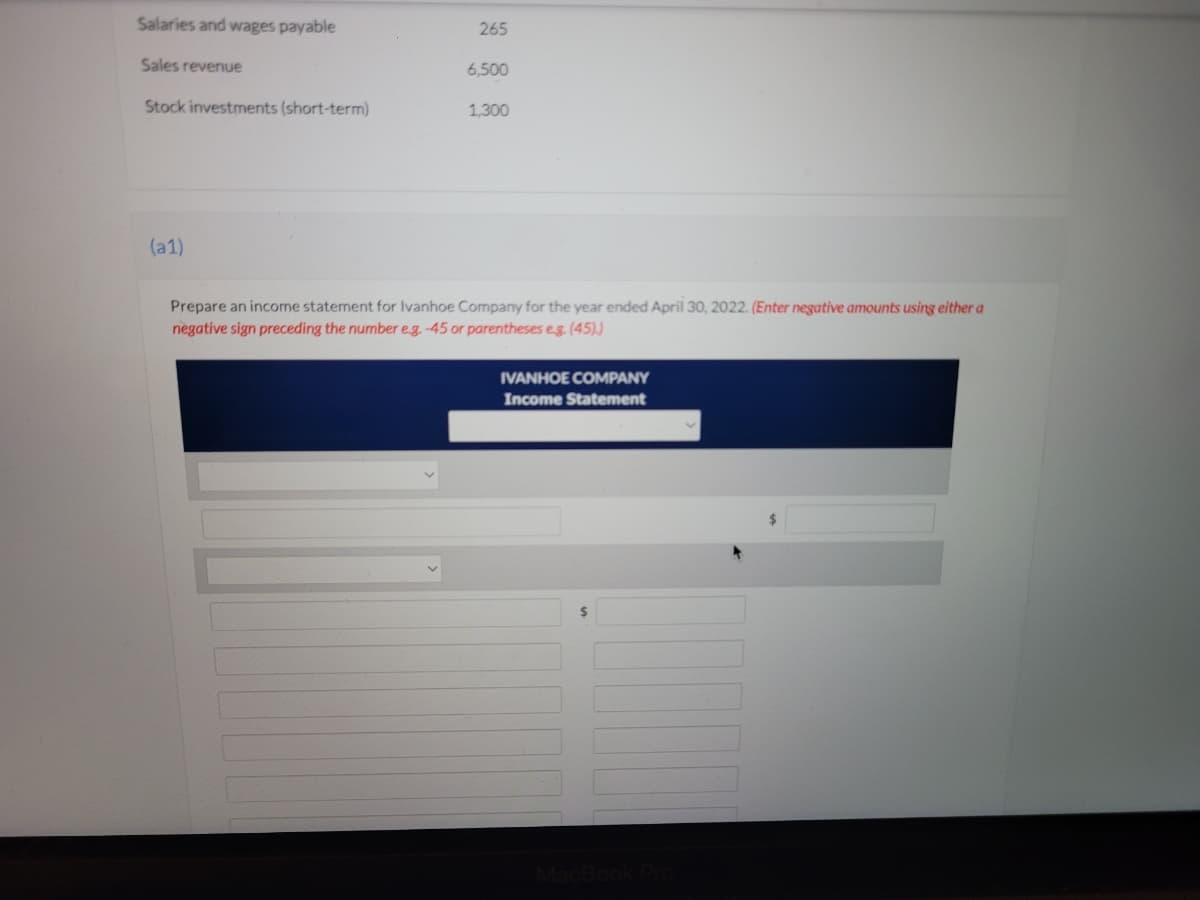

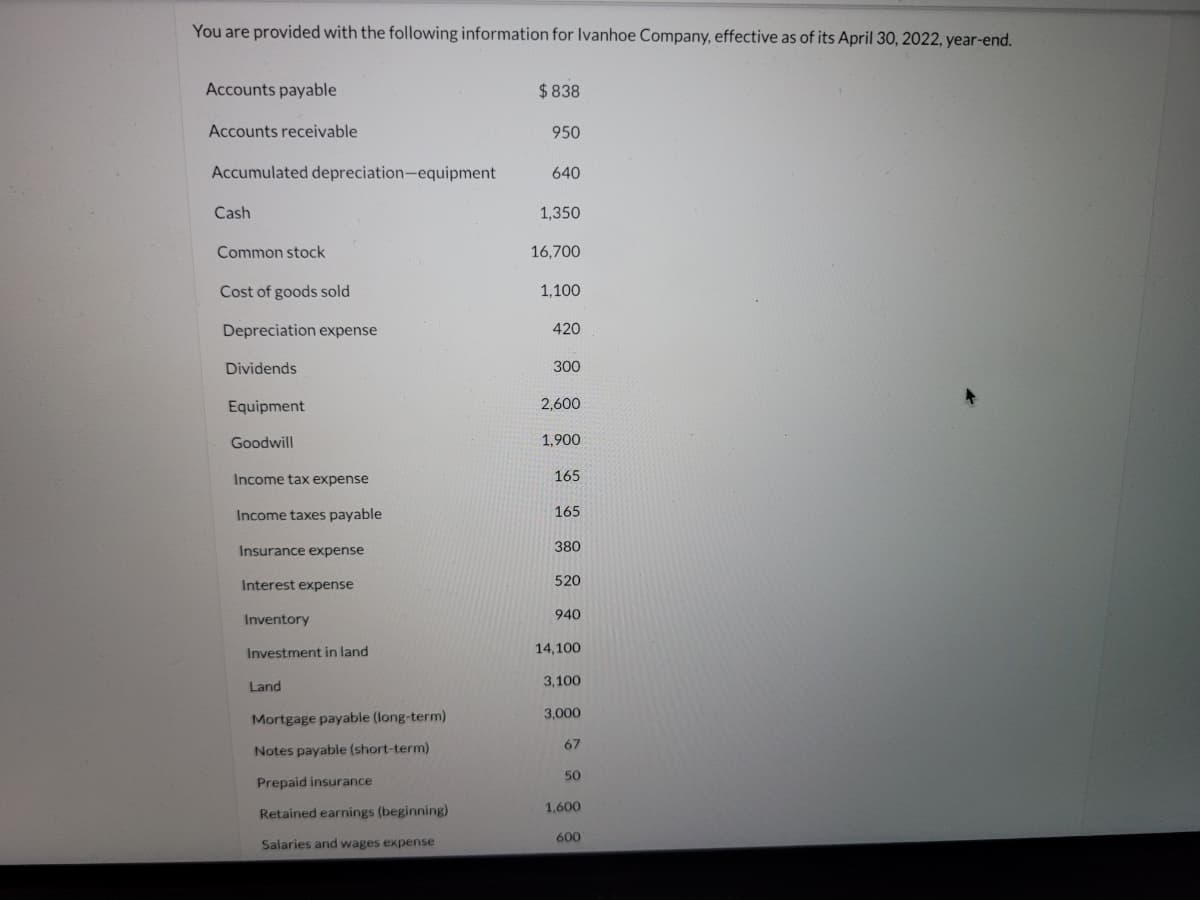

a1) Prepare an income statement for Ivanhoe Company for the year ended April 30, 2022. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) IVANHOE COMPANY Income Statement

Q: Gerald Company had the following account balances for 2021. December 31 January 1 Accounts pay...

A: SOLUTION NET INCOME REFERS TO THE AMOUNT AN INDIVIDUALS AND BUSINESS MAKES AFTER DEDUCTING COSTS , A...

Q: Required: 1 a. Using the straight-line method, compute the average remaining service life. If requi...

A: Payroll refers to the entire list of the employees of a company which includes the name of their emp...

Q: The adjusted trial balance of Karise Repairs on December 31 follows. KARISE REPAIRS Adjusted Trial B...

A:

Q: Indigo Company provides the following information about its defined benefit pension plan for the yea...

A: SOLUTION CALCULATION OF PENSION EXPENSE-. SERVICE COST 91000 INTERST COST (701800*10%) 70180 ...

Q: Even if the post-closing trial Q1:balance balances, there is no guarantee that the closing of the no...

A: Trail balance sheet is a list of all general ledger account, trail balance check mathematical error ...

Q: For the year ended Dec. 31, 2020, The Company paid interest totaling P100,000. The prepaid interest ...

A: Interest expense refers to the cost which is incurred through the entity for the borrowed funds. It ...

Q: Below is an incomplete Statement of Financial Position for a company at the end of 2020. ...

A: As per batleby policy if there are more than 3 subparts then we are allowed to do only first 3 sub...

Q: The IS audit function as a whole will normally require which of the following skills: а. Data analys...

A: Audit is the examination and verification of books of accounts and financial information in order to...

Q: The West Indies School Book Shop sells T Shirts emblazoned with the school’s name and logo. The shir...

A:

Q: rs are the allocation base. Carter is considering switching to an ABC system by splitting its manufa...

A: A.The indirect manufacturing costs assigned to Product A under the traditional costing system =1,00,...

Q: On February 2, 10X1, Solo Company purchased 900 shares of Red Corp. Red Corp has a total of 6,000 sh...

A: Purchase price = 900x 32 =28800 brokerage =2% x 28800= 576 losson ssle of shares =(28x100)-(32x100) ...

Q: A trial balance will disclose that an error has been made in Entering an amount on the wrong side o...

A: Trial balance is prepared to check the arithmatical accuracy of the ledgers accounts. A trial balanc...

Q: Explain the measurement of accounts receivable. (Write a complete thought or answer)

A: Account receivable is shown in the balance sheet as assets. Account receivables is the total outstan...

Q: xercise 4-7 (Algo) Income statement presentation; discontinued operations; restructuring -3, 4-4] sq...

A: A partial income statement only shows data for a portion of a normal accounting period. This is typi...

Q: 3b. The following information is available for the pension plan of Vaughn Company for the year 202...

A: Pension Expenses For Calculating the pension expenses it includes the details of service cost which ...

Q: The following amortization and interest schedule reflects the issuance of 10-year bonds by Cullumber...

A: >Bonds Payable are the source of finance for the companies. >The bondholders are entit...

Q: Glen carries a $125.000 insurance policy on his ife. Premiums paid over the years total S6.000. Divi...

A: Glen would be charged tax only on the amount of interest earned on accumulated dividend, i.e. $1500....

Q: furniture purhased for cash $1,500 make journal entry

A: Journal entry means transactions, which include date explanation and the amount debited and credited...

Q: The following information is available for the pension plan of Vaughn Company for the year 2020. Ac...

A: When computing pension expense for the year it considers service cost, interest cost and gain / los...

Q: Interest Receivable at 1/1/20x1 was $7,000. During 20x1, Cash received from borrowers for Interest (...

A: Adjusting entries are those journal entries which are passed at the end of accounting period for the...

Q: YSL Corporation, SME, acquired 80% of the outstanding ordinary shares of GBX Company on June 1, 2019...

A: Non-controlling interest is the part of net assets and ownership that is not in the hands of parents...

Q: KARISE REPAIRS Adjusted Trial Balance December 31 lumber 101 124 128 167 168 201 210 307 318 Account...

A: The financial statements of the business including income statement, statement of retained earnings ...

Q: Use the high-low method to estimate the fixed and variable portions of store costs based on revenues...

A: High-Low method is the method which is used by the company in order to know and calculate the fixed ...

Q: On 1st June 2021, Nutella Ltd, an Australian company with a functional currency of A$, entered busin...

A: solution concept as per the relevant accounting standards the transaction involving foreign exchange...

Q: supplies expense, and advertising expense. It categorizes the remaining expenses as general and admi...

A: Income Statement - This statement shows the income earned and loss incurred by the organization in t...

Q: An entity had the following events and transactions during 2020: - Depreciation for 2019 was underst...

A: Answer: An entity had the following events and transactions during 2020:- Depreciation for 2019 was ...

Q: Mia Company uses activity-based costing and reports the following for this year. Activity Cutting Bu...

A: Activity based costing is one of the type of costing system, under which all indirect costs and over...

Q: ABC Company experienced a decline in the value of its inventory in 2020 which resulted in a write-do...

A: Inventory write-down refers to the accounting process to record decrease in value of the inventory w...

Q: s who opened their first joint checking account at the American Bank on September 14, 2020. They've ...

A: Bank reconciliation refers to the document which reflects the banking and business activities of a c...

Q: 3. When purchasing merchandise for resale on account, record the transaction in the sales journal. b...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Multiple choice 1. A list showing the amount due to each supplier as of a specified date is known as...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Required information [The following information applies to the questions displayed below.] Lawson Co...

A: Statement of owner's equity gives information about the changes in the owner's capital account. Ow...

Q: 11. Cullumber Corp. has the following beginning-of-the-year present values for its projected benefi...

A: SOLUTION PENSION EXPENSE SIGNALS AN EMPLOYER'S ANNUAL COST FOR MAINTAINING AN EMPLOYEES PENSION PLAN...

Q: Comparative financial statement data for Oriole Corporation and Pharoah Corporation, two competitors...

A: Net income refers to the earnings of the company after accounting for all the operating and non-oper...

Q: KARISE REPAIRS Income Statement For Year Ended December 31 Revenues: Expenses:

A:

Q: Titabllity ratios (LO4-1oj The following condensed information was reported by Peabody Toys, Inc., f...

A: 1) Profit margin on sales =( Net profit/ sales) x100 Profit margin on sales =( 228/5,400)x100 =4.2%...

Q: What is the carrying value of Land after the recognition of the impairment loss?

A:

Q: 9. Carla Vista Co. at the end of 2020, its first year of operations, prepared a reconciliation betwe...

A: Income tax expenses is total tax amount calculated on taxable income by effective tax rate.

Q: Euphoria Company had a balance of P820 ecember 31, 2020, before considering year-e > Consultants wer...

A: Answer: Given is that Balance of professional fees expense = P 820,000 Amount to be reported as prof...

Q: Seattle Transit Ltd. operates a local mass transit system. The transit authority is a state governme...

A: Regular far =$ 3.3 per trip Full cost = $ 5.3 per trip Senior citizen price = 63 cents per trip Also...

Q: Exercise 3-4 (Division of Profit under Various Assumptions) Blessing and Linda formed a partnership ...

A: The partnership comes into existence when two or more persons agree to do the business and share pro...

Q: Flame Company adopted the FIFO approach of inventory pricing in connection with the use of the retai...

A: Determination of estimated cost of inventory on December 31, 2021 Particulars Cost Retail Begin...

Q: Question 4 Explain the measurement of accounts receivable. (Write a complete answer)

A: Financial Accounting: Financial accounting is the efficient strategy of recording, ordering, summing...

Q: Cost Retail Inventory, 12/31/2021 500,000.00 725,000.00 Purchases 1,285,000.00 2,220,000.00 Purchase...

A: Cost ratio is the ratio which shows the retail price made up by cost. It is the ratio which is used ...

Q: Required: 1. Prepare the adjustment to correct the estimated warranty liability on December 31, 202...

A: Warranty is a form of assurance being provided by the seller to the buyer that in case product will ...

Q: ariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Comp...

A: A variable costing income statement subtracts all variable expenses from revenue to arrive at a sepa...

Q: Prepare the journal entries to record the following transactions on Pharoah Company's books using a ...

A: The systematical recording of all monetary business transactions is called a journal entry. They are...

Q: A chart of accounts is a list of all ledger accounts and an identification number for each. Identify...

A: >Ledger accounts are the accounts of various accounting elements. >These accounts are of R...

Q: esidual value and will be depreciated using the straight line method. On March 1, 2020 the equipm...

A: journal entries refer to the concept of documenting all the transactions of a company in its books.

Q: A review of the ledger of Blue Spruce Co. at December 31, 2022, produces the following data pertaini...

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the org...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.

- Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives the following items from its adjusted trial balance as of December 31, 2019: The following; additional information is also available. The December 31, 2019, ending inventory is 14,700. During 2019, 4,200 shares of'common stock were outstanding the entire year. The income tax rate 30% on all items of income. Required: 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Gaskins cost of goods sold. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 multiple-step income statement. 4. Prepare a 2019 statement of comprehensive income.Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business depreciates a building with a book value of $12,000, using straight-line depreciation, no salvage value, and a remaining useful life of six years. B. An organization has a line of credit with a supplier. The company purchases $35,500 worth of inventory on credit. Terms of purchase are 3/20, n/60. C. An employee earns $1,000 in pay and the employer withholds $46 for federal income tax. D. A customer pays $4,000 in advance for legal services. The lawyer has previously recognized 30% of the services as revenue. The remainder is outstanding.

- Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.Unusual income statement items Assume that the amount of each of the following items is material to the financial statements. Classify each item as either normally recurring (NR) or unusual (U) items. If unusual item, then specify if it is a discontinued operations item (DO). a. Interest revenue on notes receivable. b. Gain on sale of segment of the company's operations that manufactures bottling equipment. c.Loss on sale of investments in stocks and bonds. d. Uncollectible accounts expense. e. Uninsured flood loss. (Hood insurance is unavailable because of periodic Hooding in the area.)