Problem #2 - On January 13, 2022, Ramos Enterprises sold tool sets to Home Depot for cash, f.o.b. shipping point. Ramos allows Home Depot to return any unused tool sets within 60 days of purchase. Ramos estimates the cost of recovering the products will be mmaterial, and the returned tools sets can be resold at a profit. On January 28, 2022, Home Depot return some tool sets. Information concerning the sale and returns follows: Number of tool sets sold 42,750 Selling price of each tool set $85.75 Cost of each tool set $61.25 Number of sets estimated to be returned 2,138 Number of tool sets returned by Home Depot 1,283 nstructions: )Prepare journal entries for Ramos to record (1) the sale on January 13, 2022, (2) the return on January 28, 2022, and (3) any djusting entries required on January 31, 2022 (when Ramos prepares financial statements). Ramos believes the original estimate of

Problem #2 - On January 13, 2022, Ramos Enterprises sold tool sets to Home Depot for cash, f.o.b. shipping point. Ramos allows Home Depot to return any unused tool sets within 60 days of purchase. Ramos estimates the cost of recovering the products will be mmaterial, and the returned tools sets can be resold at a profit. On January 28, 2022, Home Depot return some tool sets. Information concerning the sale and returns follows: Number of tool sets sold 42,750 Selling price of each tool set $85.75 Cost of each tool set $61.25 Number of sets estimated to be returned 2,138 Number of tool sets returned by Home Depot 1,283 nstructions: )Prepare journal entries for Ramos to record (1) the sale on January 13, 2022, (2) the return on January 28, 2022, and (3) any djusting entries required on January 31, 2022 (when Ramos prepares financial statements). Ramos believes the original estimate of

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 15RE: GameDay sells recreational vehicles along with secure parking storage to customers. Game Day sells...

Related questions

Question

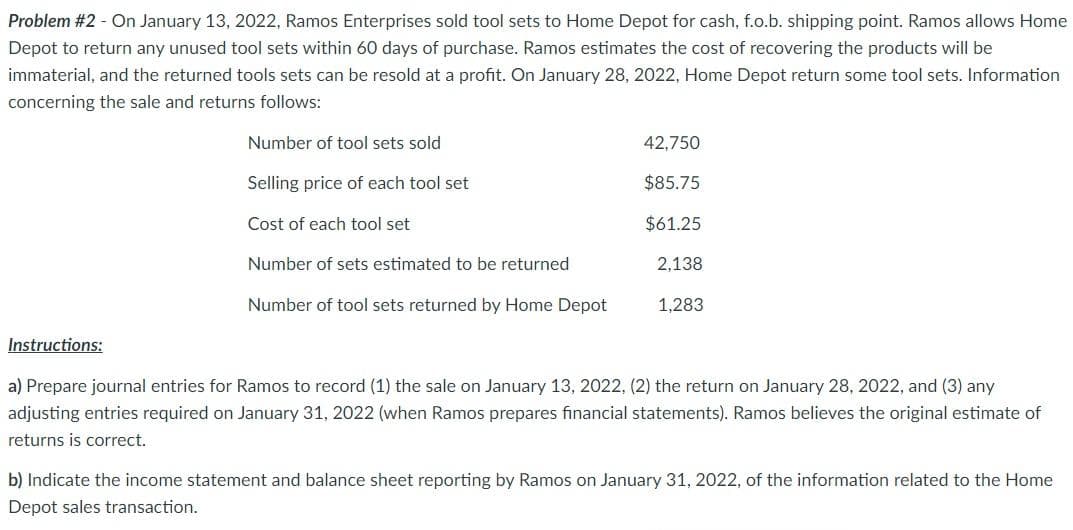

Transcribed Image Text:Problem #2 - On January 13, 2022, Ramos Enterprises sold tool sets to Home Depot for cash, f.o.b. shipping point. Ramos allows Home

Depot to return any unused tool sets within 60 days of purchase. Ramos estimates the cost of recovering the products will be

immaterial, and the returned tools sets can be resold at a profit. On January 28, 2022, Home Depot return some tool sets. Information

concerning the sale and returns follows:

Number of tool sets sold

42,750

Selling price of each tool set

$85.75

Cost of each tool set

$61.25

Number of sets estimated to be returned

2,138

Number of tool sets returned by Home Depot

1,283

Instructions:

a) Prepare journal entries for Ramos to record (1) the sale on January 13, 2022, (2) the return on January 28, 2022, and (3) any

adjusting entries required on January 31, 2022 (when Ramos prepares financial statements). Ramos believes the original estimate of

returns is correct.

b) Indicate the income statement and balance sheet reporting by Ramos on January 31, 2022, of the information related to the Home

Depot sales transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT