Problent 3 Assume the following relates to the Candy Corporation for the month of July Job No. 101 Job No.102 Job No. 103 In process, July 1 Materials Labor P 40,000 60,000 75,000 P 30,000 40,000. 50,000 Overhead Cost added in July 55,000 80,000 92,000 115,000 Materials 80,000 95,000 Labor, Actual overhead incurred in July amounted to P 375,000. Job No. 101 and 102 were completed and transferred to finished goods warehouse in July. Overhead i: applied using a predetermined overhead rate. Job 101 was sold for P 550,000. Requirements: Compute for the following - 1. Work in process, July 1 2. Overhead assigned to production in July assuming same factory OH rate 3. Cost of goods manufactured 4. Cost of goods sold (actual) 5. Finished goods inventory, July 31

Problent 3 Assume the following relates to the Candy Corporation for the month of July Job No. 101 Job No.102 Job No. 103 In process, July 1 Materials Labor P 40,000 60,000 75,000 P 30,000 40,000. 50,000 Overhead Cost added in July 55,000 80,000 92,000 115,000 Materials 80,000 95,000 Labor, Actual overhead incurred in July amounted to P 375,000. Job No. 101 and 102 were completed and transferred to finished goods warehouse in July. Overhead i: applied using a predetermined overhead rate. Job 101 was sold for P 550,000. Requirements: Compute for the following - 1. Work in process, July 1 2. Overhead assigned to production in July assuming same factory OH rate 3. Cost of goods manufactured 4. Cost of goods sold (actual) 5. Finished goods inventory, July 31

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter5: Accounting For Retailing Businesses

Section: Chapter Questions

Problem 5.41EX: Appendix Cost of goods sold and related items The following data were extracted from the accounting...

Related questions

Question

Problem 8

Transcribed Image Text:4. Gross profit

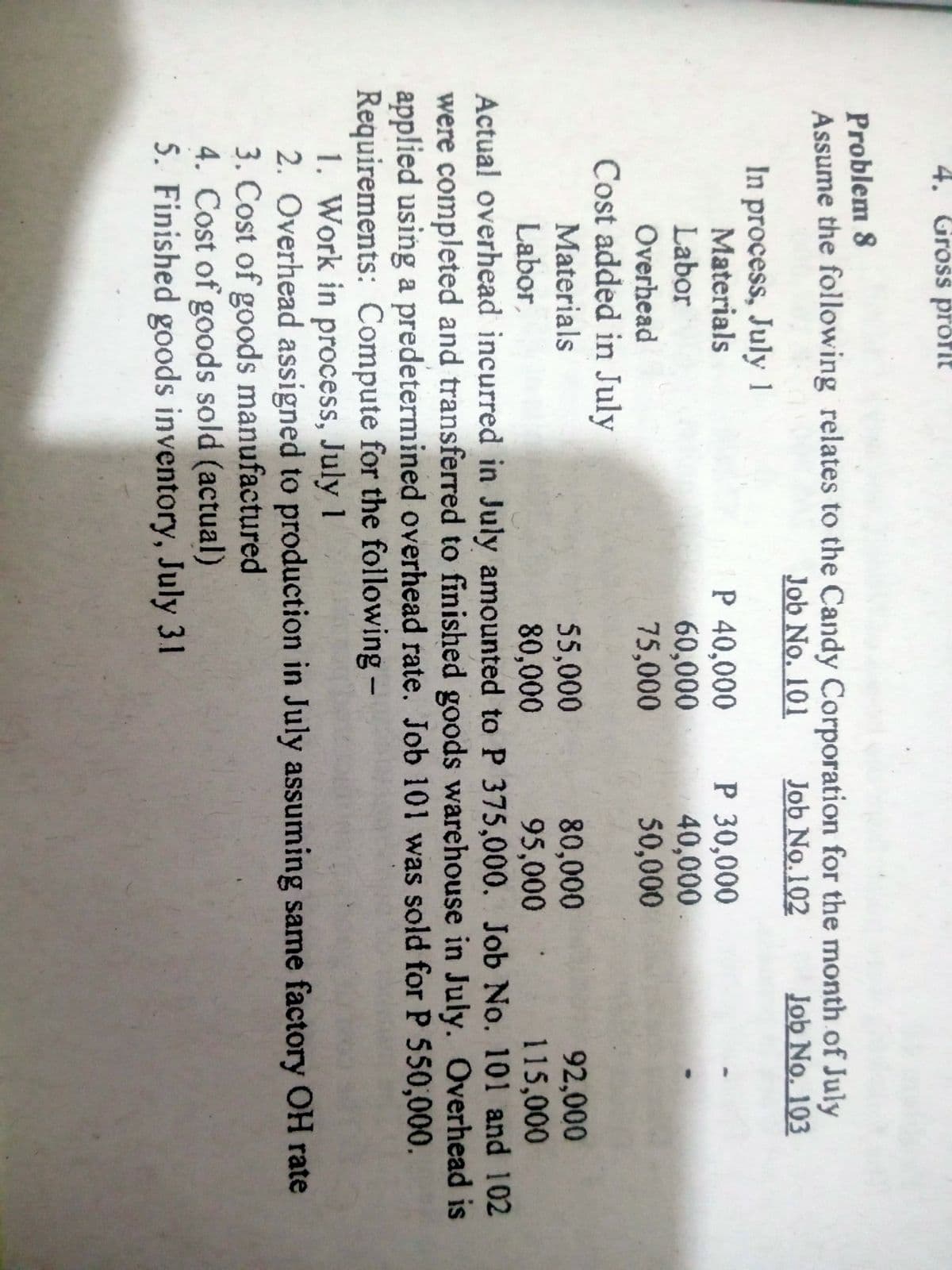

Problem 8

Assume the following relates to the Candy Corporation for the month of July

Job No. 101

Job No.102

Job No. 103

In process, July 1

Materials

Labor

P 40,000

60,000

75,000

P 30,000

40,000

50,000

Overhead

Cost added in July

92,000

115,000

Materials

55,000

80,000

80,000

95,000

Labor,

Actual overhead incurred in July amounted to P 375,000. Job No. 101 and 102

were completed and transferred to finished goods warehouse in July. Overhead is

applied using a predetermined overhead rate. Job 101 was sold for P 550,000.

Requirements: Compute for the following -

1. Work in process, July 1

2. Overhead assigned to production in July assuming same factory OH rate

3. Cost of goods manufactured

4. Cost of goods sold (actual)

5. Finished goods inventory, July 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning