Exercise 1: Sales tax On November 1, Sassy Boutique rings up cash sales of $6,000 for merchandise costing $2,20o. The sales tax rate is 9%. Please record this event on November 1st. Date Accounts Debit Credit Sales tax must be remitted by the end of the month, please record Sassy's entry to record the remittance of the collected sales tax to the appropriate government agency on November 30th. Date Accounts Debit Credit

Exercise 1: Sales tax On November 1, Sassy Boutique rings up cash sales of $6,000 for merchandise costing $2,20o. The sales tax rate is 9%. Please record this event on November 1st. Date Accounts Debit Credit Sales tax must be remitted by the end of the month, please record Sassy's entry to record the remittance of the collected sales tax to the appropriate government agency on November 30th. Date Accounts Debit Credit

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 38E: Exercise 1-38 Identifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing...

Related questions

Question

100%

Can anyone help me out for those questions? Thank you.

Transcribed Image Text:Chapter 12

In-Class Assignment

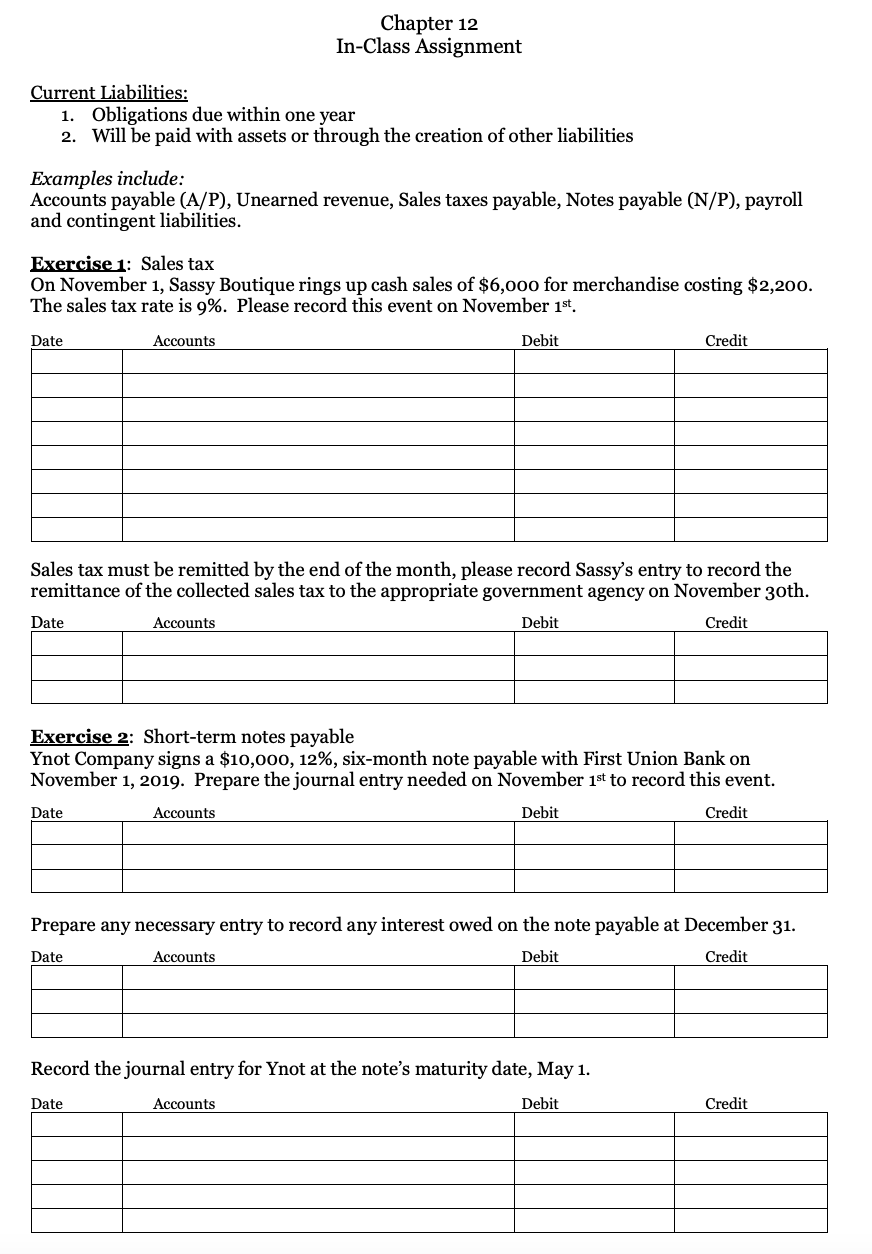

Current Liabilities:

1. Obligations due within one year

2. Will be paid with assets or through the creation of other liabilities

Examples include:

Accounts payable (A/P), Unearned revenue, Sales taxes payable, Notes payable (N/P), payroll

and contingent liabilities.

Exercise 1: Sales tax

On November 1, Sassy Boutique rings up cash sales of $6,000 for merchandise costing $2,200.

The sales tax rate is 9%. Please record this event on November 1st.

Date

Аccounts

Debit

Credit

Sales tax must be remitted by the end of the month, please record Sassy's entry to record the

remittance of the collected sales tax to the appropriate government agency on November 30th.

Date

Accounts

Debit

Credit

Exercise 2: Short-term notes payable

Ynot Company signs a $10,000, 12%, six-month note payable with First Union Bank on

November 1, 2019. Prepare the journal entry needed on November 1st to record this event.

Date

Accounts

Debit

Credit

Prepare any necessary entry to record any interest owed on the note payable at December 31.

Date

Аccounts

Debit

Credit

Record the journal entry for Ynot at the note's maturity date, May 1.

Date

Accounts

Debit

Credit

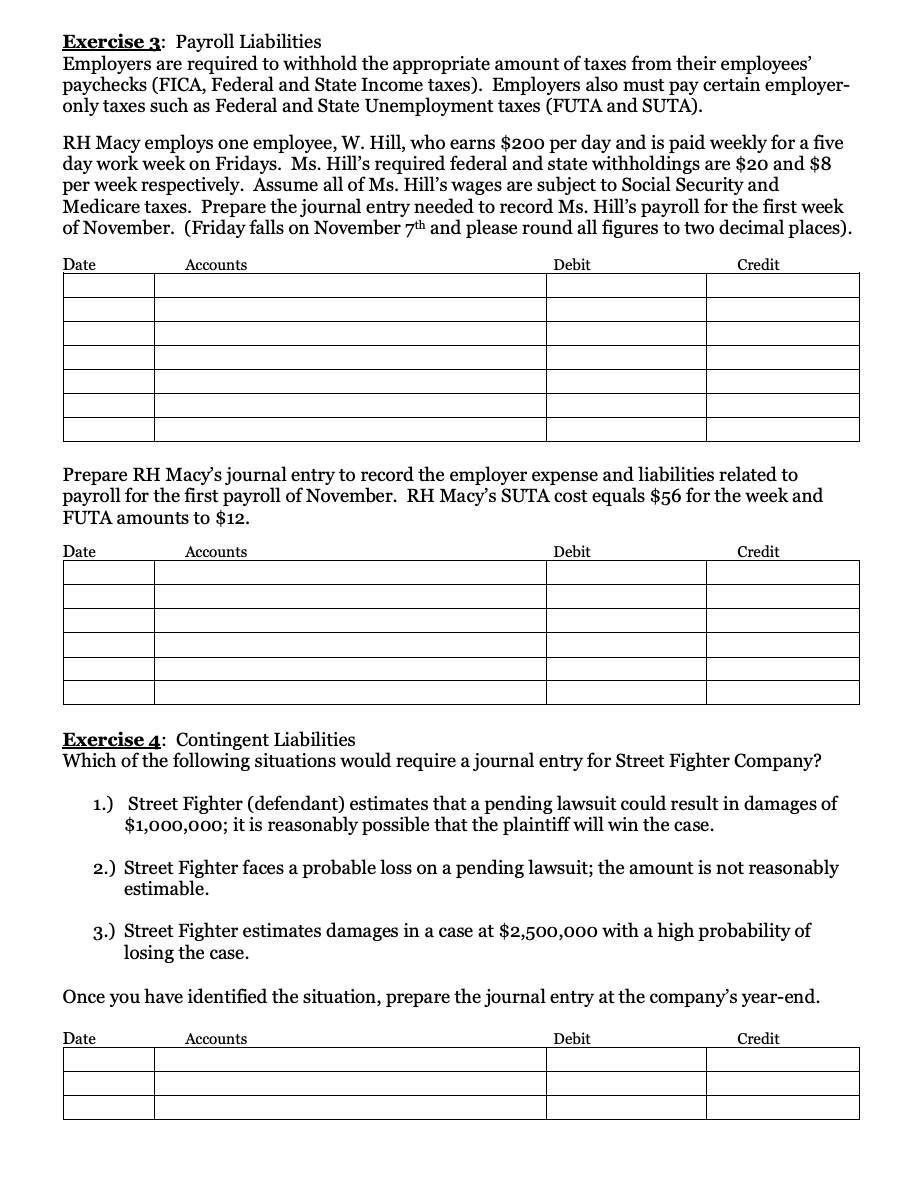

Transcribed Image Text:Exercise 3: Payroll Liabilities

Employers are required to withhold the appropriate amount of taxes from their employees'

paychecks (FICA, Federal and State Income taxes). Employers also must pay certain employer-

only taxes such as Federal and State Unemployment taxes (FUTA and SUTA).

RH Macy employs one employee, W. Hill, who earns $200 per day and is paid weekly for a five

day work week on Fridays. Ms. Hill's required federal and state withholdings are $20 and $8

per week respectively. Assume all of Ms. Hill's wages are subject to Social Security and

Medicare taxes. Prepare the journal entry needed to record Ms. Hill's payroll for the first week

of November. (Friday falls on November 7th and please round all figures to two decimal places).

Date

Accounts

Debit

Credit

Prepare RH Macy's journal entry to record the employer expense and liabilities related to

payroll for the first payroll of November. RH Macy's SUTA cost equals $56 for the week and

FUTA amounts to $12.

Date

Accounts

Debit

Credit

Exercise 4: Contingent Liabilities

Which of the following situations would require a journal entry for Street Fighter Company?

1.) Street Fighter (defendant) estimates that a pending lawsuit could result in damages of

$1,000,000; it is reasonably possible that the plaintiff will win the case.

2.) Street Fighter faces a probable loss on a pending lawsuit; the amount is not reasonably

estimable.

3.) Street Fighter estimates damages in a case at $2,500,000 with a high probability of

losing the case.

Once you have identified the situation, prepare the journal entry at the company's year-end.

Date

Accounts

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning