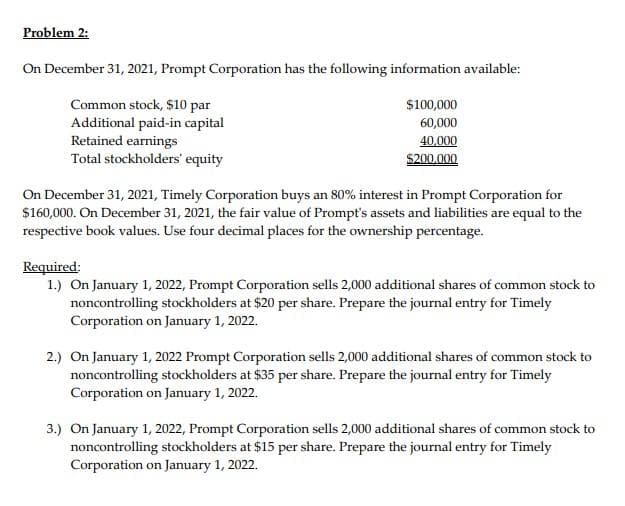

Problem 2: On December 31, 2021, Prompt Corporation has the following information available: Common stock, $10 par Additional paid-in capital Retained earnings Total stockholders' equity $100,000 60,000 40,000 $200.000 On December 31, 2021, Timely Corporation buys an 80% interest in Prompt Corporation for $160,000. On December 31, 2021, the fair value of Prompt's assets and liabilities are equal to the respective book values. Use four decimal places for the ownership percentage. Required: 1.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $20 per share. Prepare the journal entry for Timely Corporation on January 1, 2022. 2.) On January 1, 2022 Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $35 per share. Prepare the journal entry for Timely Corporation on January 1, 2022. 3.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $15 per share. Prepare the journal entry for Timely Corporation on January 1, 2022.

Problem 2: On December 31, 2021, Prompt Corporation has the following information available: Common stock, $10 par Additional paid-in capital Retained earnings Total stockholders' equity $100,000 60,000 40,000 $200.000 On December 31, 2021, Timely Corporation buys an 80% interest in Prompt Corporation for $160,000. On December 31, 2021, the fair value of Prompt's assets and liabilities are equal to the respective book values. Use four decimal places for the ownership percentage. Required: 1.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $20 per share. Prepare the journal entry for Timely Corporation on January 1, 2022. 2.) On January 1, 2022 Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $35 per share. Prepare the journal entry for Timely Corporation on January 1, 2022. 3.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $15 per share. Prepare the journal entry for Timely Corporation on January 1, 2022.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

DONT GIVE ANSWER IN IMAGE FORMAT

Transcribed Image Text:Problem 2:

On December 31, 2021, Prompt Corporation has the following information available:

$100,000

Common stock, $10 par

Additional paid-in capital

Retained earnings

60,000

40,000

Total stockholders' equity

$200.000

On December 31, 2021, Timely Corporation buys an 80% interest in Prompt Corporation for

$160,000. On December 31, 2021, the fair value of Prompt's assets and liabilities are equal to the

respective book values. Use four decimal places for the ownership percentage.

Required:

1.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to

noncontrolling stockholders at $20 per share. Prepare the journal entry for Timely

Corporation on January 1, 2022.

2.) On January 1, 2022 Prompt Corporation sells 2,000 additional shares of common stock to

noncontrolling stockholders at $35 per share. Prepare the journal entry for Timely

Corporation on January 1, 2022.

3.) On January 1, 2022, Prompt Corporation sells 2,000 additional shares of common stock to

noncontrolling stockholders at $15 per share. Prepare the journal entry for Timely

Corporation on January 1, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning