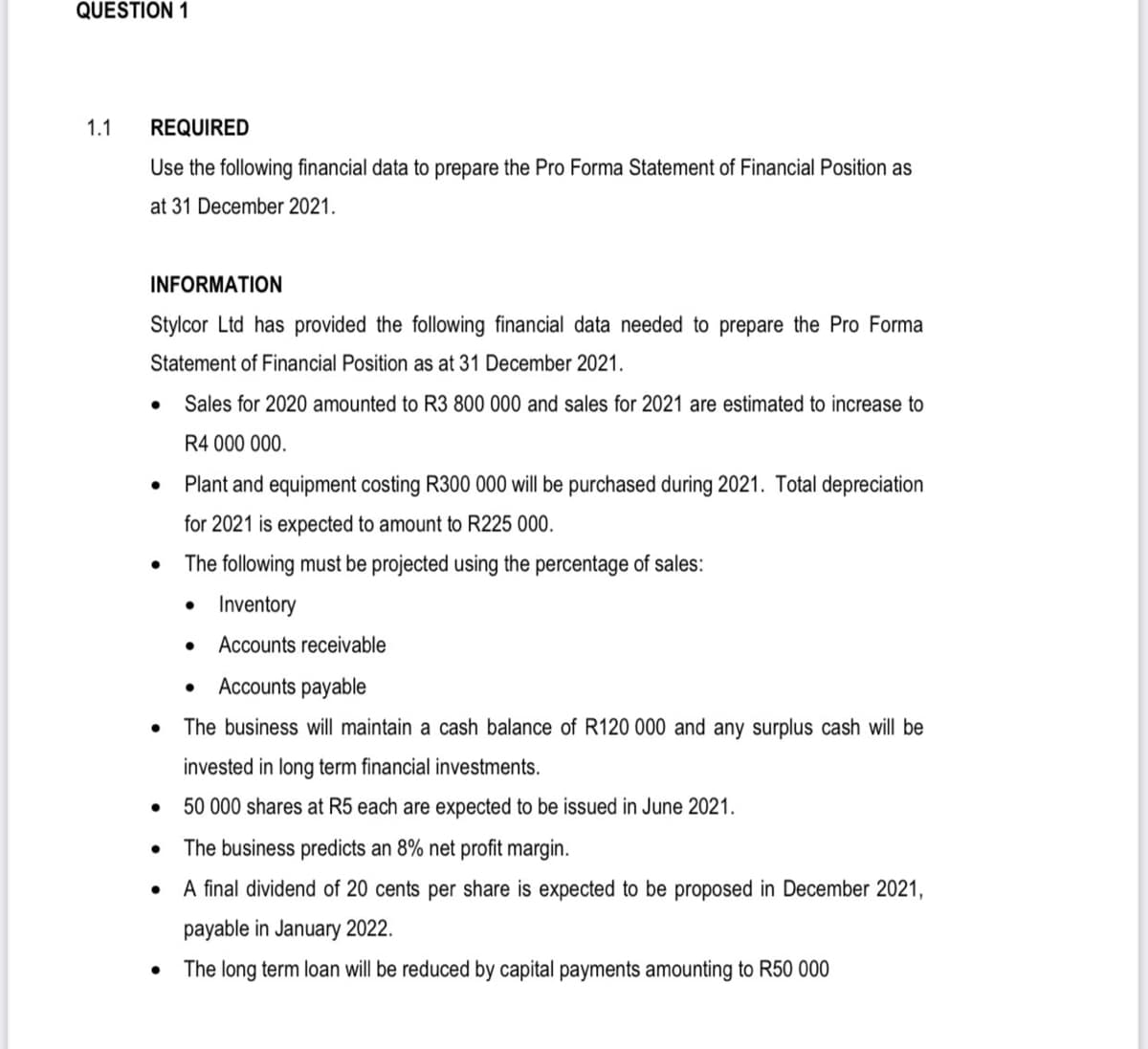

1.1 REQUIRED Use the following financial data to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. INFORMATION Stylcor Ltd has provided the following financial data needed to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. Sales for 2020 amounted to R3 800 000 and sales for 2021 are estimated to increase R4 000 000. Plant and equipment costing R300 000 will be purchased during 2021. Total depreciation for 2021 is expected to amount to R225 000. • The following must be projected using the percentage of sales: • Inventory • Accounts receivable Accounts payable The business will maintain a cash balance of R120 000 and any surplus cash will be invested in long term financial investments. • 50 000 shares at R5 each are expected to be issued in June 2021. The business predicts an 8% net profit margin. A final dividend of 20 cents per share is expected to be proposed in December 2021, payable in January 2022. The long term loan will be reduced by capital payments amounting to R50 000

1.1 REQUIRED Use the following financial data to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. INFORMATION Stylcor Ltd has provided the following financial data needed to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. Sales for 2020 amounted to R3 800 000 and sales for 2021 are estimated to increase R4 000 000. Plant and equipment costing R300 000 will be purchased during 2021. Total depreciation for 2021 is expected to amount to R225 000. • The following must be projected using the percentage of sales: • Inventory • Accounts receivable Accounts payable The business will maintain a cash balance of R120 000 and any surplus cash will be invested in long term financial investments. • 50 000 shares at R5 each are expected to be issued in June 2021. The business predicts an 8% net profit margin. A final dividend of 20 cents per share is expected to be proposed in December 2021, payable in January 2022. The long term loan will be reduced by capital payments amounting to R50 000

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 13PC

Related questions

Question

Transcribed Image Text:QUESTION 1

1.1

REQUIRED

Use the following financial data to prepare the Pro Forma Statement of Financial Position as

at 31 December 2021.

INFORMATION

Stylcor Ltd has provided the following financial data needed to prepare the Pro Forma

Statement of Financial Position as at 31 December 2021.

Sales for 2020 amounted to R3 800 000 and sales for 2021 are estimated to increase to

R4 000 000.

Plant and equipment costing R300 000 will be purchased during 2021. Total depreciation

for 2021 is expected to amount to R225 000.

The following must be projected using the percentage of sales:

• Inventory

Accounts receivable

Accounts payable

The business will maintain a cash balance of R120 000 and any surplus cash will be

invested in long term financial investments.

50 000 shares at R5 each are expected to be issued in June 2021.

The business predicts an 8% net profit margin.

A final dividend of 20 cents per share is expected to be proposed in December 2021,

payable in January 2022.

The long term loan will be reduced by capital payments amounting to R50 000

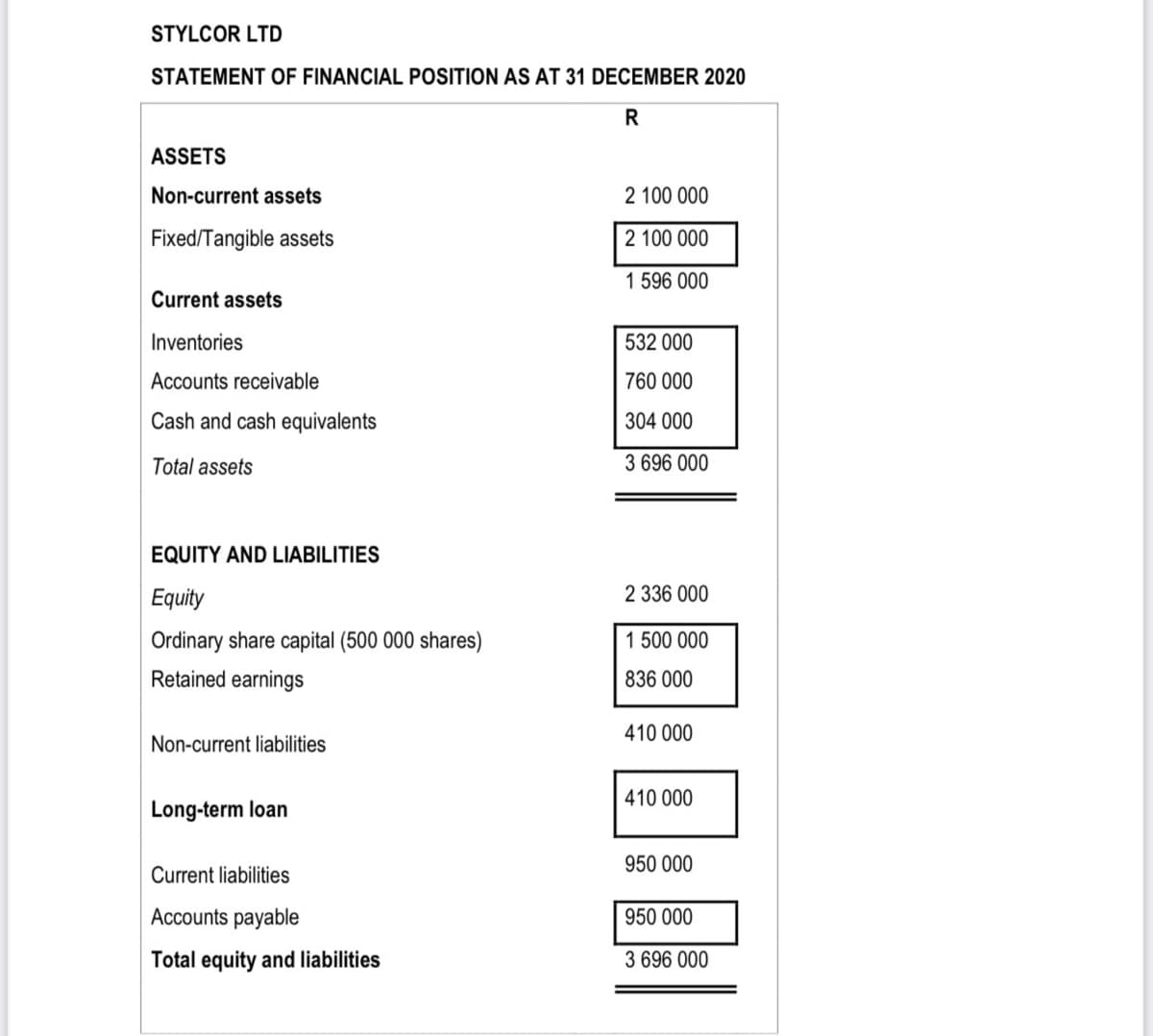

Transcribed Image Text:STYLCOR LTD

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020

R

ASSETS

Non-current assets

2 100 000

Fixed/Tangible assets

2 100 000

1 596 000

Current assets

Inventories

532 000

Accounts receivable

760 000

Cash and cash equivalents

304 000

Total assets

3 696 000

EQUITY AND LIABILITIES

Equity

2 336 000

Ordinary share capital (500 000 shares)

1 500 000

Retained earnings

836 000

410 000

Non-current liabilities

410 000

Long-term loan

950 000

Current liabilities

Accounts payable

950 000

Total equity and liabilities

3 696 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning