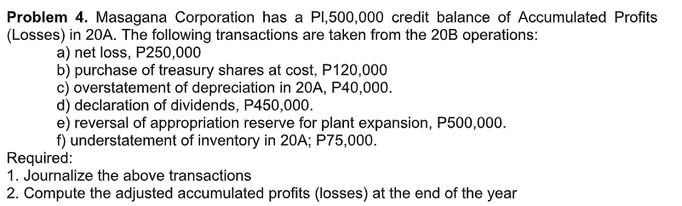

Problem 4. Masagana Corporation has a PI,500,000 credit balance of Accumulated Profits (Losses) in 20A. The following transactions are taken from the 20B operations: a) net loss, P250,000 b) purchase of treasury shares at cost, P120,000 c) overstatement of depreciation in 20A, P40,000. d) declaration of dividends, P450,000. e) reversal of appropriation reserve for plant expansion, P500,000. f) understatement of inventory in 20A; P75,000. Required: 1. Journalize the above transactions 2. Compute the adjusted accumulated profits (losses) at the end of the year

Problem 4. Masagana Corporation has a PI,500,000 credit balance of Accumulated Profits (Losses) in 20A. The following transactions are taken from the 20B operations: a) net loss, P250,000 b) purchase of treasury shares at cost, P120,000 c) overstatement of depreciation in 20A, P40,000. d) declaration of dividends, P450,000. e) reversal of appropriation reserve for plant expansion, P500,000. f) understatement of inventory in 20A; P75,000. Required: 1. Journalize the above transactions 2. Compute the adjusted accumulated profits (losses) at the end of the year

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:Problem 4. Masagana Corporation has a PI,500,000 credit balance of Accumulated Profits

(Losses) in 20A. The following transactions are taken from the 20B operations:

a) net loss, P250,000

b) purchase of treasury shares at cost, P120,000

c) overstatement of depreciation in 20A, P40,000.

d) declaration of dividends, P450,000.

e) reversal of appropriation reserve for plant expansion, P500,000.

f) understatement of inventory in 20OA; P75,000.

Required:

1. Journalize the above transactions

2. Compute the adjusted accumulated profits (losses) at the end of the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning