Problem 13-51 (LO. 1, 2, 3) Karen Samuels (Social Security number 123-45-6789) makes the following purchases and sales of stock: Number Price of per Transaction Date Company Shares Share 1-1- Purchase 300 MDG $75 2018 6-1- Purchase 150 GRU 300 2018 11-1- Purchase 60 MDG 70 2018 12-3- Sale 200 MDG 80 2018 3-1- Purchase 120 GRU 375 2019 8-1- Sale 90 GRU 330 2019 1-1- Sale 150 MDG 90 2020 2-1- Sale 75 GRU 500 2020 Assuming that Karen is unable to identify the specific lots that are sold with the original purchase, what is the recognized gain or loss on each type of stock as of the following dates.

Problem 13-51 (LO. 1, 2, 3) Karen Samuels (Social Security number 123-45-6789) makes the following purchases and sales of stock: Number Price of per Transaction Date Company Shares Share 1-1- Purchase 300 MDG $75 2018 6-1- Purchase 150 GRU 300 2018 11-1- Purchase 60 MDG 70 2018 12-3- Sale 200 MDG 80 2018 3-1- Purchase 120 GRU 375 2019 8-1- Sale 90 GRU 330 2019 1-1- Sale 150 MDG 90 2020 2-1- Sale 75 GRU 500 2020 Assuming that Karen is unable to identify the specific lots that are sold with the original purchase, what is the recognized gain or loss on each type of stock as of the following dates.

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 38P

Related questions

Question

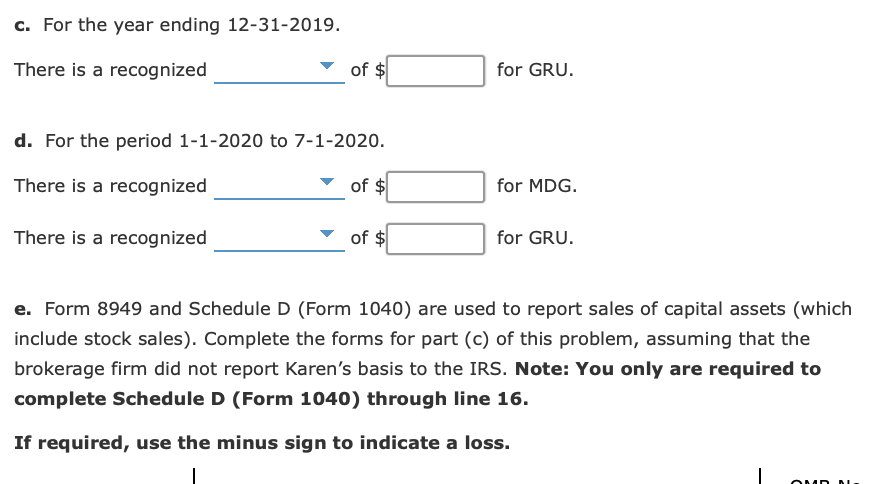

Transcribed Image Text:c. For the year ending 12-31-2019.

There is a recognized

of $

for GRU.

d. For the period 1-1-2020 to 7-1-2020.

There is a recognized

of $

for MDG.

There is a recognized

of $

for GRU.

e. Form 8949 and Schedule D (Form 1040) are used to report sales of capital assets (which

include stock sales). Complete the forms for part (c) of this problem, assuming that the

brokerage firm did not report Karen's basis to the IRS. Note: You only are required to

complete Schedule D (Form 1040) through line 16.

If required, use the minus sign to indicate a loss.

OMD DI.

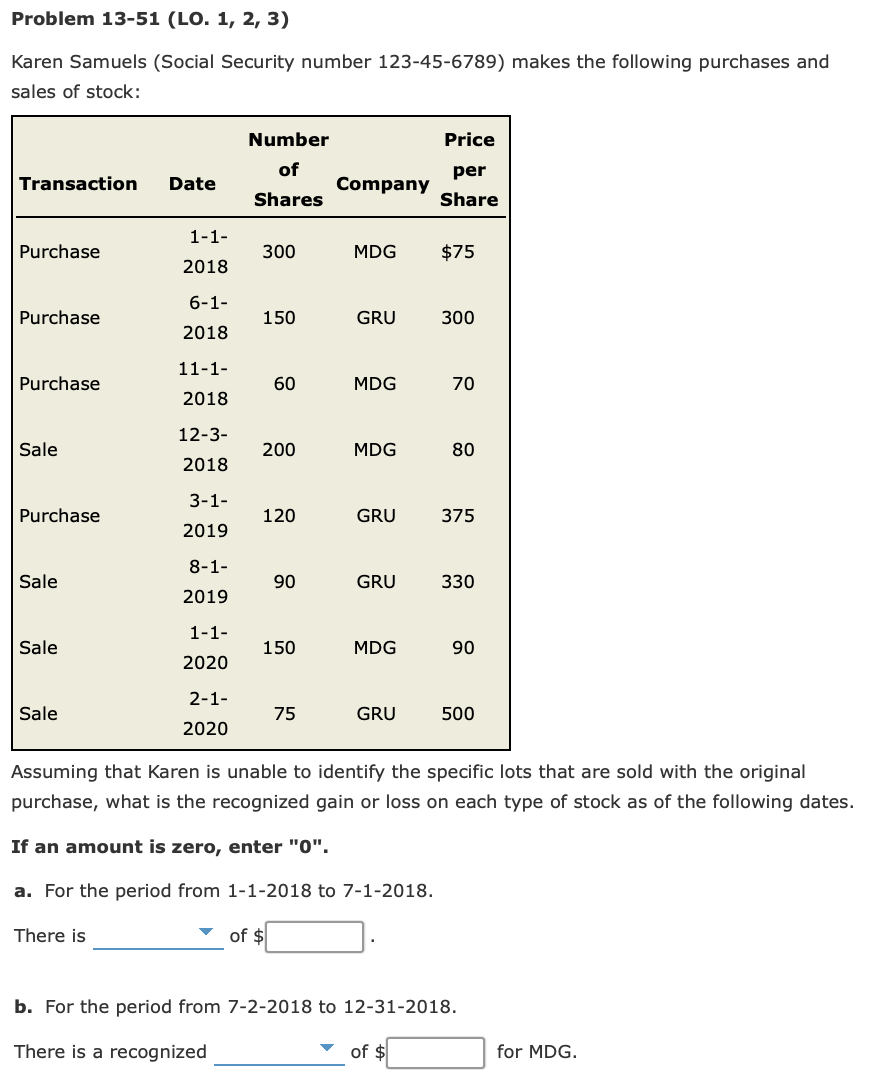

Transcribed Image Text:Problem 13-51 (LO. 1, 2, 3)

Karen Samuels (Social Security number 123-45-6789) makes the following purchases and

sales of stock:

Number

Price

of

per

Transaction

Date

Company

Shares

Share

1-1-

Purchase

300

MDG

$75

2018

6-1-

Purchase

150

GRU

300

2018

11-1-

Purchase

60

MDG

70

2018

12-3-

Sale

200

MDG

80

2018

3-1-

Purchase

120

GRU

375

2019

8-1-

Sale

90

GRU

330

2019

1-1-

Sale

150

MDG

90

2020

2-1-

Sale

75

GRU

500

2020

Assuming that Karen is unable to identify the specific lots that are sold with the original

purchase, what is the recognized gain or loss on each type of stock as of the following dates.

If an amount is zero, enter "0".

a. For the period from 1-1-2018 to 7-1-2018.

There is

of $

b. For the period from 7-2-2018 to 12-31-2018.

There is a recognized

of $

for MDG.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning