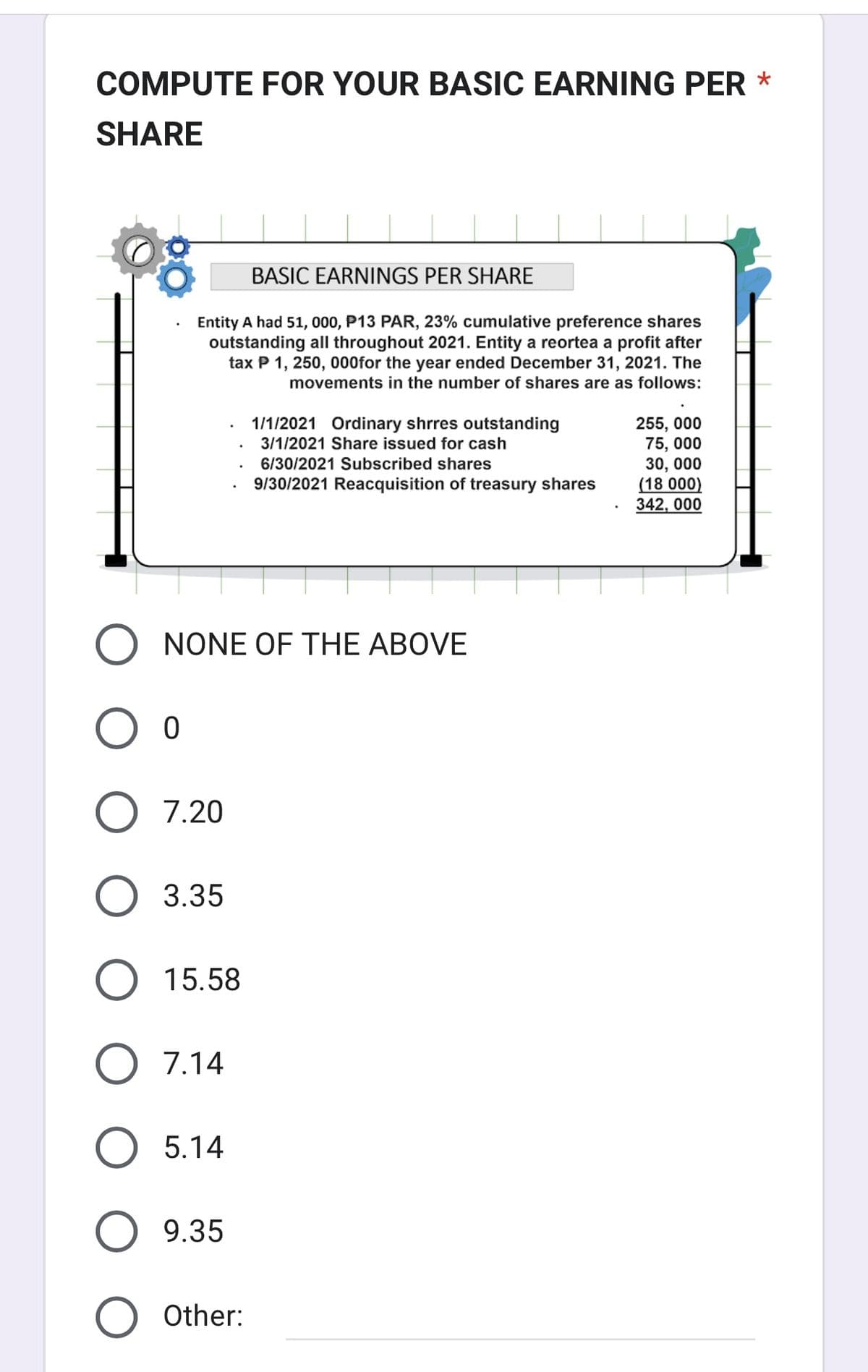

Entity A had 51, 000, P13 PAR, 23% cumulative preference shares outstanding all throughout 2021. Entity a reortea a profit after tax P 1, 250, 000for the year ended December 31, 2021. The movements in the number of shares are as follows: . . . 1/1/2021 Ordinary shrres outstanding 3/1/2021 Share issued for cash 6/30/2021 Subscribed shares 9/30/2021 Reacquisition of treasury shares 255, 000 75,000 30,000 (18 000) 342, 000

Entity A had 51, 000, P13 PAR, 23% cumulative preference shares outstanding all throughout 2021. Entity a reortea a profit after tax P 1, 250, 000for the year ended December 31, 2021. The movements in the number of shares are as follows: . . . 1/1/2021 Ordinary shrres outstanding 3/1/2021 Share issued for cash 6/30/2021 Subscribed shares 9/30/2021 Reacquisition of treasury shares 255, 000 75,000 30,000 (18 000) 342, 000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 15E

Related questions

Question

Please answer with complete solutions.

Transcribed Image Text:COMPUTE FOR YOUR BASIC EARNING PER *

SHARE

BASIC EARNINGS PER SHARE

Entity A had 51, 000, P13 PAR, 23% cumulative preference shares

outstanding all throughout 2021. Entity a reortea a profit after

tax P 1, 250, 000for the year ended December 31, 2021. The

movements in the number of shares are as follows:

0

O 7.20

O 3.35

NONE OF THE ABOVE

.

15.58

O 7.14

O 5.14

9.35

1/1/2021 Ordinary shrres outstanding

3/1/2021 Share issued for cash

O Other:

6/30/2021 Subscribed shares

9/30/2021 Reacquisition of treasury shares

255, 000

75, 000

30, 000

(18 000)

342, 000

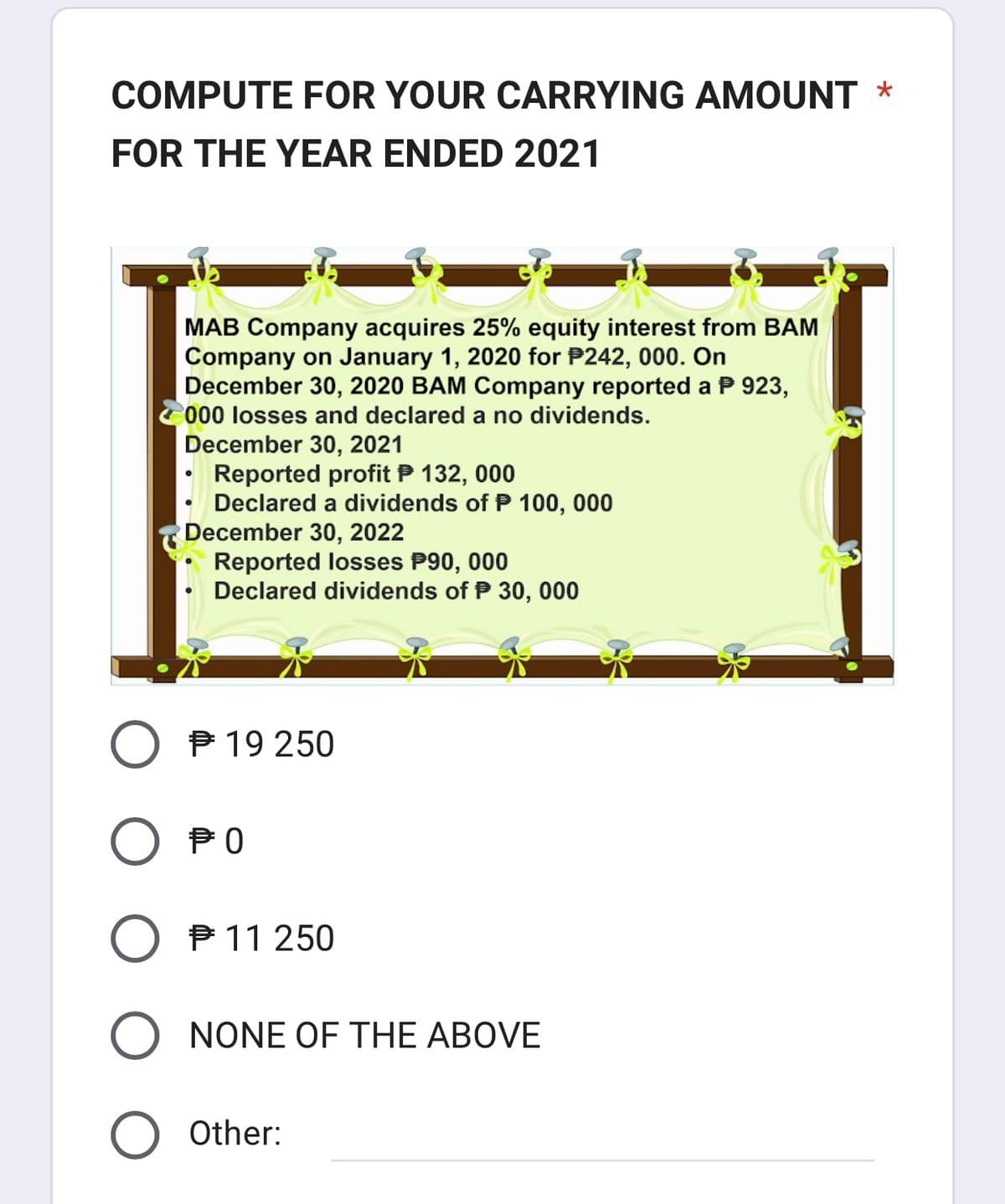

Transcribed Image Text:COMPUTE FOR YOUR CARRYING AMOUNT *

FOR THE YEAR ENDED 2021

MAB Company acquires 25% equity interest from BAM

Company on January 1, 2020 for P242, 000. On

December 30, 2020 BAM Company reported a P 923,

000 losses and declared a no dividends.

December 30, 2021

Reported profit P 132, 000

Declared a dividends of P 100, 000

December 30, 2022

Reported losses P90, 000

Declared dividends of 30, 000

# 19 250

PO

11 250

NONE OF THE ABOVE

Other:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning