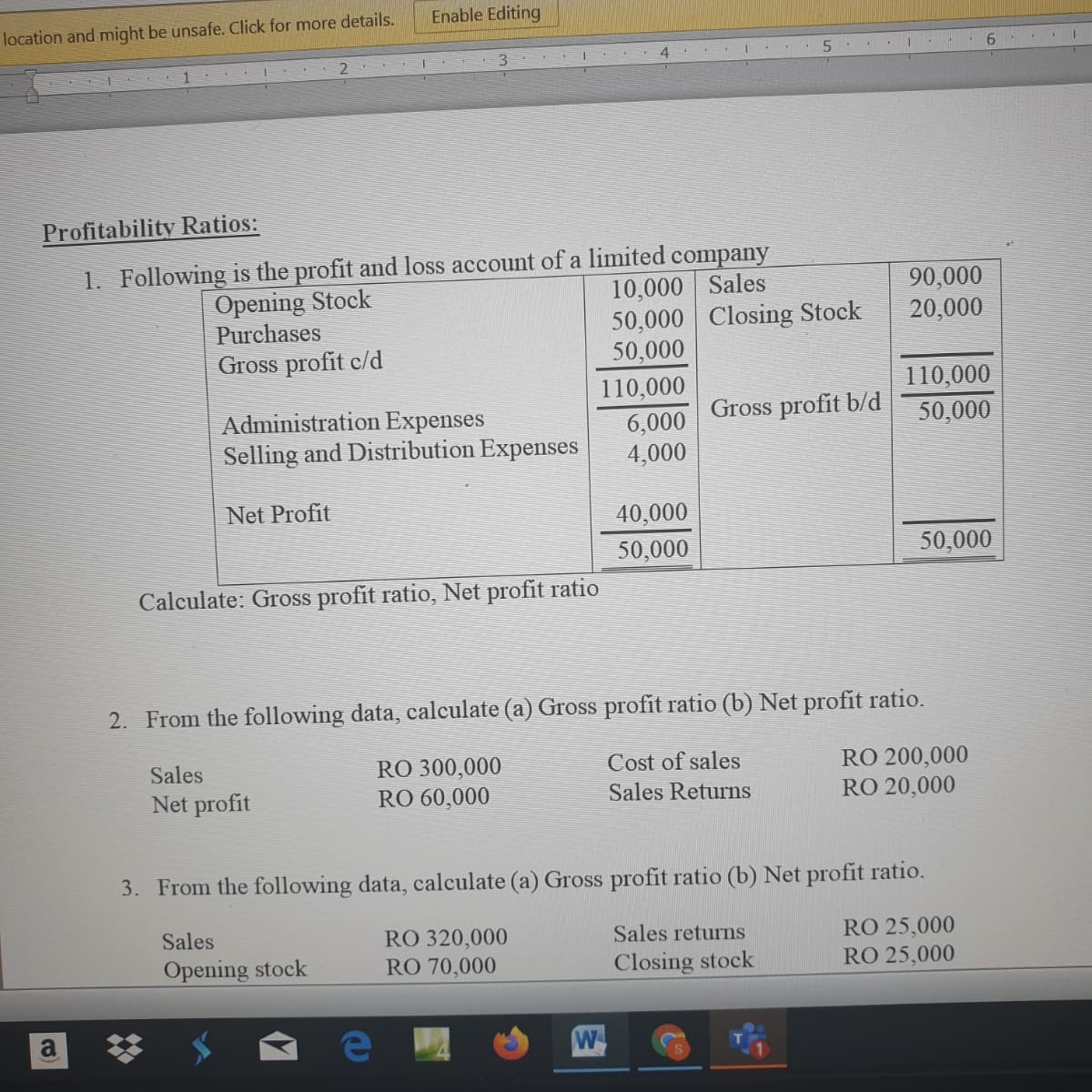

Profitability Ratios: 1. Following is the profit and loss account of a limited company 10,000 Sales 50,000 Closing Stock 50,000 110,000 Opening Stock Purchases 90,000 20,000 Gross profit c/d 110,000 Gross profit b/d Administration Expenses Selling and Distribution Expenses 50,000 6,000 4,000 Net Profit 40,000 50,000 50,000 Calculate: Gross profit ratio, Net profit ratio 2. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio. RO 200,000 RO 300,000 RO 60,000 Sales Cost of sales Net profit Sales Returns RO 20,000 3. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio. Sales RO 25,000 RO 320,000 RO 70,000 Sales returns Opening stock Closing stock RO 25,000

Profitability Ratios: 1. Following is the profit and loss account of a limited company 10,000 Sales 50,000 Closing Stock 50,000 110,000 Opening Stock Purchases 90,000 20,000 Gross profit c/d 110,000 Gross profit b/d Administration Expenses Selling and Distribution Expenses 50,000 6,000 4,000 Net Profit 40,000 50,000 50,000 Calculate: Gross profit ratio, Net profit ratio 2. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio. RO 200,000 RO 300,000 RO 60,000 Sales Cost of sales Net profit Sales Returns RO 20,000 3. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio. Sales RO 25,000 RO 320,000 RO 70,000 Sales returns Opening stock Closing stock RO 25,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4AP

Related questions

Question

Transcribed Image Text:Enable Editing

location and might be unsafe. Click for more details.

3.

Profitability Ratios:

1. Following is the profit and loss account of a limited company

Opening Stock

Purchases

10,000 Sales

50,000 Closing Stock

50,000

90,000

20,000

Gross profit c/d

110,000

110,000

Gross profit b/d

Administration Expenses

Selling and Distribution Expenses

50,000

6,000

4,000

Net Profit

40,000

50,000

50,000

Calculate: Gross profit ratio, Net profit ratio

2. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio.

RO 300,000

RO 200,000

RO 20,000

Sales

Cost of sales

Net profit

RO 60,000

Sales Returns

3. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio.

Sales

RO 320,000

RO 70,000

RO 25,000

RO 25,000

Sales returns

Opening stock

Closing stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College