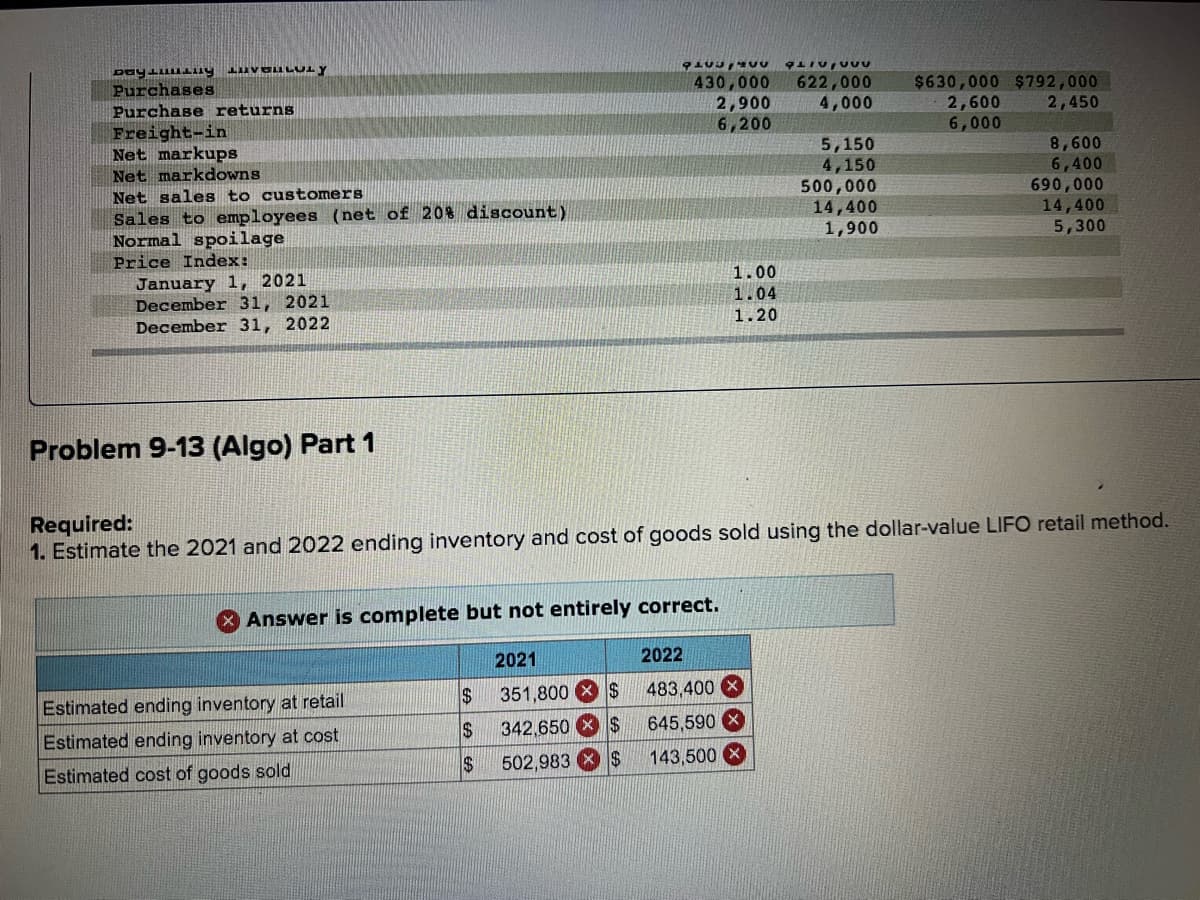

Problem 9-13 (Algo) Retail inventory method; various applications (LO9-3, 9-4, 9-5] [The following information applies to the questions displayed below.] On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both co and cost indexes for 2021 and 2022 are as follows: 2021 2022 Cost Retail Cost Retail $105,400 $170,000 430,000 2,900 6,200 Beginning inventory Purchases 622,000 4,000 $630,000 $792,000 2,600 6,000 Purchase returns 2,450 Freight-in Net markups 8,600 6,400 5,150 4,150 Net markdowns Net sales to customers Sales to employees (net of 20% discount) Normal spoilage 500,000 14,400 1,900 690,000 14,400 5,300 Price Index: January 1, 2021 1.00

Problem 9-13 (Algo) Retail inventory method; various applications (LO9-3, 9-4, 9-5] [The following information applies to the questions displayed below.] On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both co and cost indexes for 2021 and 2022 are as follows: 2021 2022 Cost Retail Cost Retail $105,400 $170,000 430,000 2,900 6,200 Beginning inventory Purchases 622,000 4,000 $630,000 $792,000 2,600 6,000 Purchase returns 2,450 Freight-in Net markups 8,600 6,400 5,150 4,150 Net markdowns Net sales to customers Sales to employees (net of 20% discount) Normal spoilage 500,000 14,400 1,900 690,000 14,400 5,300 Price Index: January 1, 2021 1.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 5MC: The moving average inventory cost flow assumption is applicable to which of the following inventory...

Related questions

Topic Video

Question

![Problem 9-13 (Algo) Retail inventory method; various applications (LO9-3, 9-4, 9-5)

(The following information applies to the questions displayed below.]

On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail,

and cost indexes for 2021 and 2022 are as follows:

2021

2022

Cost

Retail

Cost

Retail

$105,400 $170,000

430,000

2,900

6,200

Beginning inventory

Purchases

622,000

4,000

$630,000 $792,000

2,600

6,000

Purchase returns

2,450

Freight-in

Net markups

Net markdowns

Net sales to customers

5,150

4,150

500,000

14,400

1,900

8,600

6,400

690,000

14,400

5,300

Sales to employees (net of 20% discount)

Normal spoilage

Price Index:

January 1, 2021

December 31, 2021

December 31, 2022

1.00

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

X Answer is complete but not entirely correct.

2021

2022

Estimated ending inventory at retail

24

351,800

2$

483,400](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F3e1bfd6a-3cb6-4031-858f-4ba8da8545b1%2F48418f26-73e0-45cb-83fc-19238636d379%2Fdx8lll8_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Problem 9-13 (Algo) Retail inventory method; various applications (LO9-3, 9-4, 9-5)

(The following information applies to the questions displayed below.]

On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail,

and cost indexes for 2021 and 2022 are as follows:

2021

2022

Cost

Retail

Cost

Retail

$105,400 $170,000

430,000

2,900

6,200

Beginning inventory

Purchases

622,000

4,000

$630,000 $792,000

2,600

6,000

Purchase returns

2,450

Freight-in

Net markups

Net markdowns

Net sales to customers

5,150

4,150

500,000

14,400

1,900

8,600

6,400

690,000

14,400

5,300

Sales to employees (net of 20% discount)

Normal spoilage

Price Index:

January 1, 2021

December 31, 2021

December 31, 2022

1.00

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

X Answer is complete but not entirely correct.

2021

2022

Estimated ending inventory at retail

24

351,800

2$

483,400

Transcribed Image Text:9103 0

430,000

2,900

6,200

$630,000 $792,000

2,600

6,000

Purchases

Purchase returns

622,000

4,000

2,450

Freight-in

Net markups

Net markdowns

Net sales to customers

Sales to employees (net of 20% discount)

Normal spoilage

5,150

4,150

500,000

14,400

1,900

8,600

6,400

690,000

14,400

5,300

Price Index:

1.00

January 1, 2021

December 31, 2021

December 31, 2022

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

Answer is complete but not entirely correct.

2021

2022

2$

351,800 X $

483,400

Estimated ending inventory at retail

Estimated ending inventory at cost

2$

342,650 X $

645,590

502,983

2$

143,500

Estimated cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning