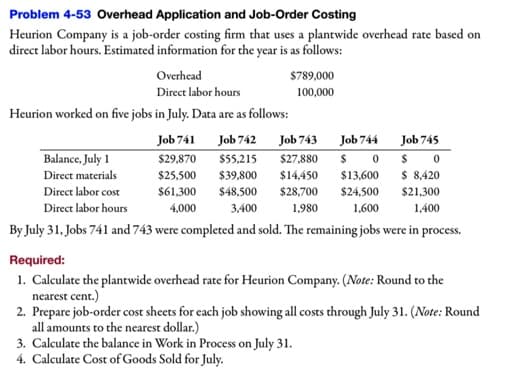

Problem 4-53 Overhead Application and Job-Order Costing Heurion Company is a job-order costing firm that uses a plantwide overhead rate based on direct labor hours. Estimated information for the year is as follows: Overhead $789,000 Direct labor hours 100,000 Heurion worked on five jobs in July. Data are as follows: Job 741 $29,870 $25,500 Job 742 Job 743 Job 744 Job 745 $55,215 $0S0 Balance, July 1 Direct materials $27,880 $39,800 $14450 $13,600 $ 8,420 Direct labor cost $61,300 $48,500 $28,700 $24,500 $21,300 Direct labor hours 4,000 3,400 1,980 1,600 1,400 By July 31, Jobs 741 and 743 were completed and sold. The remaining jobs were in process, Required: 1. Calculate the plantwide overhead rate for Heurion Company. (Note: Round to the nearest cent.) 2. Prepare job-order cost sheets for cach job showing all costs through July 31. (Note: Round all amounts to the nearest dollar.) 3. Calculate the balance in Work in Process on July 31.

Problem 4-53 Overhead Application and Job-Order Costing Heurion Company is a job-order costing firm that uses a plantwide overhead rate based on direct labor hours. Estimated information for the year is as follows: Overhead $789,000 Direct labor hours 100,000 Heurion worked on five jobs in July. Data are as follows: Job 741 $29,870 $25,500 Job 742 Job 743 Job 744 Job 745 $55,215 $0S0 Balance, July 1 Direct materials $27,880 $39,800 $14450 $13,600 $ 8,420 Direct labor cost $61,300 $48,500 $28,700 $24,500 $21,300 Direct labor hours 4,000 3,400 1,980 1,600 1,400 By July 31, Jobs 741 and 743 were completed and sold. The remaining jobs were in process, Required: 1. Calculate the plantwide overhead rate for Heurion Company. (Note: Round to the nearest cent.) 2. Prepare job-order cost sheets for cach job showing all costs through July 31. (Note: Round all amounts to the nearest dollar.) 3. Calculate the balance in Work in Process on July 31.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 62P: (Appendix 4A) Overhead Application, Journal Entries, Job Cost At the beginning of the year, Smith...

Related questions

Question

Please ensure that the information from the picture is changed to the information listed below.

Use the information in the problem 4-53 (picture listed below) to prepare

Transcribed Image Text:Problem 4-53 Overhead Application and Job-Order Costing

Heurion Company is a job-order costing firm that uses a plantwide overhead rate based on

direct labor hours. Estimated information for the year is as follows:

Overhead

$789,000

Direct labor hours

100,000

Heurion worked on five jobs in July. Data are as follows:

Job 741

Job 742

Job 743

Job 744

Job 745

Balance, July 1

$29,870

$27,880

$ 0

$ 0

$ 8,420

$5,215

Direct materials

$25,500

$39,800

$14,450

$13,600

Direct labor cost

$61,300

$48,500

$28,700

$24,500

$21,300

Direct labor hours

4,000

3,400

1,980

1,600

1,400

By July 31, Jobs 741 and 743 were completed and sold. The remaining jobs were in process.

Required:

1. Calculate the plantwide overhead rate for Heurion Company. (Note: Round to the

nearest cent.)

2. Prepare job-order cost sheets for each job showing all costs through July 31. (Note: Round

all amounts to the nearest dollar.)

3. Calculate the balance in Work in Process on July 31.

4. Calculate Cost of Goods Sold for July.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,