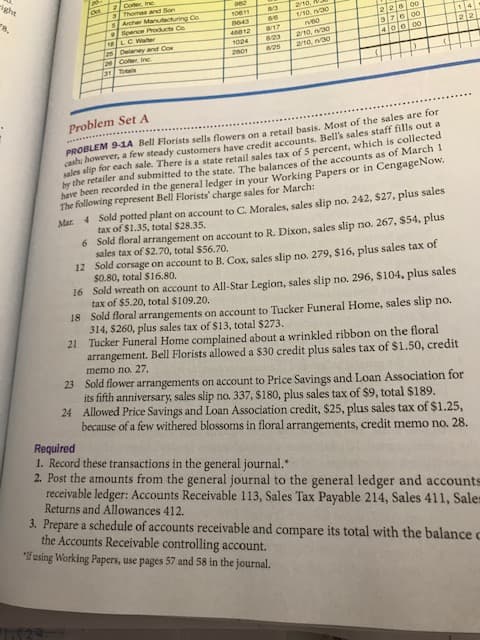

Problem Set A PROBLEM 9-11A Bell Florists sells flowers on a retail basis. Most of the sales are for cash however, a few steady customers have credit accounts. Bell's sales staff fills out a sales alip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists' charge sales for March: Mar 4 Sold potted plant on account to C. Morales, sales slip no. 242, $27. plus sales tax of $1.35, total $28.35. 6 Sold floral arrangement on account to R. Dixon, sales slip no. 267, $54, plus sales tax of $2.70, total $56.70. 12 Sold corsage on account to B. Cox, sales slip no. 279, $16, plus sales tax of $0.80, total $16.80. 16 Sold wreath on account to All-Star Legion, sales slip no. 296, $104, plus sales tax of $5.20, total $109.20. 18 Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, $260, plus sales tax of $13, total $273. 21 Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a $30 credit plus sales tax of $1.50, credit memo no. 27. 23 Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, $180, plus sales tax of $9, total $189. 24 Allowed Price Savings and Loan Association credit, $25, plus sales tax of $1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance c the Accounts Receivable controlling account. "fusing Working Papers, use pages 57 and 58 in the journal.

Problem Set A PROBLEM 9-11A Bell Florists sells flowers on a retail basis. Most of the sales are for cash however, a few steady customers have credit accounts. Bell's sales staff fills out a sales alip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists' charge sales for March: Mar 4 Sold potted plant on account to C. Morales, sales slip no. 242, $27. plus sales tax of $1.35, total $28.35. 6 Sold floral arrangement on account to R. Dixon, sales slip no. 267, $54, plus sales tax of $2.70, total $56.70. 12 Sold corsage on account to B. Cox, sales slip no. 279, $16, plus sales tax of $0.80, total $16.80. 16 Sold wreath on account to All-Star Legion, sales slip no. 296, $104, plus sales tax of $5.20, total $109.20. 18 Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, $260, plus sales tax of $13, total $273. 21 Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a $30 credit plus sales tax of $1.50, credit memo no. 27. 23 Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, $180, plus sales tax of $9, total $189. 24 Allowed Price Savings and Loan Association credit, $25, plus sales tax of $1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance c the Accounts Receivable controlling account. "fusing Working Papers, use pages 57 and 58 in the journal.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 1PA: Bell Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady...

Related questions

Question

100%

Transcribed Image Text:Problem Set A

PROBLEM 9-11A Bell Florists sells flowers on a retail basis. Most of the sales are for

cash however, a few steady customers have credit accounts. Bell's sales staff fills out a

sales alip for each sale. There is a state retail sales tax of 5 percent, which is collected

by the retailer and submitted to the state. The balances of the accounts as of March 1

have been recorded in the general ledger in your Working Papers or in CengageNow.

The following represent Bell Florists' charge sales for March:

Mar 4 Sold potted plant on account to C. Morales, sales slip no. 242, $27. plus sales

tax of $1.35, total $28.35.

6 Sold floral arrangement on account to R. Dixon, sales slip no. 267, $54, plus

sales tax of $2.70, total $56.70.

12 Sold corsage on account to B. Cox, sales slip no. 279, $16, plus sales tax of

$0.80, total $16.80.

16 Sold wreath on account to All-Star Legion, sales slip no. 296, $104, plus sales

tax of $5.20, total $109.20.

18 Sold floral arrangements on account to Tucker Funeral Home, sales slip no.

314, $260, plus sales tax of $13, total $273.

21 Tucker Funeral Home complained about a wrinkled ribbon on the floral

arrangement. Bell Florists allowed a $30 credit plus sales tax of $1.50, credit

memo no. 27.

23 Sold flower arrangements on account to Price Savings and Loan Association for

its fifth anniversary, sales slip no. 337, $180, plus sales tax of $9, total $189.

24 Allowed Price Savings and Loan Association credit, $25, plus sales tax of $1.25,

because of a few withered blossoms in floral arrangements, credit memo no. 28.

Required

1. Record these transactions in the general journal.

2. Post the amounts from the general journal to the general ledger and accounts

receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales

Returns and Allowances 412.

3. Prepare a schedule of accounts receivable and compare its total with the balance c

the Accounts Receivable controlling account.

"fusing Working Papers, use pages 57 and 58 in the journal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning