Project Evaluation In the previous problem, suppose your required return on the project is 10 percent and your pretax cost savings are $135,000 per year. Will you accept the project? What if the pretax cost savings are only $95,000 per year?

Project Evaluation In the previous problem, suppose your required return on the project is 10 percent and your pretax cost savings are $135,000 per year. Will you accept the project? What if the pretax cost savings are only $95,000 per year?

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 11PROB

Related questions

Question

show all excel formulas/ work answering the following:

Solve for : LO2 17

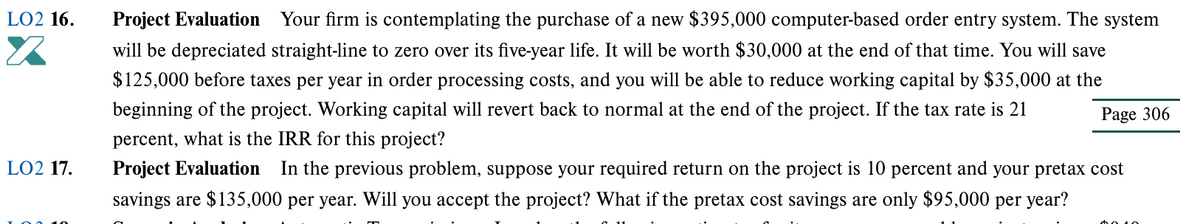

Transcribed Image Text:LO2 16.

Project Evaluation Your firm is contemplating the purchase of a new $395,000 computer-based order entry system. The system

will be depreciated straight-line to zero over its five-year life. It will be worth $30,000 at the end of that time. You will save

$125,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $35,000 at the

beginning of the project. Working capital will revert back to normal at the end of the project. If the tax rate is 21

Page 306

percent, what is the IRR for this project?

LO2 17.

Project Evaluation

In the previous problem, suppose your required return on the project is 10 percent and your pretax cost

savings are $135,000 per year. Will you accept the project? What if the pretax cost savings are only $95,000 per year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning