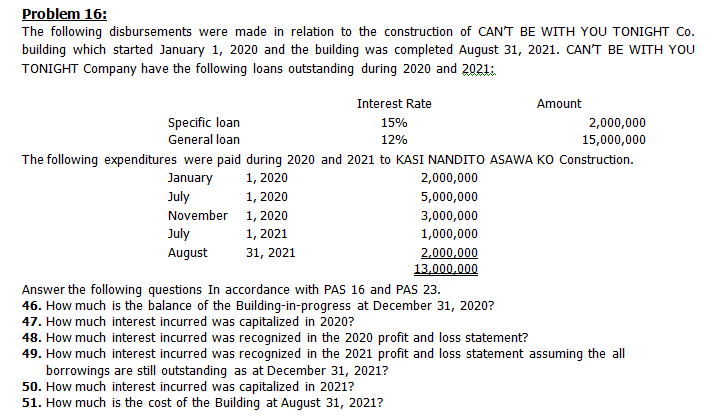

Problem 16: The following disbursements were made in relation to the construction of CAN'T BE WITH YOU TONIGHT Co. building which started January 1, 2020 and the building was completed August 31, 2021. CAN'T BE WITH YOU TONIGHT Company have the following loans outstanding during 2020 and 2021: Interest Rate Amount Specific loan General loan 15% 2,000,000 12% 15,000,000 The following expenditures were paid during 2020 and 2021 to KASI NANDITO ASAWA KO Construction. January July November 1, 2020 1, 2020 2,000,000 1, 2020 5,000,000 3,000,000 July August 1, 2021 1,000,000 2.000,000 13,000,000 31, 2021 Answer the following questions In accordance with PAS 16 and PAS 23. 46. How much is the balance of the Building-in-progress at December 31, 2020? 47. How much interest incurred was capitalized in 2020? 48. How much interest incurred was recognized in the 2020 profit and loss statement? 49. How much interest incurred was recognized in the 2021 profit and loss statement assuming the all borrowings are still outstanding as at December 31, 2021? 50. How much interest incurred was capitalized in 2021? 51. How much is the cost of the Building at August 31, 2021?

Problem 16: The following disbursements were made in relation to the construction of CAN'T BE WITH YOU TONIGHT Co. building which started January 1, 2020 and the building was completed August 31, 2021. CAN'T BE WITH YOU TONIGHT Company have the following loans outstanding during 2020 and 2021: Interest Rate Amount Specific loan General loan 15% 2,000,000 12% 15,000,000 The following expenditures were paid during 2020 and 2021 to KASI NANDITO ASAWA KO Construction. January July November 1, 2020 1, 2020 2,000,000 1, 2020 5,000,000 3,000,000 July August 1, 2021 1,000,000 2.000,000 13,000,000 31, 2021 Answer the following questions In accordance with PAS 16 and PAS 23. 46. How much is the balance of the Building-in-progress at December 31, 2020? 47. How much interest incurred was capitalized in 2020? 48. How much interest incurred was recognized in the 2020 profit and loss statement? 49. How much interest incurred was recognized in the 2021 profit and loss statement assuming the all borrowings are still outstanding as at December 31, 2021? 50. How much interest incurred was capitalized in 2021? 51. How much is the cost of the Building at August 31, 2021?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:Problem 16:

The following disbursements were made in relation to the construction of CAN'T BE WITH YOU TONIGHT Co.

building which started January 1, 2020 and the building was completed August 31, 2021. CAN'T BE WITH YOu

TONIGHT Company have the following loans outstanding during 2020 and 2021:

Interest Rate

Amount

Specific loan

15%

2,000,000

General loan

12%

15,000,000

The following expenditures were paid during 2020 and 2021 to KASI NANDITO ASAWA KO Construction.

January

1, 2020

2,000,000

July

1, 2020

5,000,000

November 1, 2020

3,000,000

July

1, 2021

1,000,000

August

31, 2021

2,000,000

13,000,000

Answer the following questions In accordance with PAS 16 and PAS 23.

46. How much is the balance of the Building-in-progress at December 31, 2020?

47. How much interest incurred was capitalized in 2020?

48. How much interest incurred was recognized in the 2020 profit and loss statement?

49. How much interest incurred was recognized in the 2021 profit and loss statement assuming the all

borrowings are still outstanding as at December 31, 2021?

50. How much interest incurred was capitalized in 2021?

51. How much is the cost of the Building at August 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning