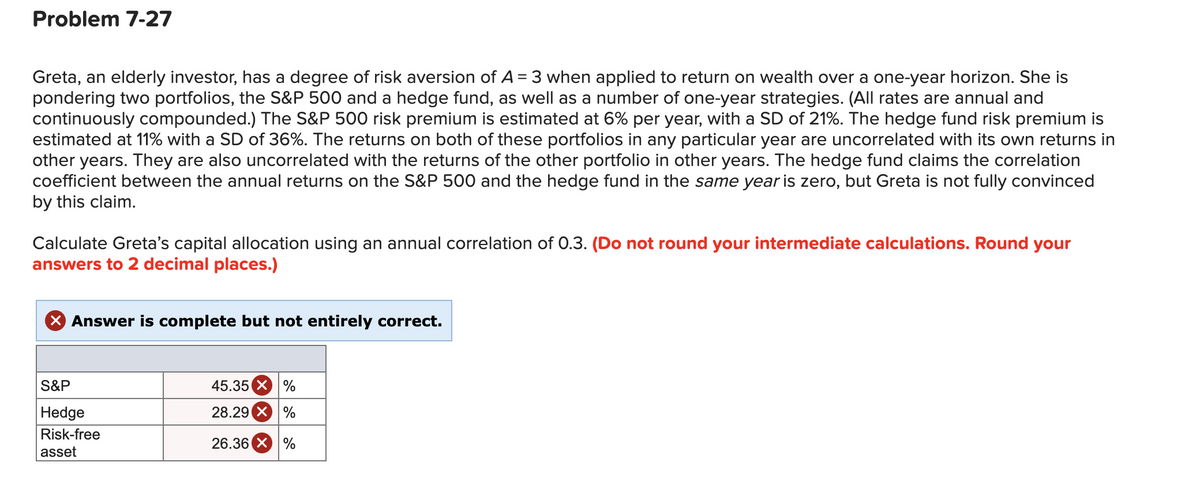

Problem 7-27 Greta, an elderly investor, has a degree of risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 6% per year, with a SD of 21%. The hedge fund risk premium is estimated at 11% with a SD of 36%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced by this claim. Calculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. S&P 45.35 X % Hedge 28.29 X % Risk-free 26.36 X % asset

Problem 7-27 Greta, an elderly investor, has a degree of risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 6% per year, with a SD of 21%. The hedge fund risk premium is estimated at 11% with a SD of 36%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced by this claim. Calculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. S&P 45.35 X % Hedge 28.29 X % Risk-free 26.36 X % asset

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

1

Transcribed Image Text:Problem 7-27

Greta, an elderly investor, has a degree of risk aversion of A= 3 when applied to return on wealth over a one-year horizon. She is

pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and

continuously compounded.) The S&P 500 risk premium is estimated at 6% per year, with a SD of 21%. The hedge fund risk premium is

estimated at 11% with a SD of 36%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in

other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation

coefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced

by this claim.

Calculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your

answers to 2 decimal places.)

Answer is complete but not entirely correct.

S&P

45.35 X %

Hedge

28.29 X %

Risk-free

26.36 X %

asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning