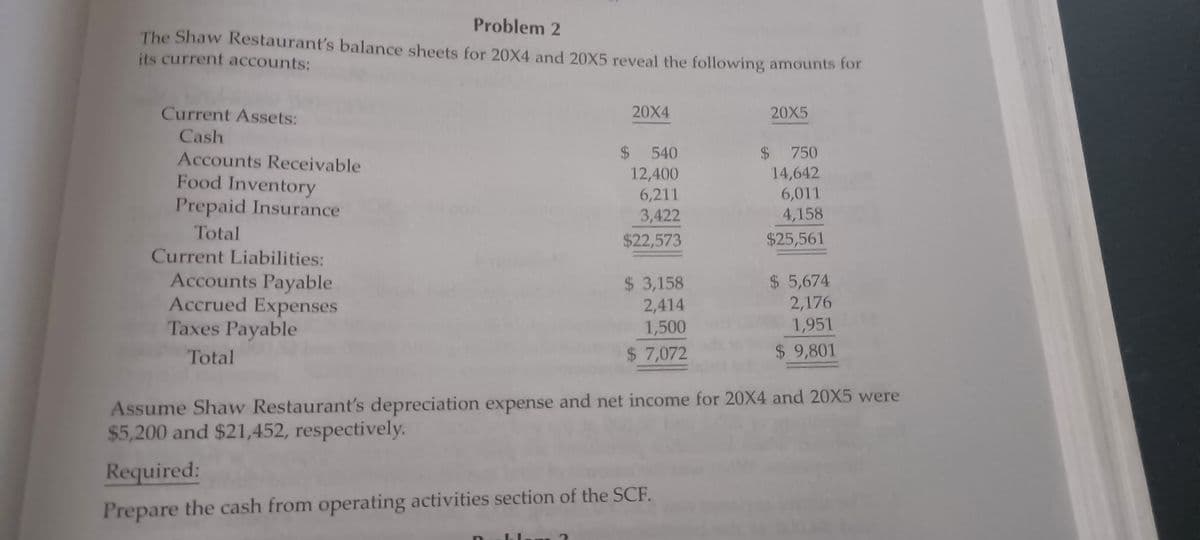

Problem 2 The Shaw Restaurant's balance sheets for 20X4 and 20X5 reveal the following amounts for its current accounts: Current Assets: 20X4 20X5 Cash Accounts Receivable Food Inventory Prepaid Insurance $ 540 12,400 6,211 3,422 $ 750 14,642 6,011 4,158 $25,561 Total Current Liabilities: Accounts Payable Accrued Expenses Taxes Payable $22,573 $ 5,674 $ 3,158 2,414 1,500 2,176 1,951 Total $ 7,072 $ 9,801 Assume Shaw Restaurant's depreciation expense and net income for 20X4 and 20X5 were $5,200 and $21,452, respectively. Required: Prepare the cash from operating activities section of the SCF.

Problem 2 The Shaw Restaurant's balance sheets for 20X4 and 20X5 reveal the following amounts for its current accounts: Current Assets: 20X4 20X5 Cash Accounts Receivable Food Inventory Prepaid Insurance $ 540 12,400 6,211 3,422 $ 750 14,642 6,011 4,158 $25,561 Total Current Liabilities: Accounts Payable Accrued Expenses Taxes Payable $22,573 $ 5,674 $ 3,158 2,414 1,500 2,176 1,951 Total $ 7,072 $ 9,801 Assume Shaw Restaurant's depreciation expense and net income for 20X4 and 20X5 were $5,200 and $21,452, respectively. Required: Prepare the cash from operating activities section of the SCF.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 59BPSB: Problem 2-593 Journalizing Transactions Monilast Chemicals engaged in the following transactions...

Related questions

Question

Help

Transcribed Image Text:Problem 2

The Shaw Restaurant's balance sheets for 20X4 and 20X5 reveal the following amounts for

its current accounts:

Current Assets:

20X4

20X5

Cash

$ 750

14,642

6,011

4,158

2$

540

Accounts Receivable

Food Inventory

Prepaid Insurance

12,400

6,211

3,422

Total

$22,573

$25,561

Current Liabilities:

Accounts Payable

Accrued Expenses

Taxes Payable

$ 5,674

$ 3,158

2,414

1,500

2,176

1,951

Total

$ 7,072

$ 9,801

Assume Shaw Restaurant's depreciation expense and net income for 20X4 and 20X5 were

$5,200 and $21,452, respectively.

Required:

Prepare the cash from operating activities section of the SCF.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning