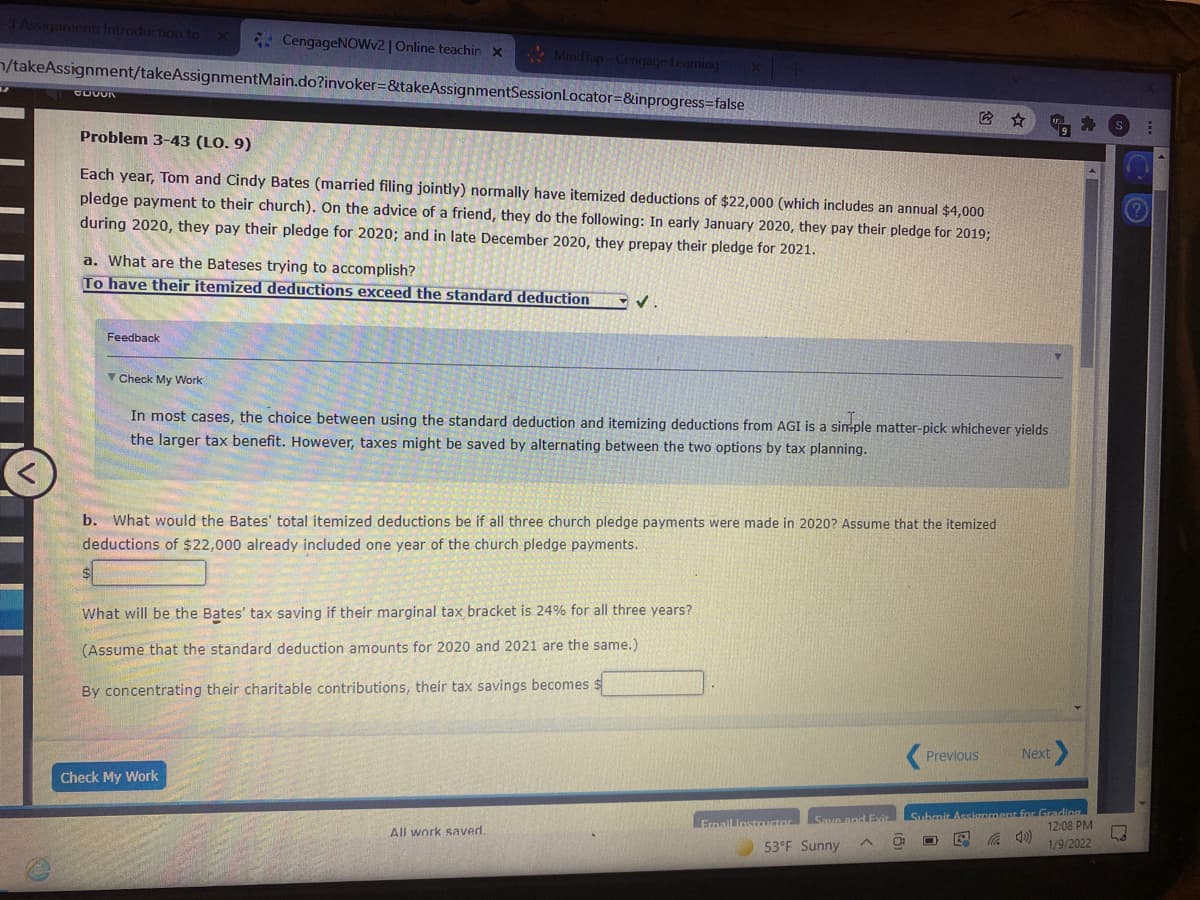

Problem 3-43 (LO. 9) Each year, Tom and Cindy Bates (married filing jointly) normally have itemized deductions of $22,000 (which includes an annual $4,000 pledge payment to their church). On the advice of a friend, they do the following: In early January 2020, they pay their pledge for 2019; during 2020, they pay their pledge for 2020; and in late December 2020, they prepay their pledge for 2021. a. What are the Bateses trying to accomplish? To have their itemized deductions exceed the standard deduction Feedback V Check My Work In most cases, the choice between using the standard deduction and itemizing deductions from AGI is a sinple matter-pick whichever yields the larger tax benefit. However, taxes might be saved by alternating between the two options by tax planning. b. What would the Bates' total itemized deductions be if all three church pledge payments were made in 2020? Assume that the itemized deductions of $22,000 already included one year of the church pledge payments. What will be the Bates' tax saving if their marginal tax bracket is 24% for all three years? (Assume that the standard deduction amounts for 2020 and 2021 are the same.) By concentrating their charitable contributions, their tax savings becomes $

Problem 3-43 (LO. 9) Each year, Tom and Cindy Bates (married filing jointly) normally have itemized deductions of $22,000 (which includes an annual $4,000 pledge payment to their church). On the advice of a friend, they do the following: In early January 2020, they pay their pledge for 2019; during 2020, they pay their pledge for 2020; and in late December 2020, they prepay their pledge for 2021. a. What are the Bateses trying to accomplish? To have their itemized deductions exceed the standard deduction Feedback V Check My Work In most cases, the choice between using the standard deduction and itemizing deductions from AGI is a sinple matter-pick whichever yields the larger tax benefit. However, taxes might be saved by alternating between the two options by tax planning. b. What would the Bates' total itemized deductions be if all three church pledge payments were made in 2020? Assume that the itemized deductions of $22,000 already included one year of the church pledge payments. What will be the Bates' tax saving if their marginal tax bracket is 24% for all three years? (Assume that the standard deduction amounts for 2020 and 2021 are the same.) By concentrating their charitable contributions, their tax savings becomes $

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:Assgament: Introduction to

* CengageNOWv2 | Online teachin x

* Mindfap-Cenqage Leaming

n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

它 ☆

Problem 3-43 (LO. 9)

Each year, Tom and Cindy Bates (married filing jointly) normally have itemized deductions of $22,000 (which includes an annual $4,000

pledge payment to their church). On the advice of a friend, they do the following: In early January 2020, they pay their pledge for 2019;

during 2020, they pay their pledge for 2020; and in late December 2020, they prepay their pledge for 2021.

a. What are the Bateses trying to accomplish?

To have their itemized deductions exceed the standard deduction

Feedback

V Check My Work

In most cases, the choice between using the standard deduction and itemizing deductions from AGI is a sinple matter-pick whichever yields

the larger tax benefit. However, taxes might be saved by alternating between the two options by tax planning.

b. What would the Bates' total itemized deductions be if all three church pledge payments were made in 2020? Assume that the itemized

deductions of $22,000 already included one year of the church pledge payments.

What will be the Bates' tax saving if their marginal tax bracket is 24% for all three years?

(Assume that the standard deduction amounts for 2020 and 2021 are the same.)

By concentrating their charitable contributions, their

savings becomes $

Previous

Next

Check My Work

Submit Assianment for Grading

12:08 PM

Ermail

Save and Evit

uctor

All work saved.

53°F Sunny

1/9/2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you