Progress Sheridan Company'sgross pay for the week ended August 22 totalled73,500, from which S4,030 was deducted for CPP. S1,350 for El, and $19.710 for income tax Prepare the entry to record the employer payrol costs, assuming these will not be paid until September. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. if no entryis required, select "No Entry" for the account titles end enter O for the amounts. Round answers to O decimal places, eg. 1,575.) Date Account Titles and Explanation Debit Credit Aug. 22 (Torecord employer payroll costs) eTextbook and Media

Progress Sheridan Company'sgross pay for the week ended August 22 totalled73,500, from which S4,030 was deducted for CPP. S1,350 for El, and $19.710 for income tax Prepare the entry to record the employer payrol costs, assuming these will not be paid until September. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. if no entryis required, select "No Entry" for the account titles end enter O for the amounts. Round answers to O decimal places, eg. 1,575.) Date Account Titles and Explanation Debit Credit Aug. 22 (Torecord employer payroll costs) eTextbook and Media

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.12EX: Payroll entries The payroll register for D. Salah Company for the week ended May 18 indicated the...

Related questions

Question

please help

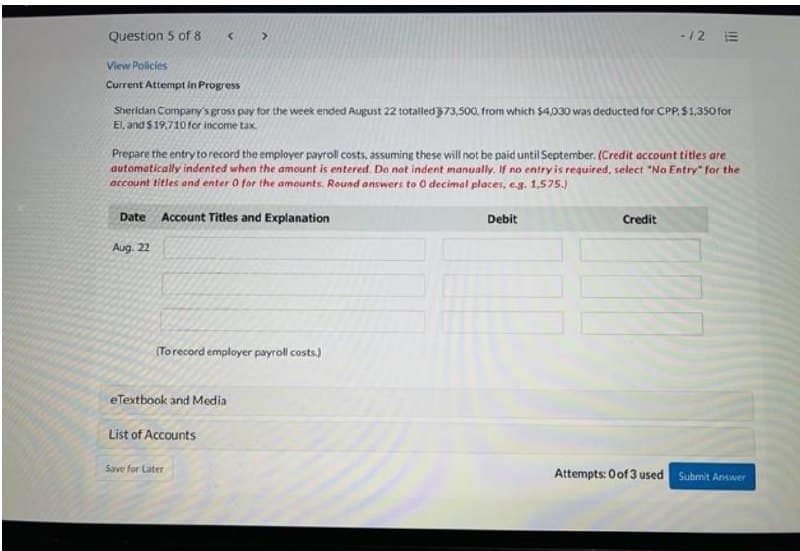

Transcribed Image Text:Question 5 of 8

-12 E

View Policies

Current Attempt in Progress

Sheridan Company'sgross pay for the week ended August 22 totaled73,500, from which $4,030 was deducted for CPP. S1,350 for

El, and $19.710 for income tax.

Prepare the entry to record the employer payroll costs, assuming these will not be paid until September. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles ond enter 0 for the amounts. Round answers to 0 decimal places, e.g. 1,575.)

Date Account Titles and Explanation

Debit

Credit

Aug. 22

(Torecord employer payroll costs.)

eTextbook and Media

List of Accounts

Save for Later

Attempts: Oof3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning