Problem 17-6AA Income statement computations and format LO A2 (The following information applies to the questions displayed below.) Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end Decembe follow. Credit 15,000 Debit a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlenent of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment (pretax) 3. Gain on insurance recovery of tornado danage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segnent's assets (pretax) o. Loss from settlement of lawsuit p. Incone tax expense q. Cost of goods sold $ 35,000 26,850 45,000 107,400 72,600 45,000 176, 500 19, 250 30, 120 1,008, 500 53,000 17,000 39,000 24,750 492, 500

Problem 17-6AA Income statement computations and format LO A2 (The following information applies to the questions displayed below.) Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end Decembe follow. Credit 15,000 Debit a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlenent of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment (pretax) 3. Gain on insurance recovery of tornado danage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segnent's assets (pretax) o. Loss from settlement of lawsuit p. Incone tax expense q. Cost of goods sold $ 35,000 26,850 45,000 107,400 72,600 45,000 176, 500 19, 250 30, 120 1,008, 500 53,000 17,000 39,000 24,750 492, 500

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.6BPR

Related questions

Question

Assume the company's income tax rate is 40%

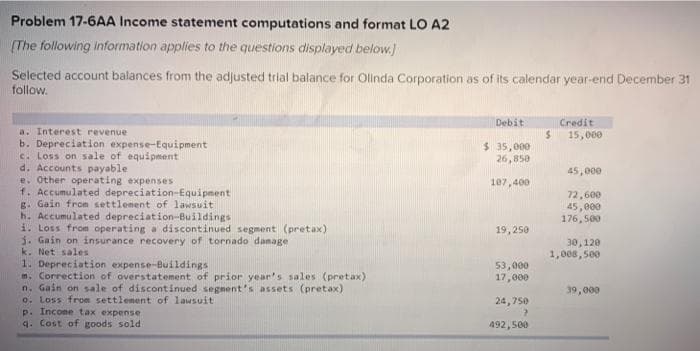

Transcribed Image Text:Problem 17-6AA Income statement computations and format LO A2

(The following information applies to the questions displayed below.)

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31

follow.

Debit

Credit

a. Interest revenue

b. Depreciation expense-Equipment

c. Loss on sale of equipment

d. Accounts payable

e. Other operating expenses

f. Accumulated depreciation-Equipment

B. Gain from settlenent of lawsuit

h. Accumulated depreciation-Buildings

i. Loss from operating a discontinued segment (pretax)

3. Gain on insurance recovery of tornado damage

k. Net sales

1. Depreciation expense-Buildings

n. Correction of overstatement of prior year's sales (pretax)

n. Gain on sale of discontinued segnent's assets (pretax)

o. Loss from settlement of lawsuit

p. Incone tax expense

q. Cost of goods sold

15,000

$ 35,000

26,850

45,000

107,400

72,600

45,000

176, 500

19,250

30, 120

1,008,500

53,000

17,000

39,000

24,750

492, 500

Transcribed Image Text:Problem 17-6AA Part 4

4. What is the amount of net income for the year?

XAnswer is not complete.

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning