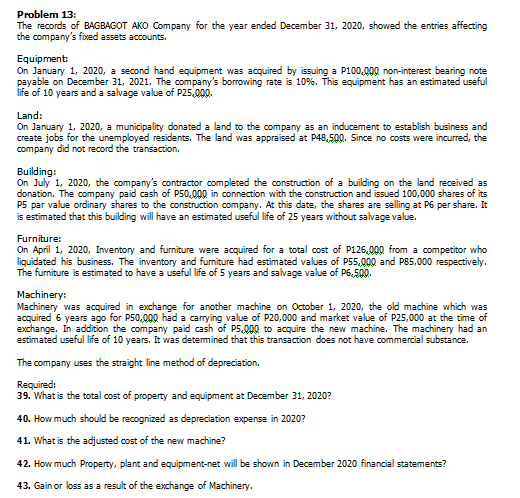

Problem 13: The records of BAGBAGOT AKO Company for the year ended December 31, 2020, showed the entries affecting the company's foxed assets accounts. Equipment: On January 1, 2020, a second hand equipment was acquired by issuing a P100,000 non-interest bearing note payable on December 31, 2021. The company's borrowing rate is 10%. This equipment has an estimated useful ife of 10 years and a salvage value of P25,000. Land: On January 1, 2020, a municipality donated a land to the company as an inducement to establish business and create jobs for the unemployed residents. The land was appraised at P48,500. Since no costs were incurred, the company did not record the transaction. Building: On July 1, 2020, the company's contractor completed the construction of a building on the land received as donation. The company paid cash of P50,000 in connection with the construction and issued 100,000 shares of its P5 par value ordinary shares to the construction company. At this date, the shares are selling at P6 per share. Ik is estimated that this building will have an estimated useful life of 25 years without salvage value. Furniture: On April 1, 2020, Inventory and furniture were acquired for a total cost of P126,000 from a competitor who liquidated his business. The inventory and furniture had estimated values of P55,000 and P85,000 respectively. The furniture is estimated to have a useful lífe of 5 years and salvage value of P6,500. Machinery: Machinery was acquired in exchange for another machine on October 1, 2020, the old machine which was acquired 6 years ago for P50,000 had a carying value of P20,000 and market value of P25,000 at the time of exchange. In addition the company paid cash of P5.000 to acquire the new machine. The machinery had an estimated useful life of 10 years. It was determined that this transaction does not have commercial substance. The company uses the straight line method of depreciation. Required: 39. What is the total cost of property and equipment at December 31, 2020? 40. How much should be recognized as depreciation expense in 2020? 41. What is the adjusted cost of the new machine? 42. How much Property, plant and equipment-net will be shown in December 2020 financial statements? 43. Gain or loss as a resut of the exchange of Machinery.

Problem 13: The records of BAGBAGOT AKO Company for the year ended December 31, 2020, showed the entries affecting the company's foxed assets accounts. Equipment: On January 1, 2020, a second hand equipment was acquired by issuing a P100,000 non-interest bearing note payable on December 31, 2021. The company's borrowing rate is 10%. This equipment has an estimated useful ife of 10 years and a salvage value of P25,000. Land: On January 1, 2020, a municipality donated a land to the company as an inducement to establish business and create jobs for the unemployed residents. The land was appraised at P48,500. Since no costs were incurred, the company did not record the transaction. Building: On July 1, 2020, the company's contractor completed the construction of a building on the land received as donation. The company paid cash of P50,000 in connection with the construction and issued 100,000 shares of its P5 par value ordinary shares to the construction company. At this date, the shares are selling at P6 per share. Ik is estimated that this building will have an estimated useful life of 25 years without salvage value. Furniture: On April 1, 2020, Inventory and furniture were acquired for a total cost of P126,000 from a competitor who liquidated his business. The inventory and furniture had estimated values of P55,000 and P85,000 respectively. The furniture is estimated to have a useful lífe of 5 years and salvage value of P6,500. Machinery: Machinery was acquired in exchange for another machine on October 1, 2020, the old machine which was acquired 6 years ago for P50,000 had a carying value of P20,000 and market value of P25,000 at the time of exchange. In addition the company paid cash of P5.000 to acquire the new machine. The machinery had an estimated useful life of 10 years. It was determined that this transaction does not have commercial substance. The company uses the straight line method of depreciation. Required: 39. What is the total cost of property and equipment at December 31, 2020? 40. How much should be recognized as depreciation expense in 2020? 41. What is the adjusted cost of the new machine? 42. How much Property, plant and equipment-net will be shown in December 2020 financial statements? 43. Gain or loss as a resut of the exchange of Machinery.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 24E: Notes Receivable and Income On January 1, 2019, Pitt Company sold a patent to Chatham Inc. which had...

Related questions

Question

Transcribed Image Text:Problem 13:

The records of BAGBAGOT AKO Company for the year ended December 31, 2020, showed the entries affecting

the company's foxed assets accounts.

Equipment:

On January 1, 2020, a second hand equipment was acquired by issuing a P100,000 non-interest bearing note

payable on December 31, 2021. The company's borrowing rate is 10%. This equipment has an estimated useful

life of 10 years and a salvage value of P25,000.

Land:

On January 1, 2020, a municipality donated a land to the company as an inducement to establish business and

create jobs for the unemployed residents. The land was appraised at P48,500. Since no costs were incurred, the

company did not record the transaction.

Building:

On July 1, 2020, the company's contractor completed the construction of a building on the land received as

donation. The company paid cash of P50,000 in connection with the construction and issued 100,000 shares of its

P5 par value ordinary shares to the construction company. At this date, the shares are selling at P6 per share. It

is estimated that this building will have an estimated useful life of 25 years without salvage value.

Furniture:

On April 1, 2020, Inventory and furniture were acquired for a total cost of P126,000 from a competitor who

liquidated his business. The inventory and furniture had estimated values of P55,000 and P85,000 respectively.

The furniture is estimated to have a useful life of 5 years and salvage value of P6,500.

Machinery:

Machinery was acquired in exchange for another machine on October 1, 2020, the old machine which was

acquired 6 years ago for P50,000. had a carrying value of P20,000 and market value of P25,000 at the time of

exchange. In addition the company paid cash of P5,000 to acquire the new machine. The machinery had an

estimated useful life of 10 years. It was determined that this transaction does not have commercial substance.

The company uses the straight line method of depreciation.

Required:

39. What is the total cost of property and equipment at December 31, 2020?

40. How much should be recognized as depreciation expense in 2020?

41. What is the adjusted cost of the new machine?

42. How much Property, plant and equipment-net will be shown in December 2020 financial statements?

43. Gain or loss as a result of the exchange of Machinery.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College