Cash Receipts Transactions Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 Received payment on account from Michael Anderson, $1,360. 2 Received payment on account from Ansel Manufacturing, $382. 7 Cash sales for the week were $3,160 plus tax. Bank credit card sales for the week were $1,000 plus tax. Bank credit card fee is 3%. 8 Received payment on account from J. Gorbea, $880. 11 Michael Anderson returned merchandise for a credit, $60 plus tax. 14 Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $800 plus tax. Bank credit card fee is 3%. 20 Received payment on account from Tom Wilson, $1,110. 21 Ansel Manufacturing returned merchandise for a credit, $22 plus tax. 21 Cash sales for the week were $3,200 plus tax. 24 Received payment on account from Rachel Carson, $2,000. Required: 1. Record the transactions in the general journal. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank. Do not enter the posting references until you complete part 2. GENERAL JOURNAL PAGE 20 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Dec. 1 Cash fill in the blank 2 fill in the blank 3 Accounts Receivable/M. Anderson fill in the blank 5/√ fill in the blank 6 Received cash on account Dec. 2 Cash fill in the blank 8 fill in the blank 9 Accounts Receivable/Ansel Manufacturing fill in the blank 11/√ fill in the blank 12 Received cash on account Dec. 7 Cash fill in the blank 14 fill in the blank 15 fill in the blank 16 Sales fill in the blank 18 fill in the blank 19 fill in the blank 20 Sales Tax Payable fill in the blank 22 fill in the blank 23 fill in the blank 24 Made cash sales Dec. 7 Cash fill in the blank 26 fill in the blank 27 fill in the blank 28 Bank Credit Card Expense fill in the blank 30 fill in the blank 31 fill in the blank 32 Sales fill in the blank 34 fill in the blank 35 fill in the blank 36 Sales Tax Payable fill in the blank 38 fill in the blank 39 fill in the blank 40 Made credit card sales Dec. 8 Cash fill in the blank 42 fill in the blank 43 Accounts Receivable/J. Gorbea fill in the blank 45/√ fill in the blank 46 Received cash on account Dec. 11 Sales Returns and Allowances fill in the blank 48 fill in the blank 49 fill in the blank 50 Sales Tax Payable fill in the blank 52 fill in the blank 53 fill in the blank 54 Accounts Receivable/M. Anderson fill in the blank 56/√ fill in the blank 57 fill in the blank 58 Returned merchandise Dec. 14 Cash fill in the blank 60 fill in the blank 61 fill in the blank 62 Sales fill in the blank 64 fill in the blank 65 fill in the blank 66 Sales Tax Payable fill in the blank 68 fill in the blank 69 fill in the blank 70 Made cash sales GENERAL JOURNAL PAGE 21 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Dec. 14 Cash fill in the blank 72 fill in the blank 73 fill in the blank 74 Bank Credit Card Expense fill in the blank 76 fill in the blank 77 fill in the blank 78 Sales fill in the blank 80 fill in the blank 81 fill in the blank 82 Sales Tax Payable fill in the blank 84 fill in the blank 85 fill in the blank 86 Made credit card sales Dec. 20 Cash fill in the blank 88 fill in the blank 89 Accounts Receivable/T. Wilson fill in the blank 91/√ fill in the blank 92 Received cash on account Dec. 21 Sales Returns and Allowances fill in the blank 94 fill in the blank 95 fill in the blank 96 Sales Tax Payable fill in the blank 98 fill in the blank 99 fill in the blank 100 Accounts Receivable/Ansel Manufacturing fill in the blank 102/√ fill in the blank 103 fill in the blank 104 Returned merchandise Dec. 21 Cash fill in the blank 106 fill in the blank 107 fill in the blank 108 Sales fill in the blank 110 fill in the blank 111 fill in the blank 112 Sales Tax Payable fill in the blank 114 fill in the blank 115 fill in the blank 116 Made cash sales Dec. 24 Cash fill in the blank 118 fill in the blank 119 Accounts Receivable/R. Carson fill in the blank 121/√ fill in the blank 122 Received cash on account 2. The beginning general ledger account balances have been entered in the accounts. Post from the journal to the general ledger accounts. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. After posting to the general ledger, go to part 1 and complete the posting. Enter the transactions in chronological order and in the order posted in part 1. Cash $9,862 Accounts Receivable 9,352

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

i don't nee help with part 1 i need help with part 2

Cash Receipts Transactions

Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%.

| Dec. 1 | Received payment on account from Michael Anderson, $1,360. |

| 2 | Received payment on account from Ansel Manufacturing, $382. |

| 7 | Cash sales for the week were $3,160 plus tax. Bank credit card sales for the week were $1,000 plus tax. Bank credit card fee is 3%. |

| 8 | Received payment on account from J. Gorbea, $880. |

| 11 | Michael Anderson returned merchandise for a credit, $60 plus tax. |

| 14 | Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $800 plus tax. Bank credit card fee is 3%. |

| 20 | Received payment on account from Tom Wilson, $1,110. |

| 21 | Ansel Manufacturing returned merchandise for a credit, $22 plus tax. |

| 21 | Cash sales for the week were $3,200 plus tax. |

| 24 | Received payment on account from Rachel Carson, $2,000. |

Required:

1. Record the transactions in the general journal. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank. Do not enter the posting references until you complete part 2.

| GENERAL JOURNAL | PAGE 20 | |||

|---|---|---|---|---|

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT |

| 20-- | ||||

| Dec. 1 | Cash | fill in the blank 2 | fill in the blank 3 | |

| |

fill in the blank 5/√ | fill in the blank 6 | ||

| Received cash on account | ||||

| Dec. 2 | Cash | fill in the blank 8 | fill in the blank 9 | |

| Accounts Receivable/Ansel Manufacturing | fill in the blank 11/√ | fill in the blank 12 | ||

| Received cash on account | ||||

| Dec. 7 | Cash | fill in the blank 14 | fill in the blank 15 | fill in the blank 16 |

| Sales | fill in the blank 18 | fill in the blank 19 | fill in the blank 20 | |

| Sales Tax Payable | fill in the blank 22 | fill in the blank 23 | fill in the blank 24 | |

| Made cash sales | ||||

| Dec. 7 | Cash | fill in the blank 26 | fill in the blank 27 | fill in the blank 28 |

| Bank Credit Card Expense | fill in the blank 30 | fill in the blank 31 | fill in the blank 32 | |

| Sales | fill in the blank 34 | fill in the blank 35 | fill in the blank 36 | |

| Sales Tax Payable | fill in the blank 38 | fill in the blank 39 | fill in the blank 40 | |

| Made credit card sales | ||||

| Dec. 8 | Cash | fill in the blank 42 | fill in the blank 43 | |

| Accounts Receivable/J. Gorbea | fill in the blank 45/√ | fill in the blank 46 | ||

| Received cash on account | ||||

| Dec. 11 | Sales Returns and Allowances | fill in the blank 48 | fill in the blank 49 | fill in the blank 50 |

| Sales Tax Payable | fill in the blank 52 | fill in the blank 53 | fill in the blank 54 | |

| Accounts Receivable/M. Anderson | fill in the blank 56/√ | fill in the blank 57 | fill in the blank 58 | |

| Returned merchandise | ||||

| Dec. 14 | Cash | fill in the blank 60 | fill in the blank 61 | fill in the blank 62 |

| Sales | fill in the blank 64 | fill in the blank 65 | fill in the blank 66 | |

| Sales Tax Payable | fill in the blank 68 | fill in the blank 69 | fill in the blank 70 | |

| Made cash sales |

| GENERAL JOURNAL | PAGE 21 | |||

|---|---|---|---|---|

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT |

| 20-- | ||||

| Dec. 14 | Cash | fill in the blank 72 | fill in the blank 73 | fill in the blank 74 |

| Bank Credit Card Expense | fill in the blank 76 | fill in the blank 77 | fill in the blank 78 | |

| Sales | fill in the blank 80 | fill in the blank 81 | fill in the blank 82 | |

| Sales Tax Payable | fill in the blank 84 | fill in the blank 85 | fill in the blank 86 | |

| Made credit card sales | ||||

| Dec. 20 | Cash | fill in the blank 88 | fill in the blank 89 | |

| Accounts Receivable/T. Wilson | fill in the blank 91/√ | fill in the blank 92 | ||

| Received cash on account | ||||

| Dec. 21 | Sales Returns and Allowances | fill in the blank 94 | fill in the blank 95 | fill in the blank 96 |

| Sales Tax Payable | fill in the blank 98 | fill in the blank 99 | fill in the blank 100 | |

| Accounts Receivable/Ansel Manufacturing | fill in the blank 102/√ | fill in the blank 103 | fill in the blank 104 | |

| Returned merchandise | ||||

| Dec. 21 | Cash | fill in the blank 106 | fill in the blank 107 | fill in the blank 108 |

| Sales | fill in the blank 110 | fill in the blank 111 | fill in the blank 112 | |

| Sales Tax Payable | fill in the blank 114 | fill in the blank 115 | fill in the blank 116 | |

| Made cash sales | ||||

| Dec. 24 | Cash | fill in the blank 118 | fill in the blank 119 | |

| Accounts Receivable/R. Carson | fill in the blank 121/√ | fill in the blank 122 | ||

| Received cash on account |

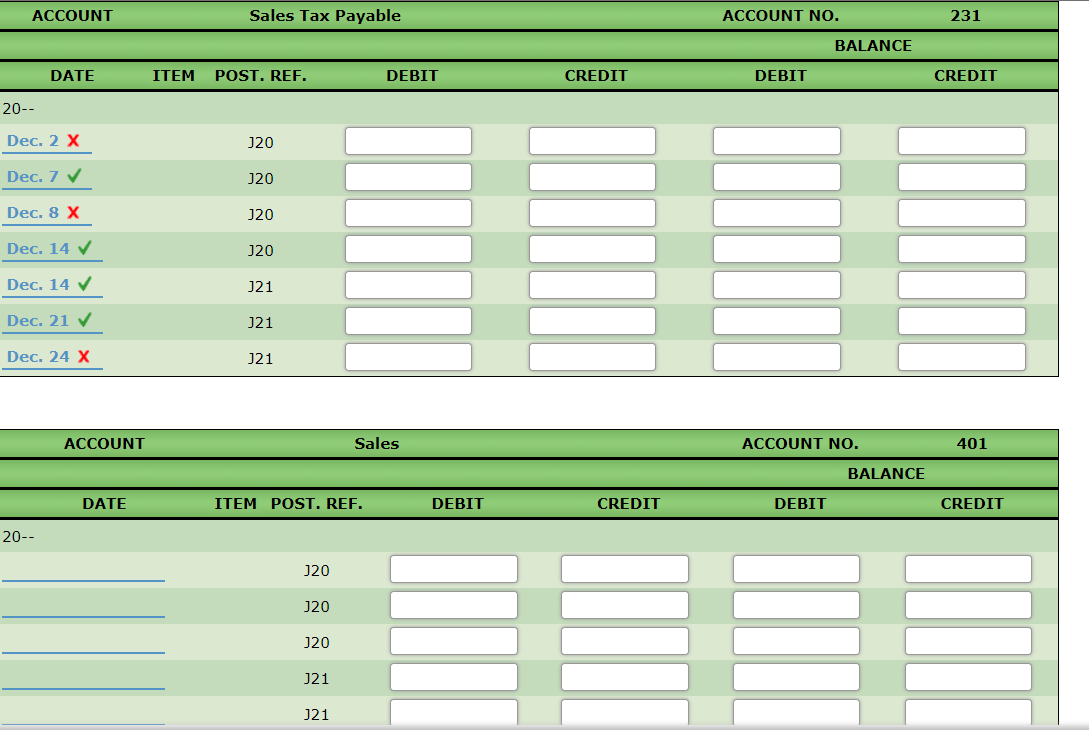

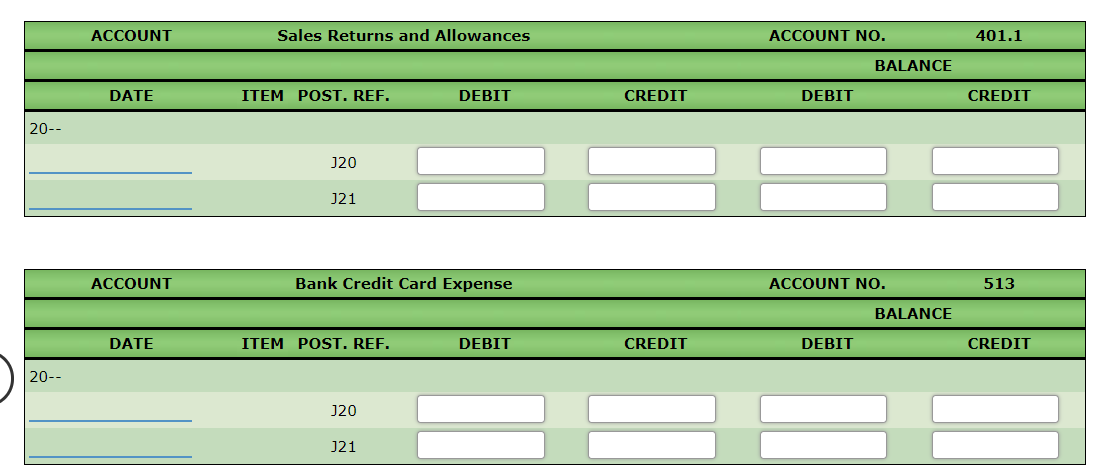

2. The beginning general ledger account balances have been entered in the accounts. Post from the journal to the general ledger accounts. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. After posting to the general ledger, go to part 1 and complete the posting. Enter the transactions in chronological order and in the order posted in part 1.

| Cash | $9,862 |

| Accounts Receivable | 9,352 |

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images