Problem 27-27 (AICPA Adapted) At the beginning of current year, Obvious Company provided the following: Accumulated depreciation Cost Land Building Machinery and equipment 875,000 7,500,000 2,250,000 1,644,500 635,000 Building – double declining balance, 25 years Machinery and equipment – Straight line, 10 years Land improvements – Straight line - On January 1, a plant facility consisting of land and building was acquired from another entity in exchange for 25,000 shares of Obvious Company. *

Problem 27-27 (AICPA Adapted) At the beginning of current year, Obvious Company provided the following: Accumulated depreciation Cost Land Building Machinery and equipment 875,000 7,500,000 2,250,000 1,644,500 635,000 Building – double declining balance, 25 years Machinery and equipment – Straight line, 10 years Land improvements – Straight line - On January 1, a plant facility consisting of land and building was acquired from another entity in exchange for 25,000 shares of Obvious Company. *

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 76APSA

Related questions

Concept explainers

Question

100%

Pls show solutions and answer

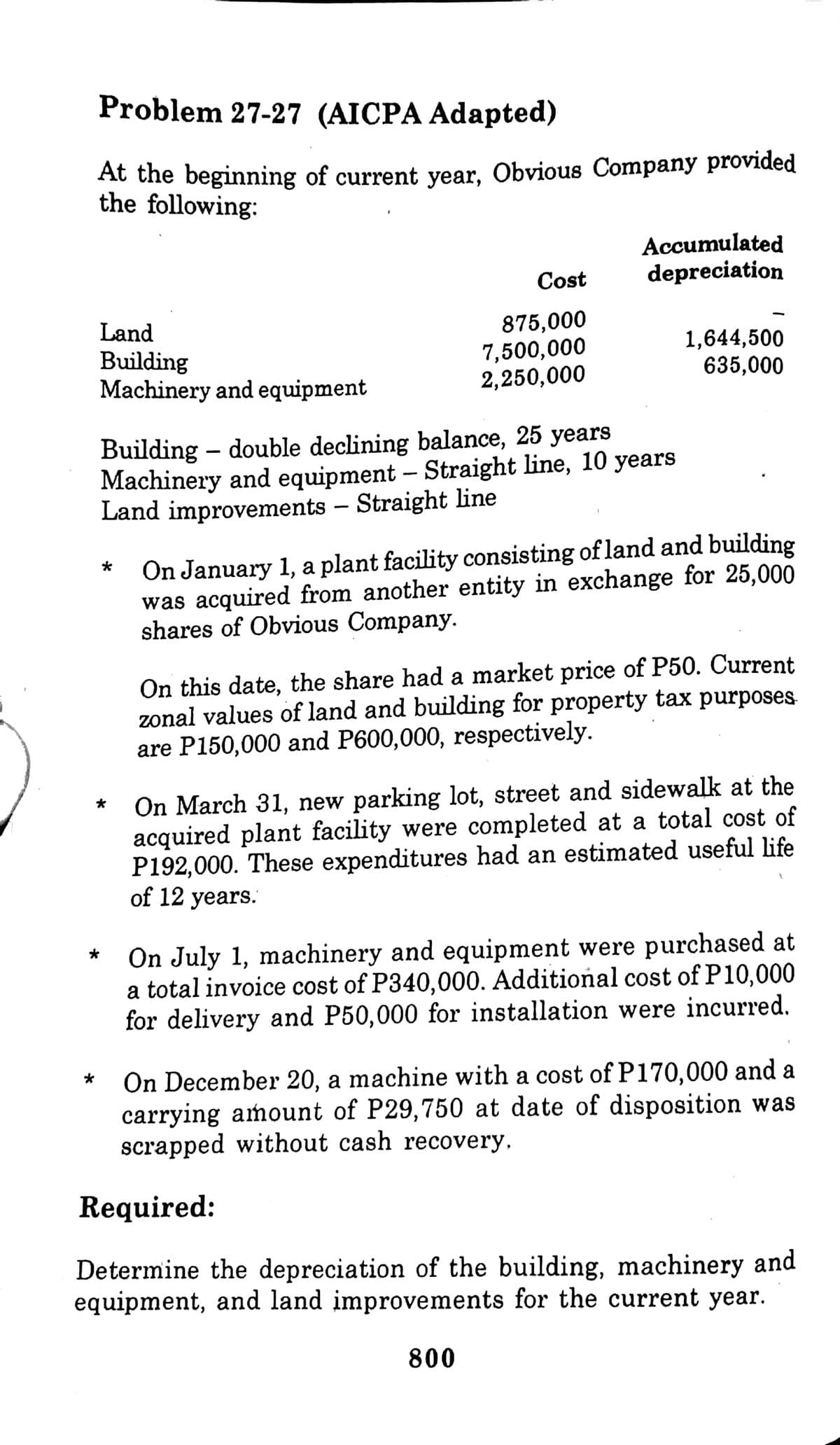

Transcribed Image Text:Problem 27-27 (AICPA Adapted)

At the beginning of current year, Obvious Company provided

the following:

Accumulated

depreciation

Cost

875,000

7,500,000

2,250,000

Land

Building

Machinery and equipment

1,644,500

635,000

Building – double declining balance, 25 years

Machinery and equipment – Straight line, 10 years

Land improvements - Straight line

On January 1, a plant facility consisting of land and building

was acquired from another entity in exchange for 25,000

shares of Obvious Company.

On this date, the share had a market price of P50. Current

zonal values of land and building for property tax purposes-

are P150,000 and P600,000, respectively.

On March 31, new parking lot, street and sidewalk at the

acquired plant facility were completed at a total cost of

P192,000. These expenditures had an estimated useful life

of 12 years.

On July 1, machinery and equipment were purchased at

a total invoice cost of P340,000. Additional cost of P10,000

for delivery and P50,000 for installation were incurred.

On December 20, a machine with a cost of P170,000 and a

carrying amount of P29,750 at date of disposition was

scrapped without cash recovery,

Required:

Determine the depreciation of the building, machinery and

equipment, and land improvements for the current year.

800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning