Problem 3 Prepare the necessary adjusting entries on December 31, 2020 to adjust the given items below. The trial balance of Liberty Enterprises contains the following balances among others on December 31, 2020: Debit Credit Notes Receivable Prepaid Insurance Office Equipment Notes Payable Salaries Expense Rent Expense Supplies Expense Taxes and Licenses Expense Advertising Expense Interest Income Rent Income 120,000.00 48,000.00 100,000.00 150,000.00 40,000.00 36,000.00 8,000.00 6,000.00 24,000.00 9,000.00 18,000.00 Additional information as of December 31, 2020 1. Unpaid taxes, P2,400. 2. Accrued salaries, P12,800. 3. The prepaid insurance amount represents premium for one-year effective October 1, 2020. 4. Unused supplies as of December 31, P3,000. 5. Accrued interest on notes receivable, P4,000. 6. Rent collected in advance, P2,000. This is included in the P18,000 rent income account. 7. Accrued interest on notes payable, P4,000. 8. Prepaid rent, P6,000. 9. Prepaid advertising, P8,000. 10. Depreciation of office equipment, 10% per year.

Problem 3 Prepare the necessary adjusting entries on December 31, 2020 to adjust the given items below. The trial balance of Liberty Enterprises contains the following balances among others on December 31, 2020: Debit Credit Notes Receivable Prepaid Insurance Office Equipment Notes Payable Salaries Expense Rent Expense Supplies Expense Taxes and Licenses Expense Advertising Expense Interest Income Rent Income 120,000.00 48,000.00 100,000.00 150,000.00 40,000.00 36,000.00 8,000.00 6,000.00 24,000.00 9,000.00 18,000.00 Additional information as of December 31, 2020 1. Unpaid taxes, P2,400. 2. Accrued salaries, P12,800. 3. The prepaid insurance amount represents premium for one-year effective October 1, 2020. 4. Unused supplies as of December 31, P3,000. 5. Accrued interest on notes receivable, P4,000. 6. Rent collected in advance, P2,000. This is included in the P18,000 rent income account. 7. Accrued interest on notes payable, P4,000. 8. Prepaid rent, P6,000. 9. Prepaid advertising, P8,000. 10. Depreciation of office equipment, 10% per year.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 31BE: Brief Exercise 3-31 Adjusting Entries-Accruals Nichols Company had the following items that required...

Related questions

Question

How can I solve the question on the photo I sent

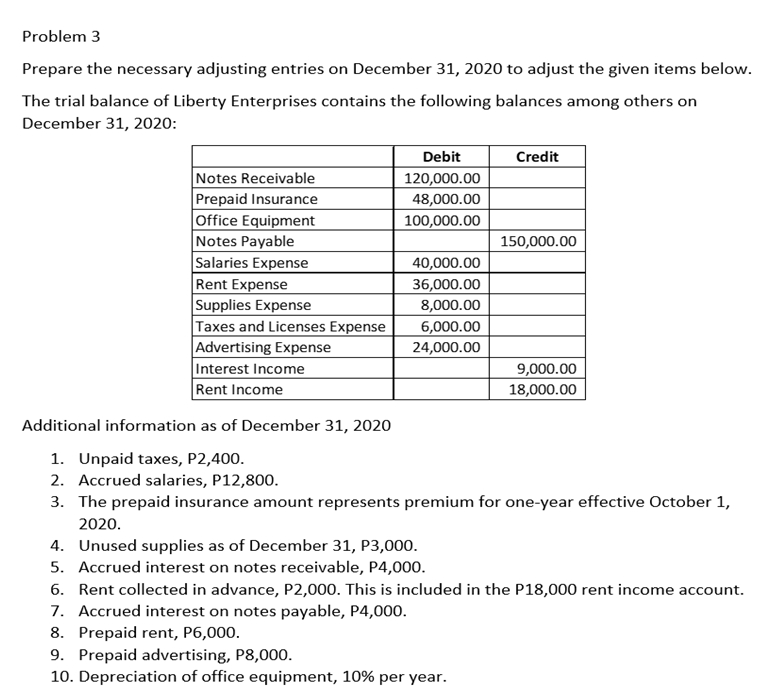

Transcribed Image Text:Problem 3

Prepare the necessary adjusting entries on December 31, 2020 to adjust the given items below.

The trial balance of Liberty Enterprises contains the following balances among others on

December 31, 2020:

Debit

Credit

Notes Receivable

Prepaid Insurance

Office Equipment

Notes Payable

Salaries Expense

Rent Expense

Supplies Expense

Taxes and Licenses Expense

Advertising Expense

Interest Income

Rent Income

120,000.00

48,000.00

100,000.00

150,000.00

40,000.00

36,000.00

8,000.00

6,000.00

24,000.00

9,000.00

18,000.00

Additional information as of December 31, 2020

1. Unpaid taxes, P2,400.

2. Accrued salaries, P12,800.

3. The prepaid insurance amount represents premium for one-year effective October 1,

2020.

4. Unused supplies as of December 31, P3,000.

5. Accrued interest on notes receivable, P4,000.

6. Rent collected in advance, P2,000. This is included in the P18,000 rent income account.

7. Accrued interest on notes payable, P4,000.

8. Prepaid rent, P6,000.

9. Prepaid advertising, P8,000.

10. Depreciation of office equipment, 10% per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,