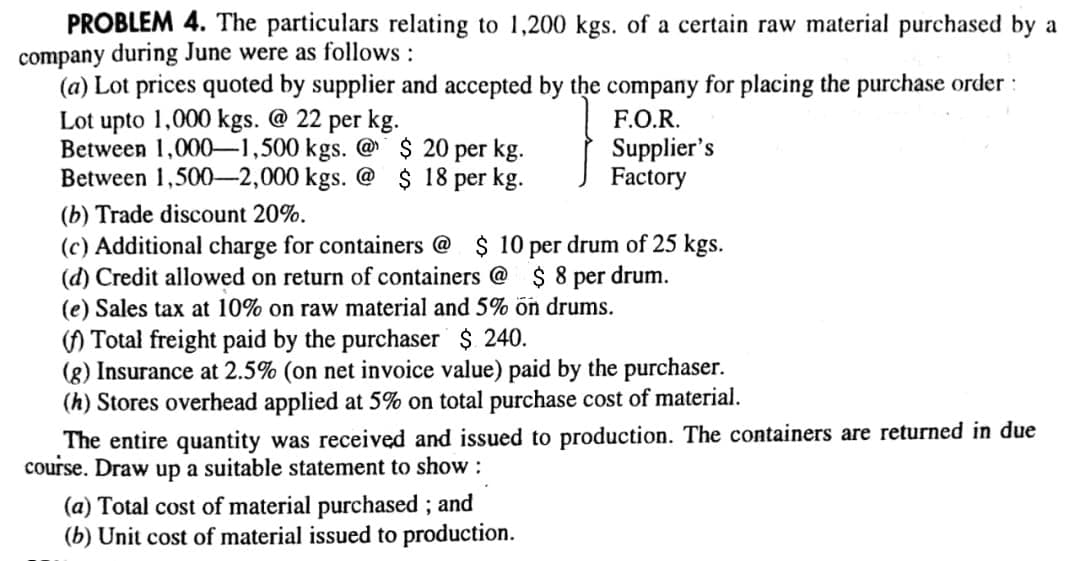

PROBLEM 4. The particulars relating to 1,200 kgs. of a certain raw material purchased by a company during June were as follows : (a) Lot prices quoted by supplier and accepted by the company for placing the purchase order : Lot upto 1,000 kgs. @ 22 per kg. Between 1,000-1,500 kgs. @$ 20 per kg. Between 1,500-2,000 kgs. @ $ 18 per kg. F.O.R. Supplier's Factory (b) Trade discount 20%. (c) Additional charge for containers @ $ 10 per drum of 25 kgs. (d) Credit allowed on return of containers @ $ 8 per drum. (e) Sales tax at 10% on raw material and 5% ön drums. () Total freight paid by the purchaser $ 240. (g) Insurance at 2.5% (on net invoice value) paid by the purchaser. (h) Stores overhead applied at 5% on total purchase cost of material. The entire quantity was received and issued to production. The containers are returned in due course. Draw up a suitable statement to show: (a) Total cost of material purchased ; and (b) Unit cost of material issued to production.

PROBLEM 4. The particulars relating to 1,200 kgs. of a certain raw material purchased by a company during June were as follows : (a) Lot prices quoted by supplier and accepted by the company for placing the purchase order : Lot upto 1,000 kgs. @ 22 per kg. Between 1,000-1,500 kgs. @$ 20 per kg. Between 1,500-2,000 kgs. @ $ 18 per kg. F.O.R. Supplier's Factory (b) Trade discount 20%. (c) Additional charge for containers @ $ 10 per drum of 25 kgs. (d) Credit allowed on return of containers @ $ 8 per drum. (e) Sales tax at 10% on raw material and 5% ön drums. () Total freight paid by the purchaser $ 240. (g) Insurance at 2.5% (on net invoice value) paid by the purchaser. (h) Stores overhead applied at 5% on total purchase cost of material. The entire quantity was received and issued to production. The containers are returned in due course. Draw up a suitable statement to show: (a) Total cost of material purchased ; and (b) Unit cost of material issued to production.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Topic Video

Question

Transcribed Image Text:PROBLEM 4. The particulars relating to 1,200 kgs. of a certain raw material purchased by a

company during June were as follows :

(a) Lot prices quoted by supplier and accepted by the company for placing the purchase order :

Lot upto 1,000 kgs. @ 22 per kg.

Between 1,000-1,500 kgs. @$ 20 per kg.

Between 1,500-2,000 kgs. @ $ 18 per kg.

F.O.R.

Supplier's

Factory

(b) Trade discount 20%.

(c) Additional charge for containers @ $ 10 per drum of 25 kgs.

(d) Credit allowed on return of containers @ $8 per drum.

(e) Sales tax at 10% on raw material and 5% ön drums.

() Total freight paid by the purchaser $ 240.

(g) Insurance at 2.5% (on net invoice value) paid by the purchaser.

(h) Stores overhead applied at 5% on total purchase cost of material.

The entire quantity was received and issued to production. The containers are returned in due

course. Draw up a suitable statement to show:

(a) Total cost of material purchased ; and

(b) Unit cost of material issued to production.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning