Problem 4 (R ulati ying Knix Products is a division of Park Textiles, Inc. During the coming year, it a net operating income of P310,000 based on sales of P3.45million; without any new investments, the division will have average net expects to earn Th dvicion ic considering a canital investment :11:

Problem 4 (R ulati ying Knix Products is a division of Park Textiles, Inc. During the coming year, it a net operating income of P310,000 based on sales of P3.45million; without any new investments, the division will have average net expects to earn Th dvicion ic considering a canital investment :11:

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter11: Performance Evaluation And Decentralization

Section: Chapter Questions

Problem 43P: Return on Investment and Economic Value Added Calculations with Varying Assumptions Knitpix Products...

Related questions

Question

100%

Answer 4 to 6

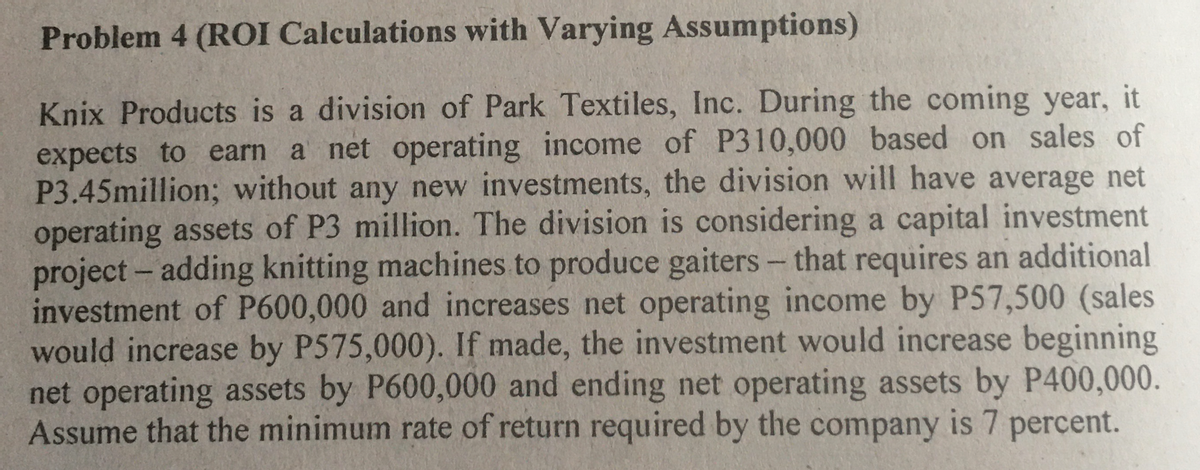

Transcribed Image Text:Problem 4 (ROI Calculations with Varying Assumptions)

Knix Products is a division of Park Textiles, Inc. During the coming year, it

expects to earn a net operating income of P310,000 based on sales of

P3.45million; without any new investments, the division will have average net

operating assets of P3 million. The division is considering a capital investment

project- adding knitting machines to produce gaiters - that requires an additional

investment of P600,000 and increases net operating income by P57,500 (sales

would increase by P575,000). If made, the investment would increase beginning

net operating assets by P600,000 and ending net operating assets by P400,000.

Assume that the minimum rate of return required by the company is 7 percent.

Transcribed Image Text:5. Assume that a JIT purchasing and manufacturing system is installed,

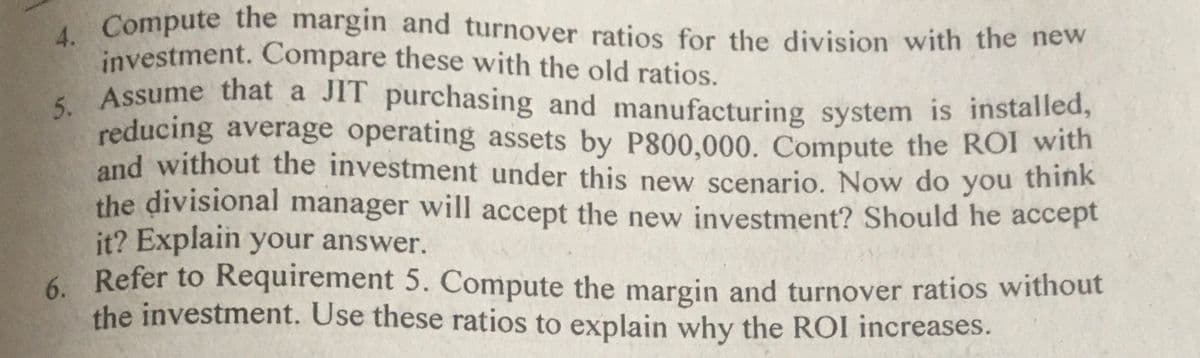

investment. Compare these with the old ratios.

, Compute the margin and turnover ratios for the division with the new

Assume that a JIT purchasing and manufacturing system is installed,

reducing average operating assets by P800,000. Compute the ROI with

and without the investment under this new scenario. Now do you think

the divisional manager will accept the new investment? Should he accept

it? Explain your answer.

6. Refer to Requirement 5. Compute the margin and turnover ratios without

the investment. Use these ratios to explain why the ROI increases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning