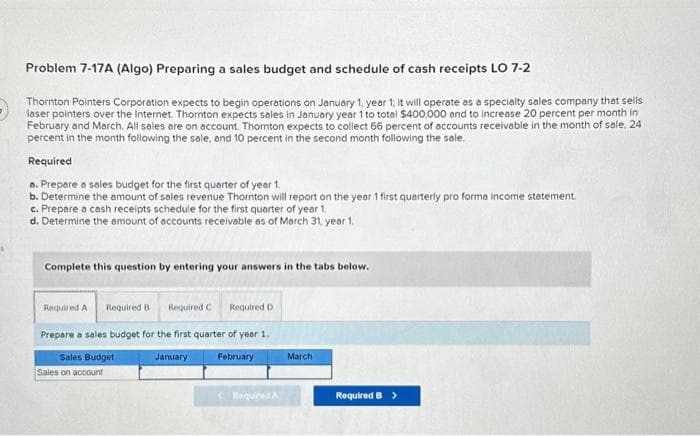

Problem 7-17A (Algo) Preparing a sales budget and schedule of cash receipts LO 7-2 Thornton Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Thornton expects sales in January year 1 to total $400,000 and to increase 20 percent per month in February and March. All sales are on account. Thornton expects to collect 66 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 10 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Thornton will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1.

Problem 7-17A (Algo) Preparing a sales budget and schedule of cash receipts LO 7-2 Thornton Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Thornton expects sales in January year 1 to total $400,000 and to increase 20 percent per month in February and March. All sales are on account. Thornton expects to collect 66 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 10 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Thornton will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 66.2C

Related questions

Question

Transcribed Image Text:Problem 7-17A (Algo) Preparing a sales budget and schedule of cash receipts LO 7-2

Thornton Pointers Corporation expects to begin operations on January 1, year 1, it will operate as a specialty sales company that sells

laser pointers over the Internet. Thornton expects sales in January year 1 to total $400,000 and to increase 20 percent per month in

February and March. All sales are on account. Thornton expects to collect 66 percent of accounts receivable in the month of sale, 24

percent in the month following the sale, and 10 percent in the second month following the sale.

Required

a. Prepare a sales budget for the first quarter of year 1.

b. Determine the amount of sales revenue Thornton will report on the year 1 first quarterly pro forma income statement.

c. Prepare a cash receipts schedule for the first quarter of year 1.

d. Determine the amount of accounts receivable as of March 31, year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Prepare a sales budget for the first quarter of year 1.

Sales Budget

January

February

Sales on account

Required D

< Required A

March

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning