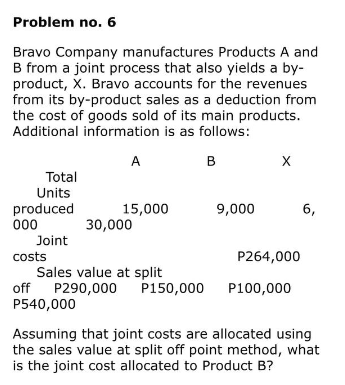

Problem no. 6 Bravo Company manufactures Products A and B from a joint process that also yields a by- product, X. Bravo accounts for the revenues from its by-product sales as a deduction from the cost of goods sold of its main products. Additional information is as follows: A B Total Units produced 15.000 9.000 X 6

Q: Empathy State Bank Assets Vault Cash Deposits at the Federal Reserve Loans Reference: Ref 12-1 This…

A: Disclaimer: "Since you have asked multiple questions, we will solve the first question for you. If…

Q: solve all parts within 30 mins

A:

Q: Schoen Corp. manufactures three types of electrical motors. Type A is sold upon completion of the…

A: In the above question, firstly we have to find total profit if product B are not sent for further…

Q: Mr Jose Peralta, a Filipino merchant residing in Greenhils, made the following gifts in 2021 and…

A: Mr Jose Peralta, a Filipino merchant residing in Greenhils has given a few gifts during the year…

Q: determine the direct labor cost budget for polishing for the year. $____

A: The company prepares a budgets based on the estimates to assess the future viability and growth of…

Q: You have just turned 22 years old, have just received your bachelor's degree, and have accepted your…

A: An RRSP refers to the retirement saving plan that is established by an individual and in which the…

Q: Instructions: 1. 2. 3. 4. Prepare ten-column journal entries (with description) that were required…

A: Journal Entry :- A journal entry is the act of recording any transaction, whether one that is…

Q: Jaclyn Biggs, who files as a head of household, never paid AMT before 2021. In 2021, her regular tax…

A: Taxpayer should pay higher tax amount between AMT and regular Tax. Total Income Tax under AMTI…

Q: Required information [The following information applies to the questions displayed below.] Listed…

A: Product costs are costs related with the production or manufacturing of goods. It includes direct…

Q: Why are discounted cash flow methods of making capital budgeting decisions superior to allother…

A: Discounted cash flow: it is a valuation method. This method helps in determining the Value of a…

Q: At the end of 2020, Monty Corp. has accounts receivable of $2.95 million and an allowance for…

A: The allowance for doubtful accounts is created to record estimated bad debt expense for the period.…

Q: Determine the account and amount to be debited and the account and amount to be credited for the…

A: There are three golden rules in accounting for recording the transaction : Debit what comes in ,…

Q: How much of the above payments are deductible from gross income?

A: Gross income is the income which has been earned by the company when the same has been computed as…

Q: The following data are available for X Corp, a Domestic Corporation, with Total Assets of P40…

A: In the context of the given question, we are required to compute the income tax payable in Quarter…

Q: Finch Company began its operations on March 31 of the current year. Finch has the following…

A: Cash Payment: A cash payment is when the receiver of goods or services hands over cash to the…

Q: Differentiate between the adoption of “Variable costing” and “absorption costing” in business.

A: Variable costing and absorption costing are the two different costing systems used by the business.…

Q: Sales taxes collected by a retailer are reported as revenues. current liabilities. expenses.…

A: Introduction: A sales tax is a consumption tax imposed by the government on the selling of goods and…

Q: Calculate the debt to equity ratio for both companies at the end of 2020. (Round answers to 2…

A: Debt means total liabilities of the business. It means all obligations which needs to be paid or…

Q: The company has Fixed cost of 500,000 and CMR of 30%. If the company projected that net loss of…

A: Contribution Margin Ratio: A company's contribution margin ratio, also known as the CM ratio, is…

Q: Journalize the 2022 transactions. (Record journal entries in the order presented in the problem.…

A: Journal Entries Date Particulars Debit ($) Credit ($) Jul-01 Cash 10840 Dividend…

Q: Use the profitability index, which project should the company choose?

A: Profitability index is also known as time-adjusted method of evaluating the investment proposal.…

Q: Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 680,000…

A: Introduction: Direct materials are materials and resources used in the production of a product that…

Q: QS 8-15 (Algo) Intangible assets and amortization LO P4 On January 1 of this year, Diaz Boutique…

A: Introduction: The act of logging any transaction, whether or not it is an economic one, is known as…

Q: On December 31, 2020, Plank Corporation issued $800,000, 6%, 5-year bonds for $735,100. The bonds…

A: PREPARATION OF BOND DISCOUNT SCHEDULE

Q: Consider the following information for a period of years: Long-term government bonds Long-term…

A: Introduction: A bond is a fixed-income investment instrument that represents an investor's loan to a…

Q: For a project that has a net investment of $1,500,000 and net cash flows of $400,000 for 5 years; Is…

A: Internal rate of return is the rate of return earned on an investment. It is the rate of return at…

Q: Process costing systems are used only by companies that manufacture physical products; companies…

A: Process Costing - Process costing is a method of allocating manufacturing costs to finished goods.…

Q: The sales, income from operations, and invested assets for each division of Wren Company are as…

A: Residual income is calculated by deducting the multiplication of the minimum rate of return and…

Q: Osprey Cycles, Inc. projected sales of 60,934 bicycles for the year. The estimated January 1…

A: Production budgets are used by manufacturing organizations to determine how many product units are…

Q: Which of the following is not an approach to compute equivalent units? Multiple Choice All of these…

A: Equivalent Units :— Number of incomplete units are assumed to be equivalent to completed units when…

Q: Profit of a Vineyard Philip, the proprietor of a vineyard, estimates that the first 10200 bottles of…

A: Total Profit can be computed as follows = Total Unit Sold x Profit per bottle.

Q: Given the following, calculate the net price of the purchase by a customer who buys 1,000 cases of…

A: Cost of product = $75.00 per case Total cost = $75 x 1000 = $75,000 Trade discount = $5 x 1000 =…

Q: Yordi Company expects to sell 1,950 units in January and 1,700 units in February. The company…

A: Introduction: The cost of goods sold budget of a firm is an important component of its operational…

Q: Required: (a) Determine the amount of stock in store at the start of the month. (b) Calculate…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: On September 1, Jerry’s Lighting purchased merchandise with a list price of $6,700 with credit terms…

A: Lets understand the basics. For attracting early cash receipt, seller generally offer discount term…

Q: latt company has a fixed cost of £200,000 per annum producing external hard disks with a selling…

A: Given in the question: Fixed Cost £2,00,000.00 Selling Price Per Unit £50.00…

Q: Differential Analysis for Machine Replacement Proposal Gutenberg Publishers Inc. is considering…

A: Differential Analysis :— Comparision Between Two Alternative and then Choose the Best Alternative is…

Q: In manufacturing footballs, Spector Company's plant used 360 direct labor hours, 450 machine hours,…

A: Overhead Expenses Volume of Activities Cost per Driver Machining Center 175000 25000 Machine…

Q: Leap Off Tours had a payroll tax liability of $67,553 during the lookback period. How frequently…

A: The payroll tax liability means the liability of the employers. In this, the employer has to deposit…

Q: These Income Statement columns from a 10-column work sheet are for Brown's Bike Rental Company.…

A: Net Income is the output of preparing income statement of the business. Closing entries are those…

Q: Dawn is a single taxpayer. Her income and expenses for the year is as follows: Income…

A:

Q: Company Z has a deposit with ABC Bank. It obtained a loan from ASAP Financing Corp. in connection…

A: Here discuss about the details of the allowable deduction from the interest expenses which are…

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to…

A: The spending variance is calculated as difference between actual costs and flexible budget costs.…

Q: a. Using the information given in the above table, construct income statements for each company and…

A: Given in the question: Domestics Used Best Average Average Selling Price…

Q: 35 million in 2022. Depreciation for the year was $216,000, accounts receivable decreased $472.500,…

A: Cash Flow Statement - It is the statement which shows the flow of cash in three different activity…

Q: A business that has a low operating leverage is considered normal for highly automated manufacturing…

A: Business is defined as any activity that assists in earning an income for the owner or the person…

Q: Listed here are the costs associated with the production of 1,000 drum sets manufactured by…

A: Manufacturing cost refers to the sum total of all the costs incurred to manufacture a product. It…

Q: If the net present value of a project is positive, the project earns a return that is Group of…

A: Introduction: According to the net present value rule, executives and shareholders must only invest…

Q: Halpern Corporation is authorized to issue 1,000,000 shares of $3 par value common stock. During…

A: Journal Entry :- A journal entry is the act of recording any transaction, whether one that is…

Q: (Quiz 2.2) Please help me answer the last question (multiple choice) if you can, all in bold! Thank…

A: The contribution margin in percentage is determined by dividing the sum of fixed cost and the…

Kindly answer with complete solution please.

Step by step

Solved in 2 steps with 1 images

- 2. ABC Company uses a joint process to produce products A, B, and C. The joint production costs for 201Awere 500,000 and were allocated using relative sales value at the split-off point method.Each product may be sold at its split-off point or processed further. Additional processing costs are entirelyvariable.ProductsSales Value atSplit-offAdditionalProcessingCostsFinal SalesValueA P300,000 P130,000 420,000B 120,000 100,000 230,000C 250,000 140,000 400,000P670,000 P370,000 P1,050,000 a. To maximize profit, which product/s should be sold at split-off point and be processed further,respectively?b. If the alternative were to sell at split-off point or to process further all products, which alternativewould be recommended?Problem 5 Ilang Ilang company manufactures Products A and B from a joint process which also yields a by-product. Ilang ilang accounts for the revenue from its by-product sales as a deduction from the cost of goods sold of its main products. Additional information follows: A B C Total Units produced 15,000 9,000 6,000 30,000 Joint Costs ? ? ? 264,000 Sales Value at Split off 290,000 150,000 10,000 450,000 Joint products are allocated using the relative sales value at split off approach What was the joint cost allocated to Product B?JOINT AND BY-PRODUCT PROBLEM 1 Maroon Ltd is a company that produces chemicals for the cleaning industry. One of its processes manufactures join products Y and Z, and by-product X. The company uses the net realizable value of its joint products to allocate joint production costs. The by-product is valued for inventory purposes at its market value less its disposal cost, and this value is used to reduce the joint production cost of P2,015,000. Information regarding the company’s August 2020 operations are presented below: In liters Y Z X Finished Goods inventory, August 1 30,000 100,000 40,000 August Sales 1,340,000 760,000 240,000 August Production 1,600,000 800,000 200,000 In Peso Further Processing cost 1,400,000 1,520,000 Final Sales value per Liter 10 14 Sales value per liter at split off 2.40 Disposal Cost per liter 0.40 Required: Calculate the allocation of joint cost…

- JOINT AND BY-PRODUCT PROBLEM 1 Maroon Ltd is a company that produces chemicals for the cleaning industry. One of its processes manufactures join products Y and Z, and by-product X. The company uses the net realizable value of its joint products to allocate joint production costs. The by-product is valued for inventory purposes at its market value less its disposal cost, and this value is used to reduce the joint production cost of P2,015,000. Information regarding the company’s August 2020 operations are presented below: In liters Y Z X Finished Goods inventory, August 1 30,000 100,000 40,000 August Sales 1,340,000 760,000 240,000 August Production 1,600,000 800,000 200,000 In Peso Further Processing cost 1,400,000 1,520,000 Final Sales value per Liter 10 14 Sales value per liter at split off 2.40 Disposal Cost per liter 0.40 Calculate the unit cost per product and value of…BC Corporation manufactures products W, X,Y, AND Z from a joint process. Additional information is as follows: Sales If processed further Units Value at Additional Sales Product Produced Split-off Costs Value W 6,000 P 80,000 P 7,500 P 90,000 X 5,000 60,000 6,000 70,000 Y 4,000 40,000 4,000 50,000 Z 3,000 20,000 2,500 30,000 Total 18,000 P200,000 P20,000 P240,000 Assuming that total joint costs of P160,000 were allocated using the relative sales value at split- off approach, what joint costs were allocated to each product? W________________ X__________________ Y________________ Z __________________Denver Fabricators manufactures products DF1 and DF2 from a joint process, which also yields a by-product, BP. The company accounts for the revenues from its by-product sales as other income. Additional information follows: DF1 DF2 BP Total Units produced 27,100 18,100 15,100 60,300 Allocated joint costs ? ? ? $ 560,100 Sales value at split-off $ 561,750 $ 187,250 $ 102,100 $ 851,100 Required: Assuming that joint product costs are allocated using the net realizable value at split-off approach, what joint costs are allocated to each of the joint products DF1 and DF2 and to the by-product, BP?

- Accounting Question 7 KLP Products Co. produces 2 joint products. Joint cost = $2,000. These products can be processed further after split – off point. Data for the current period are: Products Sales value At split - off Separable costs Final Sales value after further Processing D $1,000 $2,000 $3, 800 E $200 $600 $700 Required: Determine which product KLP Co. should sell at the split-off point and which product KLP Co. should process further.Ilang Ilang Company manufactures Product A and B from a joint process which yield a by-product. Ilang Ilang accounts for the revenue from its by-product sales as deduction from the cost of goods sold of its main products. Additional information follows: A B C Total Unit produced 15000 9000 6000 30000 Joint Costs 264000 Sales Value at Split off 290000 150000 10000 450000 Joint products are allocated using the relative sales value at split off approach What was the joint cost allocated to Product B?Bonanza Co. manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: PRODUCTS X Y Z TOTAL Units produced 32,000 32,000 16,000 80,000 Joint costs ? ? ? $ 322,000 Sales value at split-off $ 480,000 $ 240,000 $ 16,000 $ 736,000 Joint costs were allocated using the net realizable value method at the split-off point. The joint costs allocated to product X were Multiple Choice $120,000. $136,800. $240,000. $204,000.

- Happy Corp. manufactures Products A, B, C, and D from a joint process. Additional information is as follows: Market If Processed Further Units Value at Additional Market Product Produced Split-Off Costs Value A 6,000 Php 80,000 Php 7,500 Php 90,000 B 5,000 60,000 6,000 70,000 C 4,000 40,000 4,000 50,000 D 3,000 20,000 2,500 30,000 18,000 Php 200,000…Question 6. Solex Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $100,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: product X, $50,000; product Y, $90,000; and product Z, $60,000. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below: Product X Y . Z Required: Additional Processing Costs $35,000 $40,000 $12,000 Sales Value after Further Processing $80,000 $150,000 $75,000 Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.Joint Products; By-Products (Appendix) The Marshall Company has a joint production process that produces two joint products and a by-product. The joint products are Ying and Yang, andthe by-product is Bit. Marshall accounts for the costs of its products using the net realizable valuemethod. The two joint products are processed beyond the split-off point, incurring separable processing costs. There is a $1,000 disposal cost for the by-product. A summary of a recent month’s activityat Marshall is shown below:Ying Yang BitUnits sold 50,000 40,000 10,000Units produced 50,000 40,000 10,000Separable processing costs—variable $140,000 $42,000 $—Separable processing costs—fixed $10,000 $8,000 $—Sales price $6.00 $12.50 $1.60Total joint costs for Marshall in the recent month are $265,000, of which $115,000 is a variable cost.Required1. Calculate the manufacturing cost per unit for each of the three products.2. Calculate the total gross margin for each product