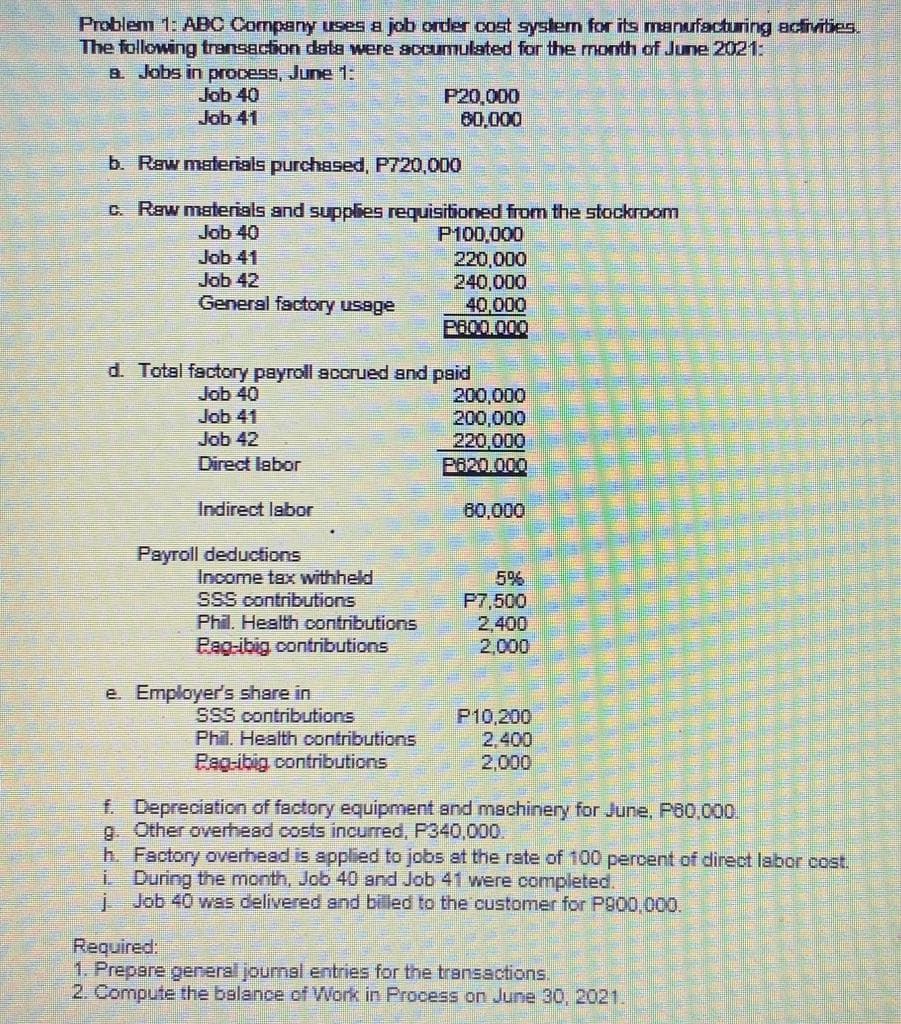

Problem 1: ABC Company uses a job order cost system for its manufacturing activities. The following transaction data were accumulated for the month of June 2021: A Jobs in process, June 1: Jab 40 P20,000 60,000 Job 41 b. Raw materials purchased, P720,000 C. Raw materials and supplies requisitioned from the stockroom Job 40 Job 41 Job 42 General factory usage P100,000 220,000 240,000 40,000 P600.000 d. Total factory payroll accrued and paid 200,000 200,000 220,000 P620.000 Job 40 Job 41 Job 42 Direct labor Indirect labor 80,000 Payroll deductions 5% P7,500 2,400 2,000 Income tax withheld SSS contributions Phil. Health contributions Pag-ibig contributions e. Employer's share in SSS contributions Phil. Health contributions Pag-ibig contributions P10,200 2,400 2,000 f. Depreciation of factory equipment and machinery for June, P80.000. g. Other overhead costs incurred, P340,000. h. Factory overhead is applied to jobs at the rate of 100 percent of direct labor cost. i During the month, Job 40 and Job 41 wer Job 40 was delivered and billed to the customer for P900,000. completed. Required. 1. Prepare general journal entries for the transactions. 2. Compute the balance of Work in Process on June 30, 2021.

Problem 1: ABC Company uses a job order cost system for its manufacturing activities. The following transaction data were accumulated for the month of June 2021: A Jobs in process, June 1: Jab 40 P20,000 60,000 Job 41 b. Raw materials purchased, P720,000 C. Raw materials and supplies requisitioned from the stockroom Job 40 Job 41 Job 42 General factory usage P100,000 220,000 240,000 40,000 P600.000 d. Total factory payroll accrued and paid 200,000 200,000 220,000 P620.000 Job 40 Job 41 Job 42 Direct labor Indirect labor 80,000 Payroll deductions 5% P7,500 2,400 2,000 Income tax withheld SSS contributions Phil. Health contributions Pag-ibig contributions e. Employer's share in SSS contributions Phil. Health contributions Pag-ibig contributions P10,200 2,400 2,000 f. Depreciation of factory equipment and machinery for June, P80.000. g. Other overhead costs incurred, P340,000. h. Factory overhead is applied to jobs at the rate of 100 percent of direct labor cost. i During the month, Job 40 and Job 41 wer Job 40 was delivered and billed to the customer for P900,000. completed. Required. 1. Prepare general journal entries for the transactions. 2. Compute the balance of Work in Process on June 30, 2021.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 1PB: Entries for costs in a job order cost system Royal Technology Company uses a job order cost system....

Related questions

Question

Please help me

Transcribed Image Text:Problem 1: ABC Company uses a job order cost system for its manufacturing acfivities.

The following transaction data were accumulated for the month of June 2021:

a Jobs in process, June 1:

Job 40

Job 41

P20,000

0,000

b. Raw materials purchased, P720,000

C. Raw materials and supplies requisitioned from the stockroom

Job 40

P100,000

220,000

240,000

40,000

P600.000

Job 41

Job 42

General factory usage

d. Total factory payroll accrued and paid

200,000

200,000

220,000

P620.000

Job 40

Job 41

Job 42

Direct labor

Indirect labor

80,000

Payroll deductions

Income tax withheld

SSS contributions

Phil. Health contributions

Pag-ibig contributions

5%

P7,500

2,400

2,000

e. Employer's share in

SSS contributions

Phil. Health contributions

P10,200

2,400

2,000

Pag-ibig contributions

f. Depreciation of factory equipment and machinery for June, P60,000.

9 Other overhead costs incurred, P340,000.

h. Factory overhead is applied to jobs at the rate of 100 percent of direct labor cost.

i During the month, Job 40 and Job 41 were completed.

i Job 40 was delivered and billed to the customer for P800,000.

Required:

1. Prepere general journal entries for the transactions.

2. Compute the balance of Work in Process on June 30, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning