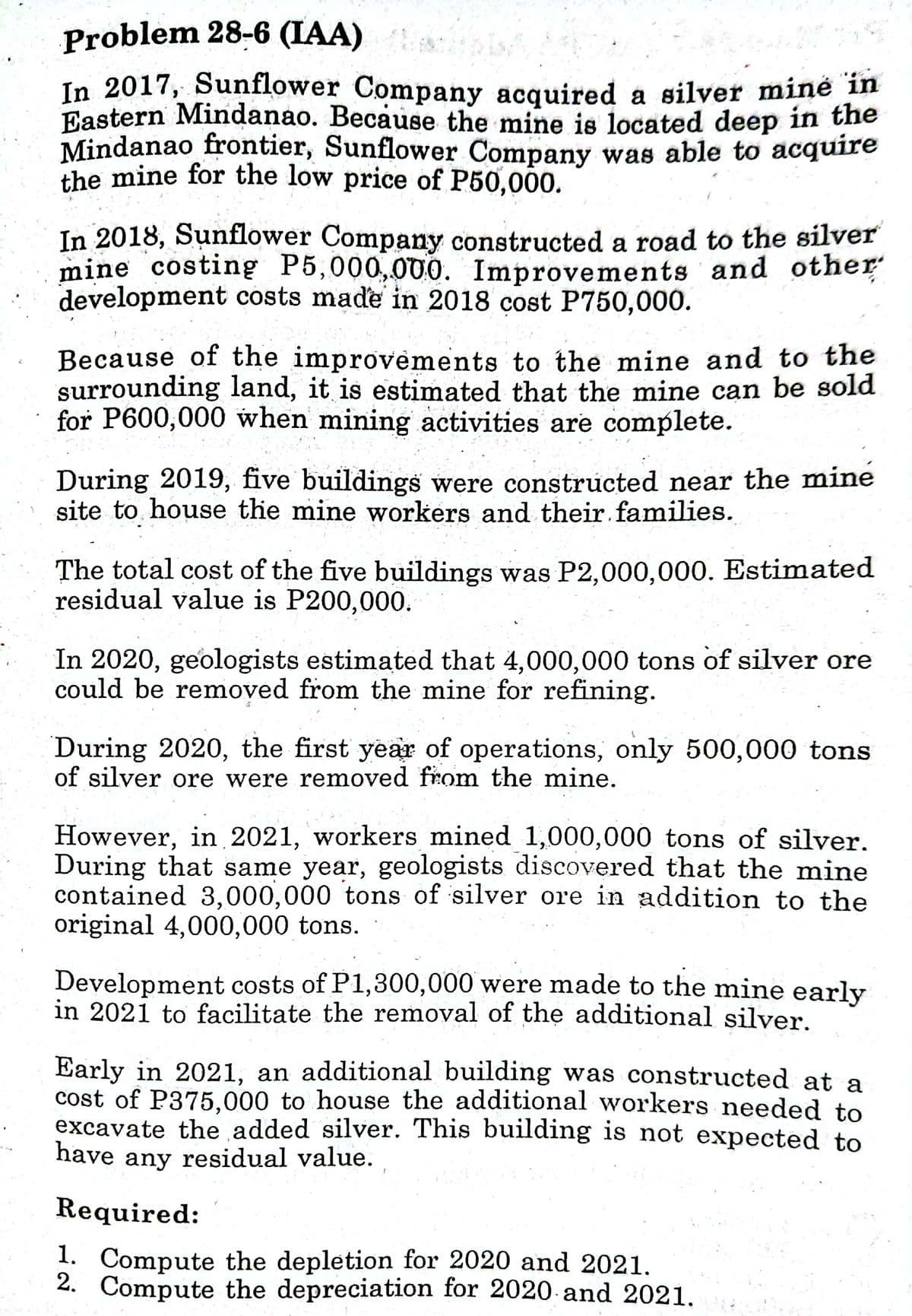

Problem 28-6 (IAA) In 2017, Sunflower Company acquired a silver miné in Eastern Mindanao. Because the mine is located deep in the Mindanao frontier, Sunflower Company was able to acquire the mine for the low price of P50,000. In 2018, Sunflower Company constructed a road to the silver mine costing P5,000,000. Improvements and other development costs made in 2018 cost P750,000. Because of the improvements to the mine and to the surrounding land, it is estimated that the mine can be sold for P600,000 when mining activities are complete. During 2019, five buildings were constructed near the mine site to house the mine workers and their.families. The total cost of the five buildings was P2,000,000. Estimated residual value is P200,000. In 2020, geologists estimated that 4,000,000 tons of silver ore could be removed from the mine for refining. During 2020, the first year of operations, only 500,000 tons of silver ore were removed from the mine. However, in 2021, workers mined 1,000,000 tons of silver. During that same year, geologists discovered that the mine contained 3,000,000 tons of silver ore in addition to the original 4,000,000 tons. Development costs of P1,300,000 were made to the mine early in 2021 to facilitate the removal of thẹ additional silver. Early in 2021, an additional building was constructed at a cost of P375,000 to house the additional workers needed to excavate the added silver. This building is not expected to have any residual value. Required: 1. Compute the depletion for 2020 and 2021, 2. Compute the depreciation for 2020 and 2021.

Problem 28-6 (IAA) In 2017, Sunflower Company acquired a silver miné in Eastern Mindanao. Because the mine is located deep in the Mindanao frontier, Sunflower Company was able to acquire the mine for the low price of P50,000. In 2018, Sunflower Company constructed a road to the silver mine costing P5,000,000. Improvements and other development costs made in 2018 cost P750,000. Because of the improvements to the mine and to the surrounding land, it is estimated that the mine can be sold for P600,000 when mining activities are complete. During 2019, five buildings were constructed near the mine site to house the mine workers and their.families. The total cost of the five buildings was P2,000,000. Estimated residual value is P200,000. In 2020, geologists estimated that 4,000,000 tons of silver ore could be removed from the mine for refining. During 2020, the first year of operations, only 500,000 tons of silver ore were removed from the mine. However, in 2021, workers mined 1,000,000 tons of silver. During that same year, geologists discovered that the mine contained 3,000,000 tons of silver ore in addition to the original 4,000,000 tons. Development costs of P1,300,000 were made to the mine early in 2021 to facilitate the removal of thẹ additional silver. Early in 2021, an additional building was constructed at a cost of P375,000 to house the additional workers needed to excavate the added silver. This building is not expected to have any residual value. Required: 1. Compute the depletion for 2020 and 2021, 2. Compute the depreciation for 2020 and 2021.

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 75P

Related questions

Question

Transcribed Image Text:Eastern Mindanao. Because the mine is located deep in the

Problem 28-6 (IAA)

In 2017, Sunflower Company acquired a silver minė in

Eastern Mindanao. Because the mine is located deep in the

Mindanao frontier, Sunflower Company was able to acquire

the mine for the low price of P50,000.

In 2018, Sunflower Company constructed a road to the silver

mine costing P5,000,000. Improvements and other

development costs made in 2018 cost P750,000.

Because of the improvements to the mine and to the

surrounding land, it is estimated that the mine can be sold

for P600,000 when mining activities are complete.

During 2019, five buildings were constrücted near the mine

site to house the mine workers and their families.

The total cost of the five buildings was P2,000,000. Estimated

residual value is P200,000.

In 2020, geologists estimated that 4,000,000 tons of silver ore

could be removed from the mine for refining.

During 2020, the first year of operations, only 500,000 tons

of silver ore were removed from the mine.

However, in 2021, workers mined 1,000,000 tons of silver.

During that same year, geologists discovered that the mine

contained 3,000,000 tons of silver ore in addition to the

original 4,000,000 tons.

Development costs of P1,300,000 were made to the mine early

in 2021 to facilitate the removal of thẹ additional silver.

Early in 2021, an additional building was constructed at a

cost of P375,000 to house the additional workers needed to

excavate the added silver. This building is not expected to

have any residual value.

Required:

1. Compute the depletion for 2020 and 2021,

2. Compute the depreciation for 2020 and 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning