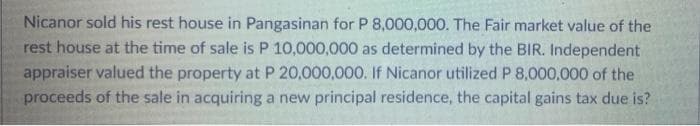

proceeds of the sale in acquiring a new principal residence, the capital gains tax due is?

Q: File Home Insert Draw Formulas Data Review View Help O Editing v 11 B .00 .0 Calibri Number ... .00 ...

A: Aging of Receivable - Aging of Accounts Receivable Schedule is the table that bifurcates the receiva...

Q: On January 1, 2021, Fingerstyle Co. (lessee) enters into a ten-year lease of equipment, with fixed a...

A: Leasing Agreement: An arrangement initiated between lessor and lessee where the lessee makes the usa...

Q: On January 1, 2021, a company issued 1,000 of its 8% 5-year P5,000 convertible bonds at P200,000 pre...

A: The carrying amount of a bond is the amount that is payable to the holder of the bond by the issuer ...

Q: Nicanor, a Resident Citizen, bought shares of established under the laws of the Philippines. Later, ...

A: P50,000- Gain on Sale of Shares is: S1: An Income derived from sources within the Philippines; The a...

Q: 48.) PLEASE ANSWER NOW PLEASE

A: Capital gain tax is calculated on principal residence @ 6% of the hig...

Q: During the month of March, direct labor cost totaled PhP850,000 and direct labor cost was 70% of pri...

A: Prime cost = Direct labor cost/Percentage of direct labor cost on prime cost

Q: DATA Units Per Unit Description Inventory on hand Purchase Date Jan 1 1,000 2$ 4 Jan 3 3,000 2$ Jan ...

A: Last in first out is also written as LIFO. It is the method used for valuation of material and endin...

Q: George Black lives in Manitoba, a non-participating province that has an 7% provincial sales tax Dur...

A: New Vehicle purchase price = $ 82000 Trade in allowance = $ 36000 PST rate = 7% The question require...

Q: CDE1. Nezee Paints purchased merchandise on account from a supplier for $9,000, terms 2/10, n/30. Ne...

A: If goods were returned by buyer then net amount due is $9000-$1200= $ 7800 1. If amount is paid with...

Q: A store sells a product that has a constant daily demand of 26 units. The store purchases the produc...

A: Inventory control may be defined as the systematic control over the procurement, storage, and usage ...

Q: The Liang Wu Carporation manufactures two models of industrial robots, the Apha 1and the Beta 2. The...

A: Variable cost is the cost that changes with the change in the output level.

Q: On December 31, 2019, Mason Company made following proper year-end adjusting entries: 1. Prepare jou...

A: Journal entry shows the recording of transactions and every transaction have a dual impact that is.,...

Q: To gather audit evidence about the proper credit approval of sales (i.e., valuation assertion), the ...

A: Audit is the detailed process of checking and verifying books of accounts and financial information ...

Q: A Company acquired a packaging machine from Taylor Corporation. Taylor completed the construction of...

A: Note:- Since you have asked multiple questions in a single question, we will solve the first questio...

Q: n February direct labor was 60% percent of conversion cost. If the manufacturing overhead cost for t...

A: The conversion costs include direct labor and manufacturing overhead. If direct labor represents 60%...

Q: Philip Enterprises, distributor of compact disks (CDs), is developing its budgeted cost of goods sol...

A: Direct materials cost utilized during the production process Direct labor cost utilized during the p...

Q: The following is an alphabetical list of Lloyd’s Hudson Dealership Inc.’s December 31, 2019, balance...

A: A Balance Sheet is the financial statement that is prepared by every organization at the end of an a...

Q: Discuss the legal effect of incorporation or registration of a Limited Liability Partnership. State ...

A: A limited liability partnership is a separate legal and business entity from its partners. Only afte...

Q: Oslo Company prepared the following contribution format income statement based on a sales volume of ...

A: Operating income is the excess of contribution margin over the fixed cost.It can be calculated by de...

Q: On January 5. 2022. a company received a P5,000,000-complaint from one of its employees who suffered...

A: Solution Explanation- Contingent liability is a liability or a potential loss that mau occur in fut...

Q: In performing risk assessment procedures for property, plant and equipment, an auditor may inquire o...

A: Lets understand the basics. Risk assessment procedure is performed by the auditor to obtain understa...

Q: CFAS Corporation issued 5,000 ordinary shares of P100 par value in Exchange for a land. Based on the...

A: General Journal Debit Credit Land P7,50,000 Common Stock (5000 shares * P100) P5,0...

Q: candal and how the Sarba

A: Sarbanes Oxley Act, popularly known as the SOX Act, introduced to protect the interest of investors ...

Q: A Company acquired a packaging machine from Taylor Corporation. Taylor completed the construction o...

A: Notes payable are written promises to pay lenders at a later date. These instruments are usually acc...

Q: Please describe the primary characteristics for governmental and not-for-profit entities. How does t...

A: The word business organization refers to how businesses are built and how that structure helps them ...

Q: George Black lives in Manitoba, a non-participating province that has an 7% provincial sales tax Dur...

A: Purchase price = $ 82000 Trade allowance = $ 36000 Provincial sales tax (PST )= 7% The question requ...

Q: Elise and Carlo would like to accumulate three times their monthly expenses in monetary assets. They...

A: Given that: Monthly Expense = Php 4500 Monetary Asset = 3 times x Monthly Expense

Q: On September 1, 2018, the board of directors was considering the distribution of a $73,280 cash divi...

A: Cumulative Preferred Shares are the type of shares on which dividend is accumulated if not paid in a...

Q: A company uses two major material inputs in its production.

A: In this question, we have to calculate the probability of the cost of material1 and material 2

Q: What amount should be reported as accrued liability on December 31, 2023? What amount should b...

A: 1. As the Grapes Company became aware in December 2023 that Engineering flaw in the product poses a ...

Q: Oslo Company prepared the following contribution format income statement based on a sales volume of ...

A: The operating leverage indicates a level at which the business entity can increase its income by inc...

Q: Entries for Bank Reconciliation

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: Whispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning D...

A: The right to use an asset is the right of the lessee to use an asset over the life of the lease.

Q: The following is a list (in random order) of KIP International Products Company’s December 31, 2019,...

A: A balance sheet is a financial statement that shows the assets, liabilities, and shareholder equity ...

Q: At the beginning of 2019, Norris Company l1ad a deferred tax liability of $6,400, because of the use...

A: Comment-Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questi...

Q: Department of Finance grants its employees 20 days' sick leave for the whole year. Such sick leave m...

A: The answer for the multiple choice question and relevant explanation are presented hereunder : Monet...

Q: An auditor’s preliminary control risk assessment is at a high level. Which of the following are poss...

A: Solution Explanation - The preliminary assessment of control risk is the process of evaluating the e...

Q: On March 2, Cullumber Company sold $835,000 of merchandise on account to Bramble Company, terms 2/10...

A: Sales = $835,000 Cost of goods sold = $585,000

Q: The following costs were incurred in January: Direct materials = PhP1,950,000 Direct Labor = PhP1,...

A: Prime costs are one of the important type of costs used in cost accounting analysis. Prime costs inc...

Q: In performing risk assessment procedures for property, plant and equipment, an auditor may inquire o...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Haidia corporation, an educational institution provided the following data for the current year: ...

A: Income from tuition fees = 3,500,000 School miscellaneous fees = 1,500,000 Total income = 3,500,000 ...

Q: STAR Corporation, a domestic corporation, had the following data: YEAR GROSS INCOME DEDUCTIONS 2...

A: Operating loss incurred in a tax year may be carried over as a deduction from gross income for 3 con...

Q: 1. What are externalities?

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new ...

Q: On April 1, 2028, A Company purchased three units of baking equipment by issuing a four-year, non-in...

A: Carrying value of note on April 1, 2028 = Present value of the Notes on April 1, 2028 where, Present...

Q: How much is the amount of bonus under the second plan? How much is the amount of bonus under the fir...

A: Suppose B is the amount of Bonus Under Second Plan, B = {(Profits before bonus and tax - B) x (1 - T...

Q: Nicanor, a Non-Resident Alien residing in Canada, bought 20,000 (@par value of Php 100) shares of st...

A: As per the provisions of BIR . a non-resident alien is charged for in...

Q: unrealized gain or loss?

A: During 2020 , Boston Company purchased marketable securities as a trading investment. At the end of ...

Q: internal controls over cash receipts and cash payments. Identify and discuss the similarities and di...

A: lnternal control are methods that are ensure the proper safeguarding of assets are necessary to en...

Q: On January 1, 2022, a company issued serial bonds with a face value of P3,000,000 and stated rate of...

A: The question is based on the concept of Financial Accounting.

Q: Francis Company has 24,000 shares of common stock outstanding at the begining of 2019. Francis issue...

A: 1. Calculation of weighted average number of outstanding shares as,

Step by step

Solved in 2 steps

- Floyd, a cash basis taxpayer, has received an offer to purchase his land. The cash basis buyer will pay him either 100,000 at closing or 50,000 at closing and 56,000 two years after the date of closing. If Floyd recognizes the entire gain in the current year, his marginal tax rate will be 25% (combined Federal and state rates). However, if he spreads the gain over the two years, his combined marginal tax rate on the gain will be only 20%. Floyd does not consider the buyer a credit risk, and he understands that shifting the gain to next year with an installment sale will save taxes. Still, he realizes that the deferred payment will, in effect, earn only 6,000 for waiting two years for the other 50,000. Floyd believes he can earn a 10% before-tax rate of return on his after-tax cash. Floyds adjusted basis for the land is 25,000, the buyer is also a cash basis taxpayer, and the short-term Federal rate is 4%. Floyd has asked you to evaluate the two alternatives on an after-tax basis.Ed owns investment land with an adjusted basis of 35,000. Polly has offered to purchase the land from Ed for 175,000 for use in a real estate development. The amount offered by Polly is 10,000 in excess of what Ed perceives as the fair market value of the land. Ed would like to dispose of the land to Polly but does not want to incur the tax liability that would result. He identifies an office building with a fair market value of 175,000 that he would like to acquire. Polly purchases the office building and then exchanges the office building for Eds land. a. Calculate Eds realized and recognized gain on the exchange and his basis for the office building. b. Calculate Pollys realized and recognized gain on the exchange and her basis in the land.