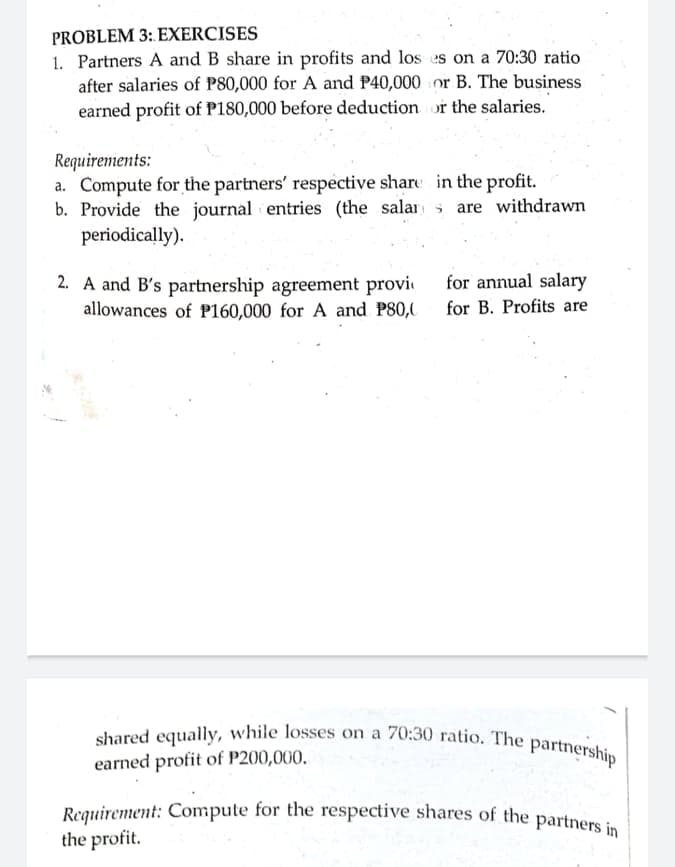

PROBLEM 3: EXERCISES 1. Partners A and B share in profits and los es on a 70:30 ratio after salaries of P80,000 for A and P40,000 or B. The business earned profit of P180,000 before deduction or the salaries. Requirements: a. Compute for the partners' respective share in the profit. b. Provide the journal entries (the salar are withdrawn periodically).

PROBLEM 3: EXERCISES 1. Partners A and B share in profits and los es on a 70:30 ratio after salaries of P80,000 for A and P40,000 or B. The business earned profit of P180,000 before deduction or the salaries. Requirements: a. Compute for the partners' respective share in the profit. b. Provide the journal entries (the salar are withdrawn periodically).

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 47P

Related questions

Question

The image has a large space but the continued question is below. Pls provide an explanation in order for me to review it. It's just so hard since I don't have a reference or book. Thank you!

Transcribed Image Text:Requirement: Compute for the respective shares of the partners in |

shared equally, while losses on a 70:30 ratio. The partnership

PROBLEM 3: EXERCISES

1. Partners A and B share in profits and los es on a 70:30 ratio

after salaries of P80,000 for A and P40,000 or B. The business

earned profit of P180,000 before deduction or the salaries.

Requirements:

a. Compute for the partners' respective share in the profit.

b. Provide the journal entries (the salar are withdrawn

periodically).

for annual salary

2. A and B's partnership agreement provi

allowances of P160,000 for A and P80, for B. Profits are

earned profit of P200,000.

Reguirement: Compute for the respective shares of the partners in

the profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning