Program- Year-Section: Multiple Choices I Kịm, Tak and Gu are partners in the KIMT partner, contributed P100,000, Gu, a limited pa a purely industrial partner. The partnership op From the period July 1 to end of the calendar- 20x1; the partnership incurred a loss of P30,00m business earned a profit of P240,000. So the year was only P210,000. Case 1. In the Articles of Partnership, it was a profits equally. 1. How much is the share of Kim from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 2. How much is the share of Tak from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 3. How much is the share of Gu from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 4. How much is the share of Kim from the pr a. P 80,000 b. P 70,000 c. P 60,000 d. Not given

Program- Year-Section: Multiple Choices I Kịm, Tak and Gu are partners in the KIMT partner, contributed P100,000, Gu, a limited pa a purely industrial partner. The partnership op From the period July 1 to end of the calendar- 20x1; the partnership incurred a loss of P30,00m business earned a profit of P240,000. So the year was only P210,000. Case 1. In the Articles of Partnership, it was a profits equally. 1. How much is the share of Kim from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 2. How much is the share of Tak from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 3. How much is the share of Gu from the loss a. P 30,000 b. P 15,000 c. P 10,000 d. Not given 4. How much is the share of Kim from the pr a. P 80,000 b. P 70,000 c. P 60,000 d. Not given

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.22E

Related questions

Question

100%

Transcribed Image Text:ibution

Name:

Program-Year-Section

Multiple Choices 1

Date

Professor:

Score

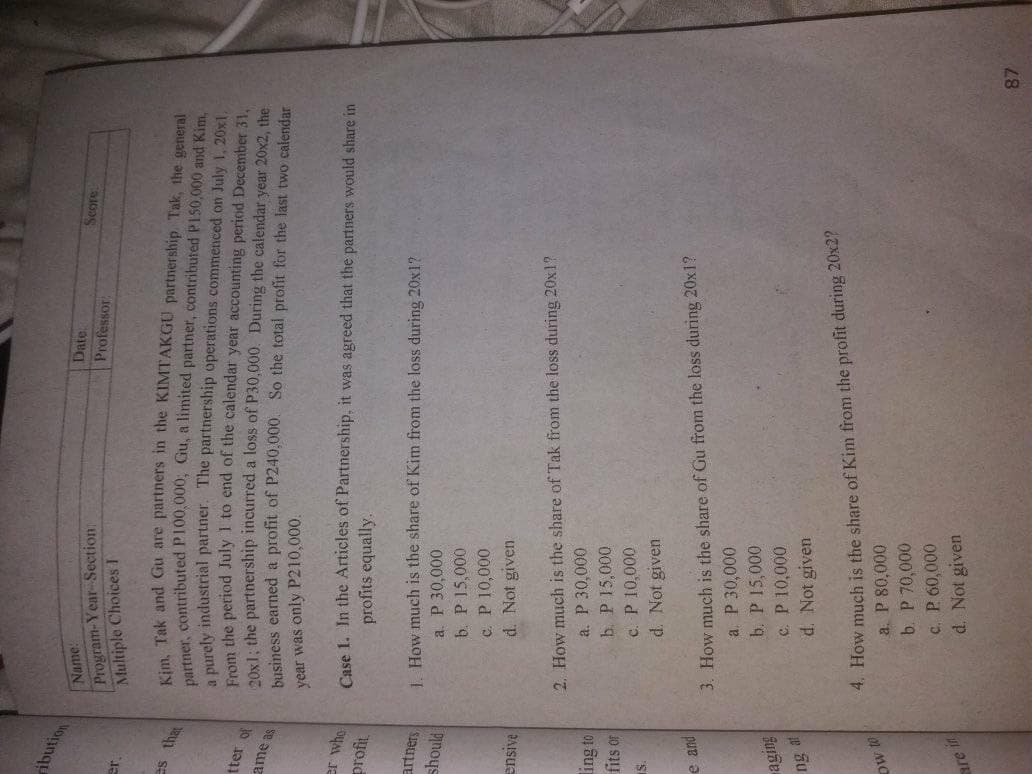

Vim Tak and Gu are partners in the KIMTAKGU partnership Tak, the general

purely industrial partner. The partnership operations commenced on July 1, 20x1.

From the period July 1 to end of the calendar year accounting period December 31,

20sl: the partnership incurred a loss of P30,000. During the calendar year 20x2, the

business earned a profit of P240,000. So the total profit for the last two calendar

tter of

ame as

year was only P210,000.

er who

profi

Case 1. In the Articles of Partnership, it was agreed that the partners would share in

profits equally.

artners

should

1. How much is the share of Kim from the loss during 20x1?

a. P 30,000

b. P 15,000

c. P 10,000

d. Not given

ensive

2. How much is the share of Tak from the loss during 20x1?

a. P 30,000

b. P 15,000

c. P 10,000

d. Not given

ling to

fits or

e and

3. How much is the share of Gu from the loss during 20x1?

a. P 30,000

b. P 15,000

c. P 10,000

d. Not given

4. How much is the share of Kim from the profit during 20x2?

a. P 80,000

b. P 70,000

C. P 60,000

d. Not given

01 MC

87

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College