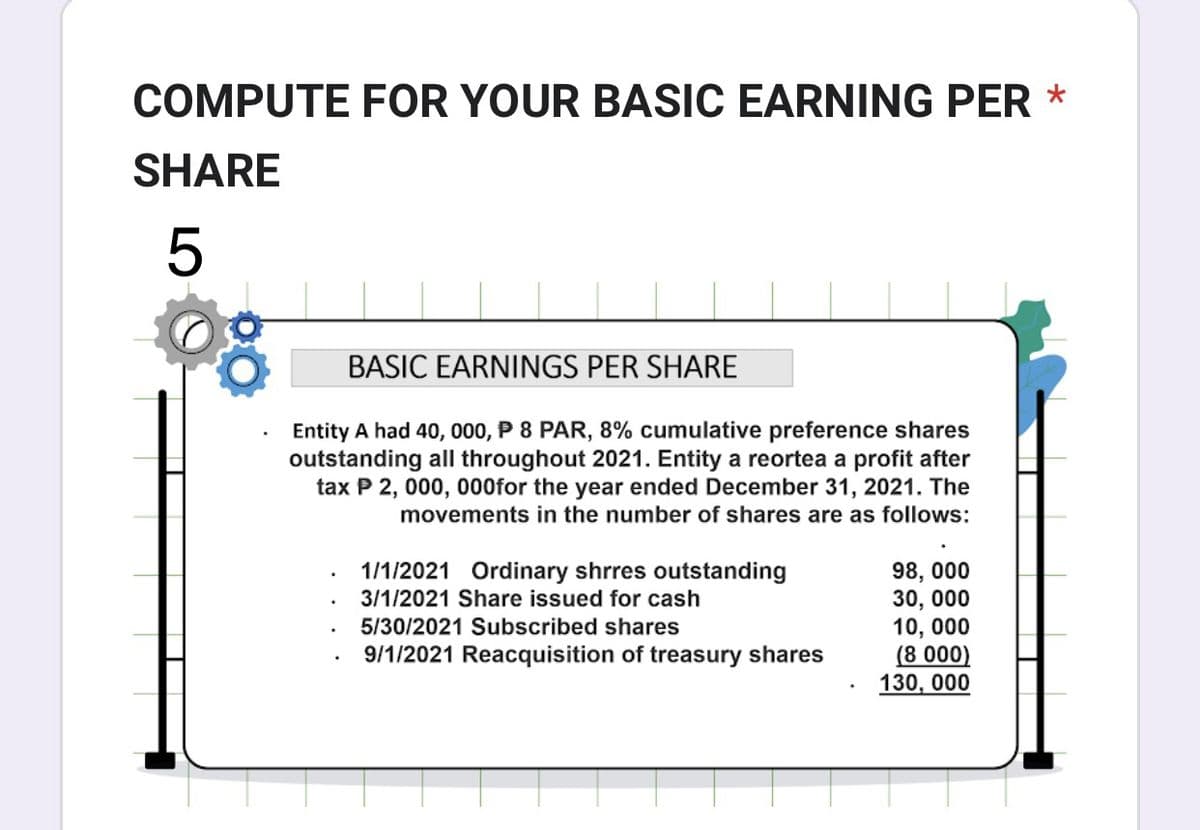

COMPUTE FOR YOUR BASIC EARNING PER * SHARE 5 BASIC EARNINGS PER SHARE Entity A had 40, 000, P 8 PAR, 8% cumulative preference shares outstanding all throughout 2021. Entity a reortea a profit after tax P 2,000,000for the year ended December 31, 2021. The movements in the number of shares are as follows: . 1/1/2021 Ordinary shrres outstanding 3/1/2021 Share issued for cash 5/30/2021 Subscribed shares 9/1/2021 Reacquisition of treasury shares 98, 000 30,000 10, 000 (8 000) 130, 000

Q: Anis is single and reports taxable income of $102,000. His tax liability in 2022 is: OA $15,213 OB.…

A: As per the income tax rules and provisions the status of filing are different depending on the…

Q: Oriole Company expects to produce 1,260,000 units of product XX in 2022. Monthly production is…

A: Flexible budget : It is the budget prepared for various levels of activity by classification of…

Q: Enter the transactions shown above in appropriate general ledger accounts (use T-accounts). (Post…

A: Journal entries recording is initial step in accounting cycle process under which atleast one…

Q: Fuson Corporation makes one product and has provided the following information to help prepare the…

A: Lets understand the basics. Management prepares budget in order to estimate future profit and loss…

Q: The following inventory transactions took place for Ivanhoe Ltd. for the year ended December 31,…

A: Inventory Valuation: Inventory valuation can be done by the organization by three methods - 1. FIFO…

Q: Entity A had 51, 000, P13 PAR, 23% cumulative preference shares outstanding all throughout 2021.…

A: The question is based on the concept of Financial Accounting. Earning per share is calculated by…

Q: Grocery Corporation received $301,001 for 13.50 percent bonds issued on January 1, 2021, at a market…

A: Introduction If stated interest rate on bonds is higher than the market rate of interest then such…

Q: Lovell Variety Seeds mass produces wildflower seed packs. Relevant information used for the process…

A: Concept of equivalent units is used in process costing where cost per equivalent unit is calculated.…

Q: Use the following information for #4 - 5: Motown Corporation has the following transactions: Common…

A: Equity shares holders fund includes common share capital, paid up capital in excess of par value,…

Q: The research, based on 63 patients, showed the following regression results: R-squared: 56%…

A: According to the regression model, It's important to note that this is an estimate based on the…

Q: X ltd manufactures a product incurring variable cost 200$ per unit fixed cost $100000 per month.…

A: Break-even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: Novak Corporation had 318,000 shares of common stock outstanding on January 1, 2025. On May 1, Novak…

A: Stock dividend means the dividend which is issued in the form of shares. It is usually issued by the…

Q: Pace Corporation acquired 100 percent of Spin Company's common stock on January 1, 20X9. Balance…

A: Stockholders' equity is the amount which represents the amount of ownership of the shareholders in…

Q: Bulluck Corporation makes a product with the following standard costs: Standard Quantity or…

A: Variable overhead rate variance :— It is the difference between actual hours at standard variable…

Q: Grove Audio is considering the introduction of a new model of wireless speakers with the following…

A: Introduction:- CVP analysis is used to identify the changes in costs and volume affect a company's…

Q: The following February journal entries all involved cash. Increases to Cash-Debits 2/1 2/9 2/16 2/21…

A: A cash account is a ledger that includes all cash transactions i.e, cash receipts and payments in…

Q: This information relates to Sheridan Supply Co. 1. 2. 3. 4. 5. On April 5 purchased merchandise from…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction is…

Q: Werner Chemical, Incorporated, leased a protein analyzer on September 30, 2024. The five-year lease…

A: Lease is defined a contractual agreement incorporated between two business entities where one entity…

Q: I Can't Think of a Company Name (CTCN) manufacturers products. They had 6,200 physical units that…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Each earns $600 per week for a five-day workweek ending on Friday. The last day of the current month…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period. The…

Q: Beauty Company issued $1,000,000, 4%, 10-year, bonds. Interest to be paid semiannually. The market…

A: Payment of interest will be calculated on on coupon rate of 4% and market rate will not affect…

Q: Start Me Up Incorporated manufactures a caffeinated energy drink that sells for $4.30 each. The…

A: Full costing and variable costing are the two costing systems of assigning production costs to…

Q: Jessica has an account with $4,900. She earns 5%, compounded monthly. She doesn't added nothing to…

A: Given information, A = final amount = 4900 + 2700 = $7600 P = principal amount = $4900 r = annual…

Q: Health 'R Us, Inc., uses a traditional product costing system to assign overhead costs uniformly to…

A: The overhead cost can be applied to the production on the basis of predetermined overhead rate. The…

Q: Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments:…

A: Total factory overhead is the amount of overhead incurred by the entity on the making of the goods.…

Q: The budget director of Heather's Florist has prepared the following sales budget. The company had…

A: Cash will be reported on collection basis and Accounts receivable will be collected by one month…

Q: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the…

A: Using FIFO method, the inventory in beginning is completed at first and assumed to be sold at first.…

Q: I Love My Chocolate Company makes dark chocolate and light chocolate. Both products require cocoa…

A: Standard costing in simple terms can be defined as a system in which the standard costs and revenues…

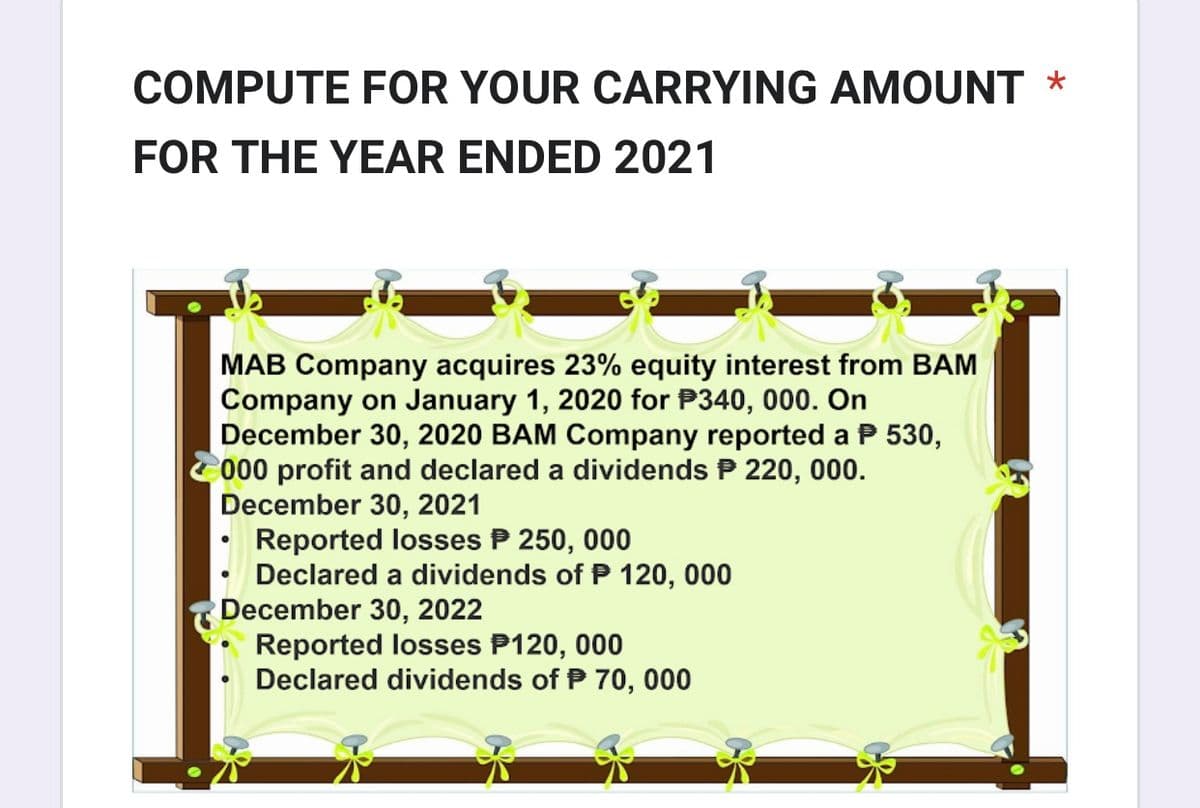

Q: COMPUTE FOR YOUR CARRYING AMOUNT FOR THE YEAR ENDED 2020 *

A: Percentage which has been acquired is 45% equity interest. Acquired interest for P860,000

Q: Zachary manufacturing company makes tents that it sells directly to camping enthusiasts through a…

A: Direct cost is the cost which is directly related to production process such as labour, material…

Q: What is the weighted-average contribution margin ratio? Weighted-average contribution margin ratio…

A: Introduction:- CVP analysis is used to identify the changes in costs and volume affect a…

Q: Gg.103.

A: Notes payable refers to the amount of liability that the person/ company owe from investors,…

Q: if you have a percentage tax due of 70,000, is this monthly or quartelry paid to BIR

A: Given in the question: Percentage tax due is 70,000 Taxes have to be paid to the department of tax…

Q: James's Televisions produces television sets in three categories: portable, midsize, and…

A: The last-in-first-out method is also known as the LIFO method. It is a method in which the goods…

Q: Preparing a consolidated income statement - with noncontrolling interest, but no AAP or intercompany…

A: Consolidated financial statements includes consolidated income statement, balance sheet and cash…

Q: A company sells a product for a price of $100 per unit. The variable cost per unit is $50. The…

A: The break even sales are the sales where business earns no profit no loss during the period. The…

Q: During 2024, a company sells 270 units of inventory for $94 each. The company has the following…

A: In case of FIFO method beginning inventory/ first purchased goods will be sold first.

Q: Required: Compute the ending inventory for the years 2018, 2019, 2020, and 2021, using the…

A: Hey dear student, I'm hereby answering the detailed solution & working note with required…

Q: Galati Ghost Guides manufacturers the booklets that are used for historic ghost tours. Galati uses a…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: The following information is available for Sunland Company for the month of January: expected cash…

A: Cash budget: Cash budget is a tool that indicates the amount of available cash is appropriate or not…

Q: manufacturers homeopathic medicine to aid in fighting minor ailments like the common cold. At the…

A: solution. In order to find the balance of work in process ending inventory first of all we need to…

Q: worksheet d adjusting entry to record bad debts expense under the Allowance for Doubtful Accounts…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Thornton Company operates three segments. Income statements for the segments imply that…

A: In order to determine how much profit was made during the year, business organizations create the…

Q: Minden Company is a wholesale distributor of premium European chocolates. The company's balance…

A: Expected Cash Collection for May (Amounts in $) Particulars Amount Cash Sales…

Q: Prepare the entries to record sales and collections during the period. Prepare the entry to record…

A: Bad debt expenses is amount of sales revenue that is uncollectable because a customer is unable to…

Q: During the year, Alexa rented out the condo for 100 days. She did not use he year. Alexa's AGI from…

A: The rental income are the passive income and all expenses associated with the property can be…

Q: During Heaton Company's first two years of operations, it reported absorption costing net operating…

A: Variable costing : Under variable costing ,product costs is the total of direct materials,direct…

Q: Blanton Plastics, a household plastic product manufacturer, borrowed $25 million cash on October 1,…

A: Notes payable, also known as promissory notes, are a type of debt that a business or individual…

Q: Cablesource sells two type of cable Cat5 and Cat6. Cat 5 price is $135 per box and Cat6 is $156 per…

A: Formulas: Contribution margin per unit = Selling price per unit - Variable cost per unit Break-even…

Q: 6.6% coupons. You hold the bond for four years, an ell it immediately after receiving the fourth…

A: Bonds are source of finance for the companies and bonds are paid annual coupon payments and par…

Please compute with a complete solutions for both question. Need ASAP

Step by step

Solved in 2 steps

- Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Cumulative Preferred Dividends Capital stock of Barr Company includes: As of December 31, 2018, 2 years dividends are in arrears on the preferred stock. During 2019, Barr plans to pay dividends that total S360.000. Required: Determine the amount of dividends that will be paid to Barrs common and preferred stockholders in 2019. If Barr paid $280,000 of dividends, determine how much each group of stockholders would receive.

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss

- Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.