. Eamings Deductions Period Ending Federal State Income Income Tax Social Regular Overtime Total Security Tax Med. Tax Hosp. Ins Tax 1/15/20-315.00 315.00

Problem 12-3 Analyzing a Source Document Use this partially completed payroll check stub to answer the questions. Th single and claims one allowance. Employee Pay Statement Detach and retain this statement. Eamings Deductions Period Ending Federal State Income Income Tax Social Regular Overtime Total Security Tax Med. Tax Hosp. Ins Tax 1/15/20-315.00 315.00

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter12: Preparing Payroll Records

Section: Chapter Questions

Problem 1CP

Related questions

Question

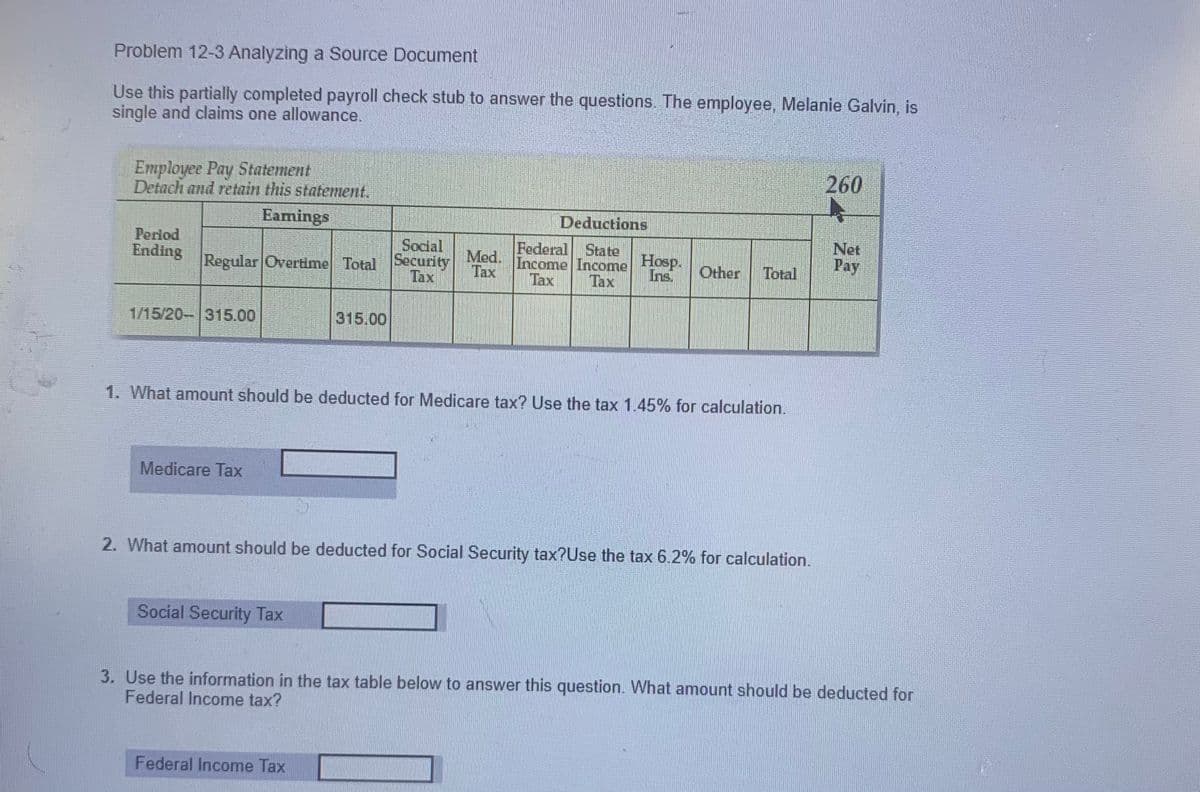

Transcribed Image Text:Problem 12-3 Analyzing a Source Document

Use this partially completed payroll check stub to answer the questions. The employee, Melanie Galvin, is

single and claims one allowance.

Employee Pay Statement

Detach and retain this statement.

260

Eamings

Deductions

Period

Ending

Net

Pay

Social

Regular Overtime Total Security

Тах

Med.

Tax

Federal State

Income Income

Тах

Hosp.

Ins.

Other

Total

Tax

1/15/20- 315.00

315.00

1. What amount should be deducted for Medicare tax? Use the tax 1.45% for calculation.

Medicare Tax

2. What amount should be deducted for Social Security tax?Use the tax 6.2% for calculation.

Social Security Tax

3. Use the information in the tax table below to answer this question. What amount should be deducted for

Federal Income tax?

Federal Income Tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning