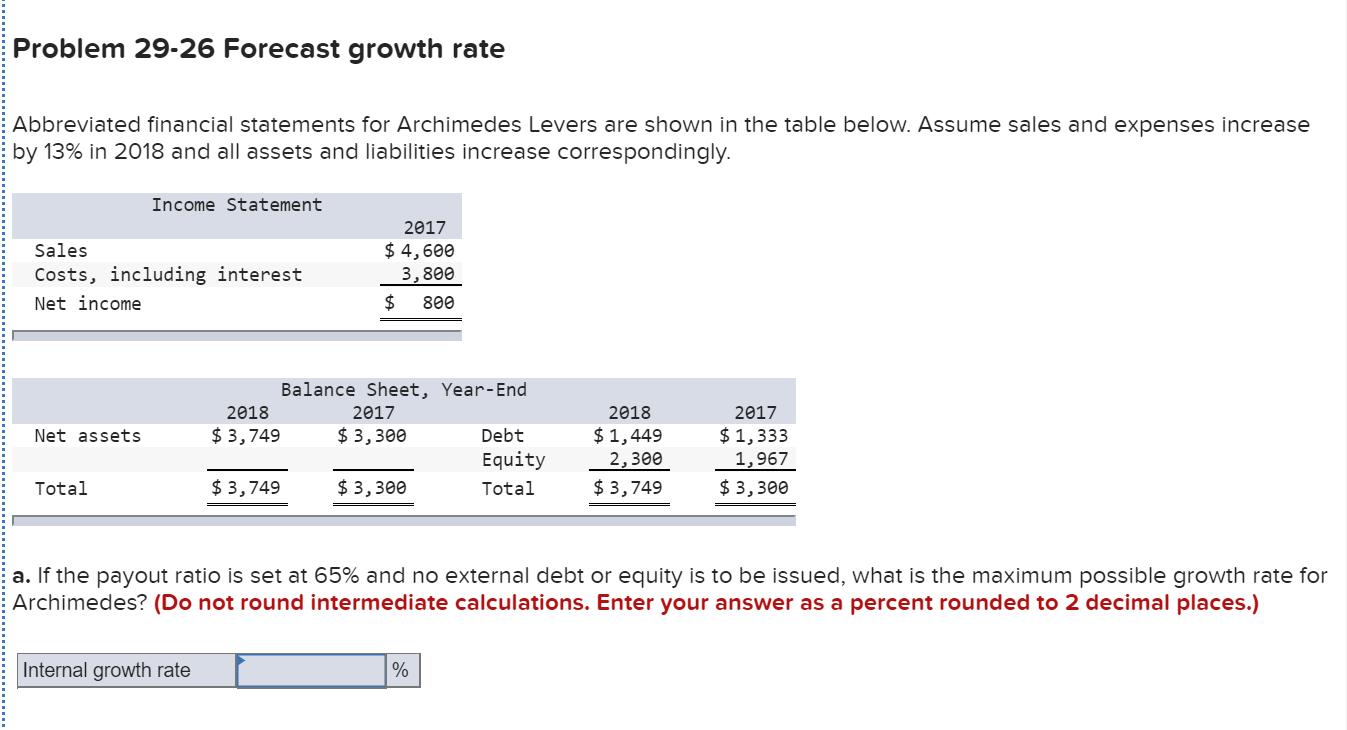

Problem 29-26 Forecast growth rate Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 13% in 2018 and all assets and liabilities increase correspondingly. Income Statement 2017 Sales $ 4,600 Costs, including interest 3,800 Net income $ 800 Balance Sheet, Year-End 2018 2017 2018 2017 $ 3,749 $ 1,333 1,967 $ 3,300 $ 1,449 2,300 $ 3,749 Net assets Debt Equity Total $ 3,749 $ 3,300 Total $ 3,300 a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal growth rate Balance Sheet, Year-End 2018 2017 2018 2017 $ 3,749 $ 1,333 1,967 $ 3,300 $ 1,449 2,300 Net assets Debt Equity Total $ 3,749 $ 3,300 Total $ 3,749 $ 3,300 a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal growth rate b. If the payout ratio is set at 65% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible E growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal E places.) Sustainable growth rate

Problem 29-26 Forecast growth rate Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 13% in 2018 and all assets and liabilities increase correspondingly. Income Statement 2017 Sales $ 4,600 Costs, including interest 3,800 Net income $ 800 Balance Sheet, Year-End 2018 2017 2018 2017 $ 3,749 $ 1,333 1,967 $ 3,300 $ 1,449 2,300 $ 3,749 Net assets Debt Equity Total $ 3,749 $ 3,300 Total $ 3,300 a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal growth rate Balance Sheet, Year-End 2018 2017 2018 2017 $ 3,749 $ 1,333 1,967 $ 3,300 $ 1,449 2,300 Net assets Debt Equity Total $ 3,749 $ 3,300 Total $ 3,749 $ 3,300 a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal growth rate b. If the payout ratio is set at 65% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible E growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal E places.) Sustainable growth rate

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 4P: Sales Increase Maggies Muffins Bakery generated 5 million in sales during 2018, and its year-end...

Related questions

Question

Transcribed Image Text:Problem 29-26 Forecast growth rate

Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase

by 13% in 2018 and all assets and liabilities increase correspondingly.

Income Statement

2017

Sales

$ 4,600

Costs, including interest

3,800

Net income

$ 800

Balance Sheet, Year-End

2018

2017

2018

2017

$ 3,749

$ 1,333

1,967

$ 3,300

$ 1,449

2,300

$ 3,749

Net assets

Debt

Equity

Total

$ 3,749

$ 3,300

Total

$ 3,300

a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for

Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Internal growth rate

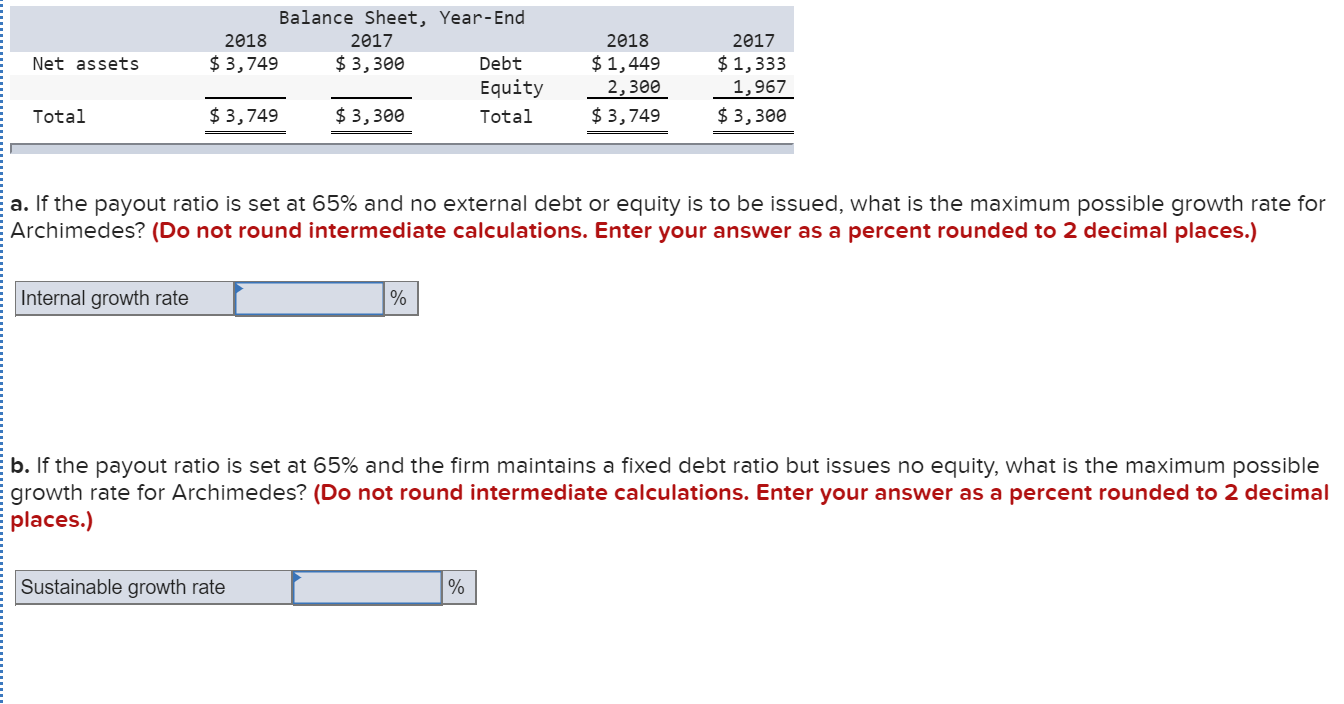

Transcribed Image Text:Balance Sheet, Year-End

2018

2017

2018

2017

$ 3,749

$ 1,333

1,967

$ 3,300

$ 1,449

2,300

Net assets

Debt

Equity

Total

$ 3,749

$ 3,300

Total

$ 3,749

$ 3,300

a. If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for

Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Internal growth rate

b. If the payout ratio is set at 65% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible

E growth rate for Archimedes? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal

E places.)

Sustainable growth rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning