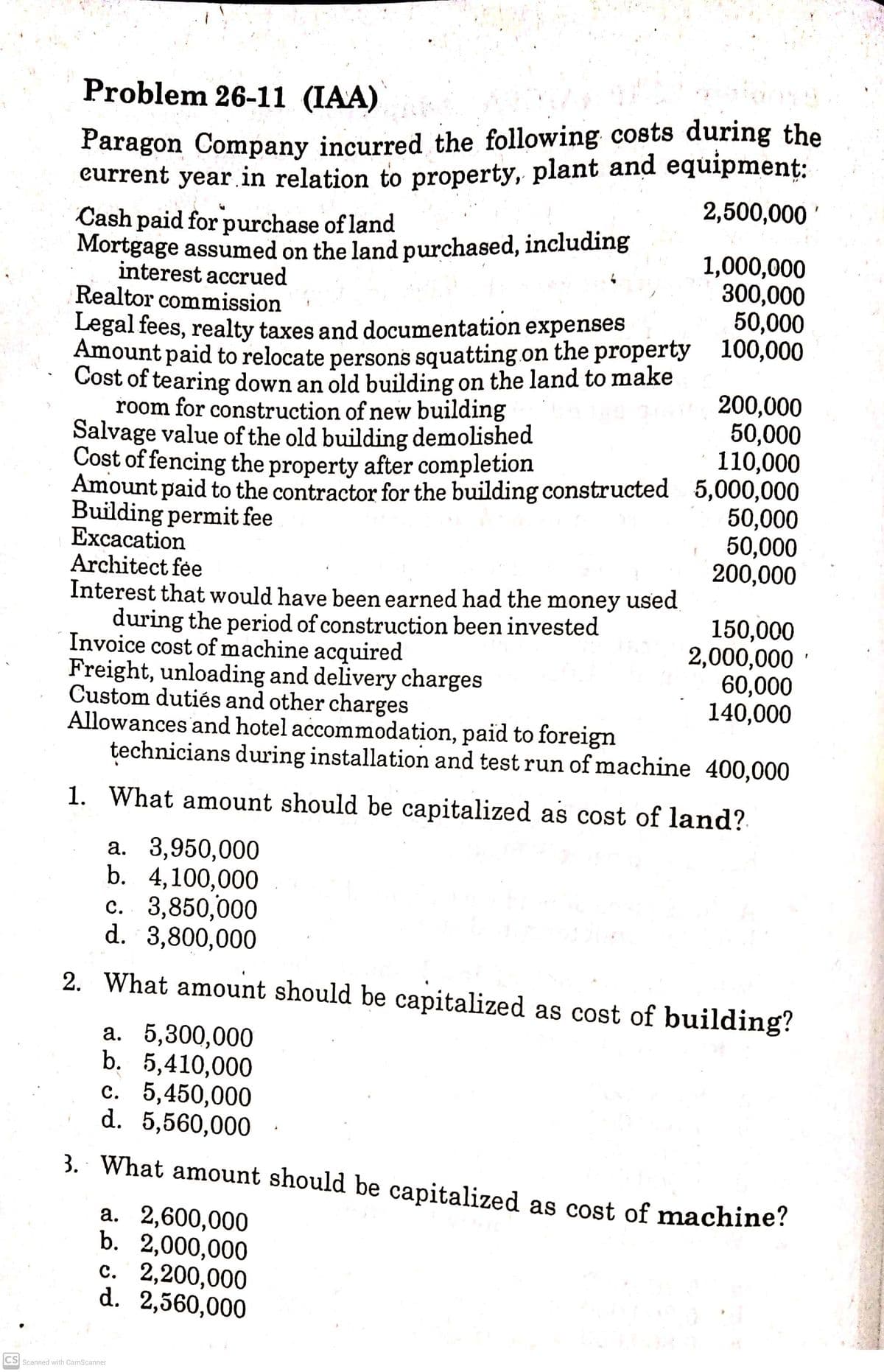

Problem 26-11 (IAA) Paragon Company incurred the following costs during the eurrent year in relation to property, plant and equipment: Cash paid for purchase of land Mortgage assumed on the land purchased, including 2,500,000' interest accrued Realtor commission 1,000,000 300,000 50,000 Legal fees, realty taxes and documentation expenses Amount paid to relocate persons squatting on the property 100,000 Cost of tearing down an old building on the land to make room for construction of new building Salvage value of the old building demolished Cost of fencing the property after completion Amount paid to the contractor for the building constructed 5,000,000 Building permit fee Еxcacation Architect fée Interest that would have been earned had the money used during the period of construction been invested Invoice cost of machine acquired Freight, unloading and delivery charges Custom dutiés and other charges Allowances and hotel accommodation, paid to foreign technicians during installation and test run of machine 400,000 200,000 50,000 110,000 50,000 50,000 200,000 150,000 2,000,000 60,000 140,000 1. What amount should be capitalized as cost of land? a. 3,950,000 b. 4,100,000 c. 3,850,000 d. 3,800,000 2. What amount should be capitalized as cost of building? а. 5,300,000 b. 5,410,000 c. 5,450,000 d. 5,560,000 3. What amount should be capitalized as cost of machine? a. 2,600,000 b. 2,000,000 c. 2,200,000 d. 2,560,000

Problem 26-11 (IAA) Paragon Company incurred the following costs during the eurrent year in relation to property, plant and equipment: Cash paid for purchase of land Mortgage assumed on the land purchased, including 2,500,000' interest accrued Realtor commission 1,000,000 300,000 50,000 Legal fees, realty taxes and documentation expenses Amount paid to relocate persons squatting on the property 100,000 Cost of tearing down an old building on the land to make room for construction of new building Salvage value of the old building demolished Cost of fencing the property after completion Amount paid to the contractor for the building constructed 5,000,000 Building permit fee Еxcacation Architect fée Interest that would have been earned had the money used during the period of construction been invested Invoice cost of machine acquired Freight, unloading and delivery charges Custom dutiés and other charges Allowances and hotel accommodation, paid to foreign technicians during installation and test run of machine 400,000 200,000 50,000 110,000 50,000 50,000 200,000 150,000 2,000,000 60,000 140,000 1. What amount should be capitalized as cost of land? a. 3,950,000 b. 4,100,000 c. 3,850,000 d. 3,800,000 2. What amount should be capitalized as cost of building? а. 5,300,000 b. 5,410,000 c. 5,450,000 d. 5,560,000 3. What amount should be capitalized as cost of machine? a. 2,600,000 b. 2,000,000 c. 2,200,000 d. 2,560,000

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 9.1APR

Related questions

Question

Transcribed Image Text:Problem 26-11 (IAA)

Paragon Company incurred the following costs during the

eurrent year in relation to property, plant and equipmenț:

2,500,000 '

Cash paid for purchase of land

Mortgage assumed on the land purchased, including

interest accrued

Realtor commission

1,000,000

300,000

50,000

Legal fees, realty taxes and documentation expenses

Amount paid to relocate persons squatting on the property 100,000

Cost of tearing down an old building on the land to make

room for construction of new building

Salvage value of the old building demolished

Cost of fencing the property after completion

Amount paid to the contractor for the building constructed 5,000,000

Building permit fee

Еxcacation

Architect fée

Interest that would have been earned had the money used

during the period of construction been invested

Invoice cost of machine acquired

Freight, unloading and delivery charges

Custom dutiés and other charges

Allowances and hotel accommodation, paid to foreign

technicians during installation and test run of machine 400,000

200,000

50,000

110,000

50,000

50,000

200,000

150,000

2,000,000

60,000

140,000

1. What amount should be capitalized as cost of land?

а. 3,950,000

b. 4,100,000

c. 3,850,000

d. 3,800,000

2. What amount should be capitalized as cost of building?

a. 5,300,000

b. 5,410,000

с. 5,450,000

d. 5,560,000

3. What amount should be capitalized as cost of machine?

a. 2,600,000

b. 2,000,000

с. 2,200,000

d. 2,560,000

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning