Product A Product B Initial cost $750,000 $650,000 Expected life 5 years 5 years Scrap value expected $35,000 Others expected cash inflows: Year 1 180,000 200,000 2 300,000 240,000 230,000 210,000 330,000 260,000 195,000 155,000 The company cost of capital for each project is 13 percent. The company relies on several criteria when evaluating new investment opportunities. The projects are independent. Give me your thoughts on these three projects by May 20, 2022. Bomeich was not surprised by the memo, for she had been expecting something like this for some time now. After re-reading the memo, Romeich decided on her plan of action and made up the following t A. Compute the ARR for each project B. Eompute the payback period for each project c. Compute the Net Present Value (NPV) for each project D. Compute the Internal Rate of Retun (IRR) for each project E. Compute the Profitability Index (PI) for each project

Product A Product B Initial cost $750,000 $650,000 Expected life 5 years 5 years Scrap value expected $35,000 Others expected cash inflows: Year 1 180,000 200,000 2 300,000 240,000 230,000 210,000 330,000 260,000 195,000 155,000 The company cost of capital for each project is 13 percent. The company relies on several criteria when evaluating new investment opportunities. The projects are independent. Give me your thoughts on these three projects by May 20, 2022. Bomeich was not surprised by the memo, for she had been expecting something like this for some time now. After re-reading the memo, Romeich decided on her plan of action and made up the following t A. Compute the ARR for each project B. Eompute the payback period for each project c. Compute the Net Present Value (NPV) for each project D. Compute the Internal Rate of Retun (IRR) for each project E. Compute the Profitability Index (PI) for each project

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

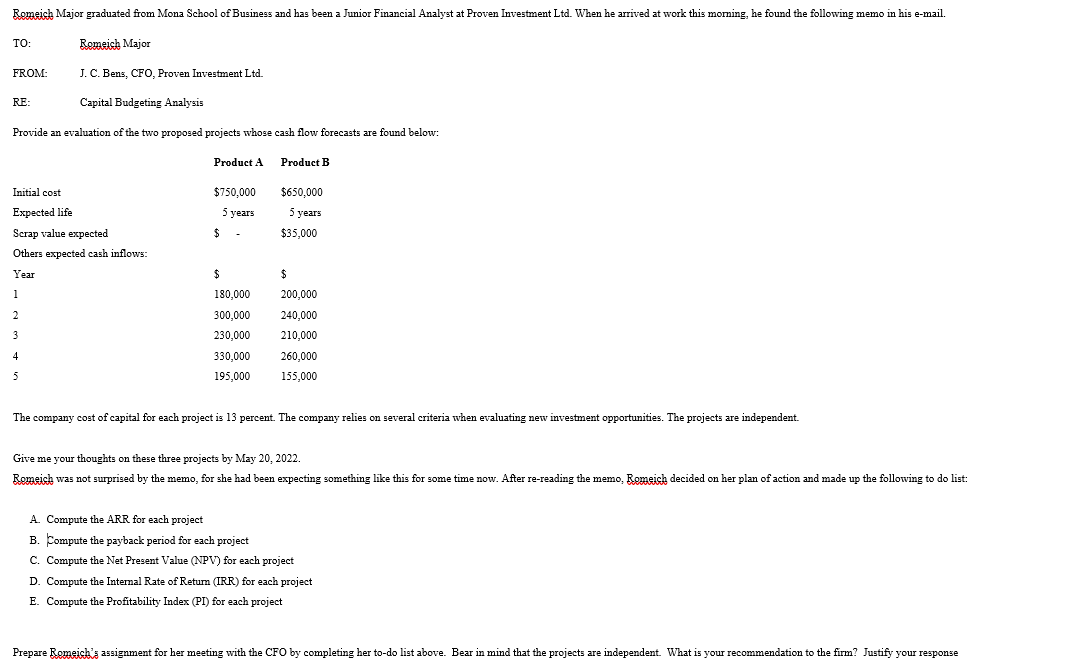

Transcribed Image Text:Romeich Major graduated from Mona School of Business and has been a Junior Financial Analyst at Proven Investment Ltd. When he arrived at work this morming, he found the following memo in his e-mail.

TO:

Romeich Major

FROM:

J. C. Bens, CFO, Proven Investment Ltd.

RE:

Capital Budgeting Analysis

Provide

evaluation of the two proposed projects whose cash flow forecasts are found below:

Product A

Product B

Initial cost

$750,000

$650,000

Expected life

5 уears

5 years

Scrap value expected

2$

$35,000

Others expected cash inflows:

Year

%24

1

180,000

200,000

300,000

240,000

3

230,000

210,000

4

330,000

260,000

5

195,000

155,000

The company cost of capital for each project is 13 percent. The company relies on several criteria when evaluating new investment opportunities. The projects are independent.

Give me your thoughts on these three projects by May 20, 2022.

Romeich was not surprised by the memo, for she had been expecting something like this for some time now. After re-reading the memo, Romeich decided on her plan of action and made up the following to do list:

A. Compute the ARR for each project

B. Compute the payback period for each project

C. Compute the Net Present Value (NPV) for each project

D. Compute the Internal Rate of Retum (IRR) for each project

E. Compute the Profitability Index (PI) for each project

Prepare Romeich's assignment for her meeting with the CFO by completing her to-do list above. Bear in mind that the projects are independent. What is your recommendation to the firm? Justify your response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College