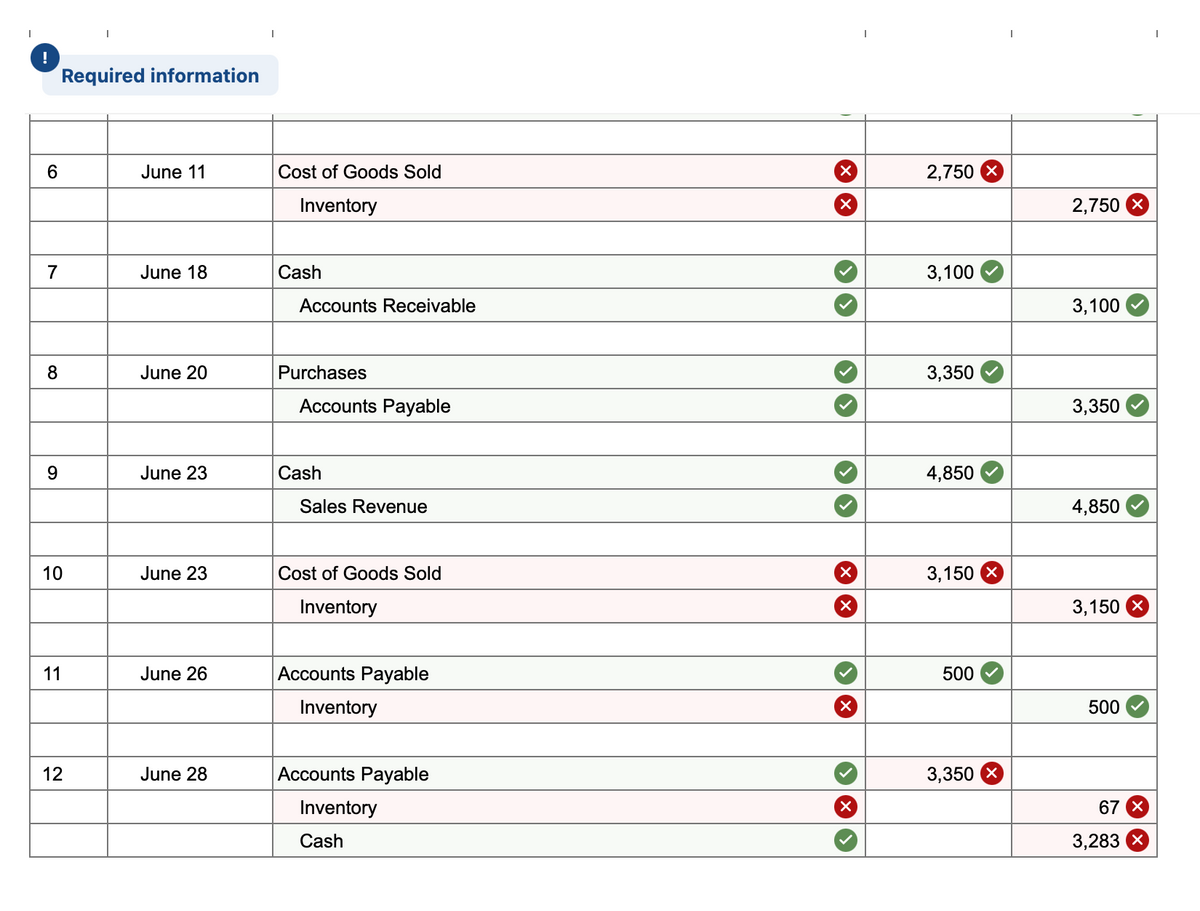

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory system (LO6-8) [The following information applies to the questions displayed below.] At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the month of June. June June June June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750. June 18 Receive payment on account from customers, $3,100. June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30. June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150. June 26 Return damaged radios to Sound Unlimited and receive credit of $500. June 28 Pay Sound Unlimited in full. 2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45. 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310. 8 Return defective radios to Radio World and receive credit, $400. Problem 6-9B Part 1 Required: 1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) X Answer is complete but not entirely correct.

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory system (LO6-8) [The following information applies to the questions displayed below.] At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the month of June. June June June June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750. June 18 Receive payment on account from customers, $3,100. June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30. June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150. June 26 Return damaged radios to Sound Unlimited and receive credit of $500. June 28 Pay Sound Unlimited in full. 2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45. 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310. 8 Return defective radios to Radio World and receive credit, $400. Problem 6-9B Part 1 Required: 1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) X Answer is complete but not entirely correct.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.24MCE

Related questions

Topic Video

Question

Transcribed Image Text:!

Required information

6

June 11

Cost of Goods Sold

2,750 X

Inventory

2,750

7

June 18

Cash

3,100

Accounts Receivable

3,100

8

June 20

Purchases

3,350

Accounts Payable

3,350

9

June 23

Cash

4,850

Sales Revenue

4,850

10

June 23

Cost of Goods Sold

3,150

Inventory

3,150

11

June 26

Accounts Payable

500

Inventory

500

12

June 28

Accounts Payable

3,350

Inventory

67 X

Cash

3,283 (х

![!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Selll radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 1

Required:

1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular

transaction, select "No Journal Entry Required" in the first account field.)

X Answer is complete but not entirely correct.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcc35bfef-1e1d-4e62-a745-481127990680%2F1816d441-e91b-4fd6-96de-c98a092af534%2Fdpp92kl_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Selll radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 1

Required:

1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular

transaction, select "No Journal Entry Required" in the first account field.)

X Answer is complete but not entirely correct.

Expert Solution

Step 1

|

>The inventory transactions are recorded either using a perpetual method or periodic method. |

|

>Under perpetual method, the inventory records are regularly updated. |

|

--The cost of goods sold is recorded after each sales transaction. |

|

--Inventory account is used to record purchase, purchase related cost, purchase discounts, returns and allowances. |

|

>Under periodic method, the inventory records are updated at period end. |

|

--The cost of goods sold is NOT recorded after each sales transaction. |

|

--Inventory account is NOT used to record purchase, purchase related cost, purchase discounts, returns and allowances. |

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage