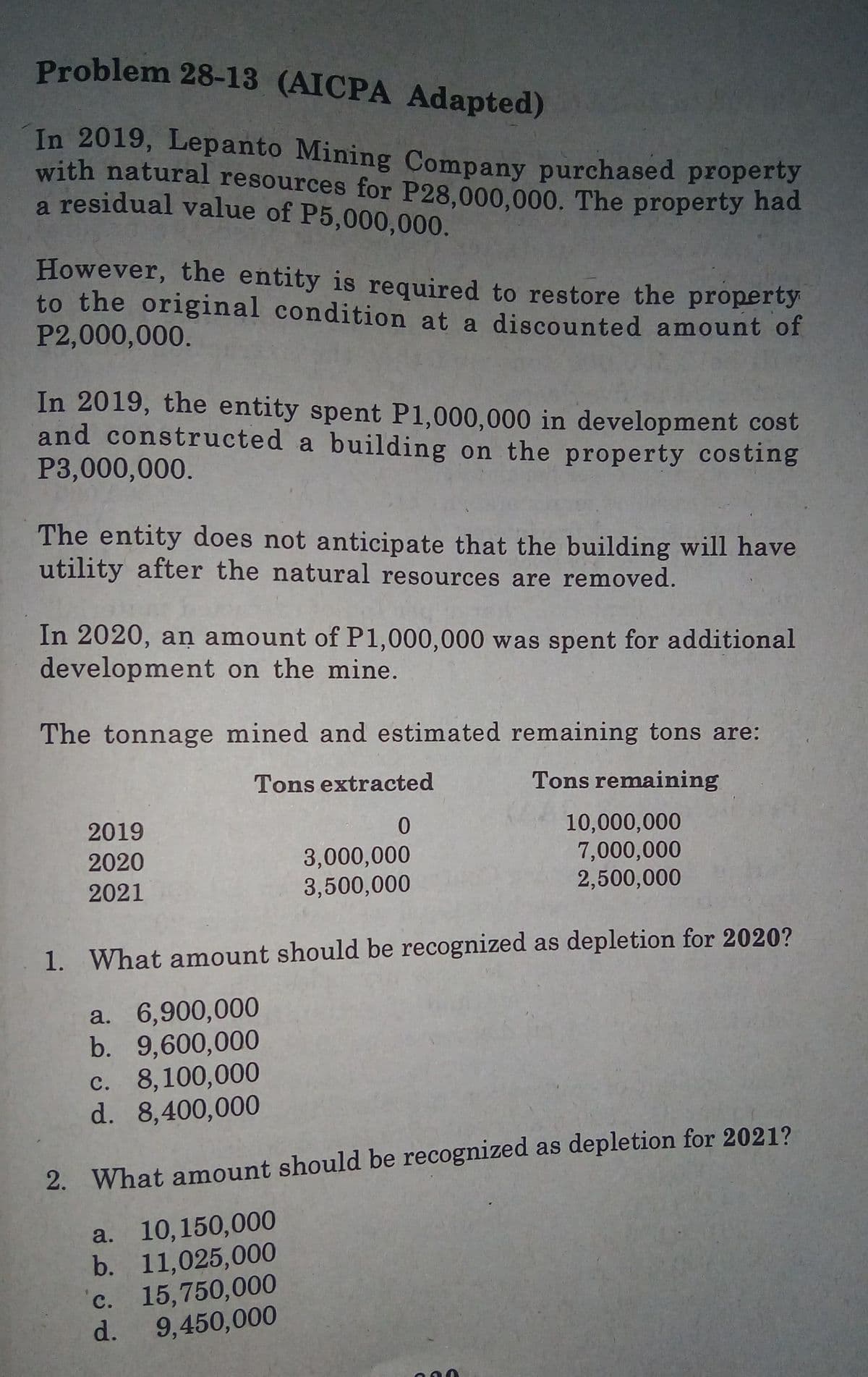

Problem 28-13 (AICPA Adapted) In 2019, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property nad a residual value of P5,000,000. However, the entity is required to restore the property to the original condition at a discounted amount of P2,000,000. In 2019, the entity spent P1,000,000 in development cost and constructed a building on the property costing P3,000,000. The entity does not anticipate that the building will have utility after the natural resources are removed. In 2020, an amount of P1,000,000 was spent for additional development on the mine. The tonnage mined and estimated remaining tons are: Tons extracted Tons remaining 10,000,000 7,000,000 2,500,000 2019 3,000,000 3,500,000 2020 2021 1. What amount should be recognized as depletion for 2020? a. 6,900,000 b. 9,600,000 c. 8,100,000 d. 8,400,000 2. What amount should be recognized as depletion for 2021? a. 10,150,000 b. 11,025,000 'c. 15,750,000 9,450,000 d.

Problem 28-13 (AICPA Adapted) In 2019, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property nad a residual value of P5,000,000. However, the entity is required to restore the property to the original condition at a discounted amount of P2,000,000. In 2019, the entity spent P1,000,000 in development cost and constructed a building on the property costing P3,000,000. The entity does not anticipate that the building will have utility after the natural resources are removed. In 2020, an amount of P1,000,000 was spent for additional development on the mine. The tonnage mined and estimated remaining tons are: Tons extracted Tons remaining 10,000,000 7,000,000 2,500,000 2019 3,000,000 3,500,000 2020 2021 1. What amount should be recognized as depletion for 2020? a. 6,900,000 b. 9,600,000 c. 8,100,000 d. 8,400,000 2. What amount should be recognized as depletion for 2021? a. 10,150,000 b. 11,025,000 'c. 15,750,000 9,450,000 d.

Chapter17: Property Transactions: § 1231 And Recapture Provisions

Section: Chapter Questions

Problem 40P

Related questions

Question

100%

Show solutions in good accounting form.

Transcribed Image Text:a residual value of P5,000,000.

In 2019, Lepanto Mining Company purchased property

Problem 28-13 (AICPA Adapted)

with natural resources for P28,000,000. The property had

However, the entity is required to restore the property

to the original condition at a discounted amount of

P2,000,000.

In 2019, the entity spent P1,000,000 in development cost

and constructed a building on the property costing

P3,000,000.

The entity does not anticipate that the building will have

utility after the natural resources are removed.

In 2020, an amount of P1,000,000 was spent for additional

development on the mine.

The tonnage mined and estimated remaining tons are:

Tons extracted

Tons remaining

10,000,000

7,000,000

2,500,000

2019

3,000,000

3,500,000

2020

2021

1. What amount should be recognized as depletion for 2020?

a. 6,900,000

b. 9,600,000

c. 8,100,000

d. 8,400,000

2. What amount should be recognized as depletion for 2021?

a. 10,150,000

b. 11,025,000

c. 15,750,000

d.

9,450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College