Show the solution in good accounting form. Thank you! 1. How much should be shown in FIVE's 2021 income statement as gross rental income? a. ₱ 60,000 b. ₱ - 0 - c. ₱ 6,000 d. ₱ 30,00

Q: Multiple choice: 1. If you had purchased P500 of supplies during the month and at the end of the…

A: Here the purchase value of supplies P500 And at the end of year closing supplies balance exisis is…

Q: Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4A Req 4B…

A: Pre-determined overhead rate : Estimated total overhead/ Estimated Direct labor hours $351,000/900…

Q: You were employed by the entity as its bookkeeper in its first year of operations. You are now to…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: ed by JANE on December 31, 20x6?

A: Given: To calculate the total revenue in which recognized by JANE in the year Dec 31, 20x6 as,

Q: Assume that Global Cleaning Service performed cleaning services for a department store on account…

A: The accounting equation shows the effect of every transaction of the business on the assets and…

Q: basis. How much revenue will the company recognize in 20x6 under this arrangement?

A: Revenue recognition stipulates on how and when revenue has to be recognized. It is a concept or…

Q: Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an…

A: A. Prepare an income statement for the year 2020 using the multiple-step form. Common shares…

Q: c) Prepare the Trial Balance as at 30 September 2020. [Sediakan Imbangan Duga pada 30 September…

A: Financial statement is prepared from the trial balance which include :- Profit and loss and…

Q: Instructions: Prepare a Statement of Comprehensive Income - Horizontal Analysis including the…

A: Income statement or statement of profit or loss is one of an important financial statement which…

Q: Based on the above trial balance, prepare the r Gross Profit Blank 1 Net Income from operation Blank…

A: Preparation of Income Statement

Q: Please answer in good accounting form Thankyou 4. How much should be reported as rent expense in…

A: Rent expense: It implies to the expense that is incurred by the tenant for taking a rental room from…

Q: Direction: Act as an accountant. Enter the given data in excel and compute for the gross income, the…

A: Note :All deductions are calculated on Gross income

Q: 1) In accounting, what do we call this type of situation? 2) Detail the impact to the financial…

A:

Q: C. In June, Nikea Inc. received the $10,000 payment from XYZ Which of Nikea's accounts are affected…

A: Given transaction is: Nikea Inc. received the $10,000 payment from XYZ. Cash (Assets) - Increase XYZ…

Q: Using the information in the attached pictures, prepare the income statement. Clear Copy Co. Income…

A: Income statement is one of the financial statement of business, which shows all incomes and all…

Q: 1. Prepare Statement of Goods Manufactured for Yan Min Factory Sdn Bhd for the year ended 31…

A: Cost of goods manufactured = prime cost + factory cost Gross profit =…

Q: The concept of materiality is an underlying principle of financial reporting.a. Briefly explain the…

A: Requirement a:

Q: The financial year of Shah Enterprise ended on 31 December 2019. Show the ledger account for the…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted…

A: Journal entry is the primary step to record the transaction in the books of account. The debit and…

Q: EX.01.270 From the following list of items taken from Lamar's accounting records, identify those…

A: Income statement means a statement where income or expenses items are shown . Assets and liabilities…

Q: In work sheet Net loss of $ 100,000 should be shown as a. Debit balance in the Balance sheet O b.…

A: Income statement is a part of financial statements of a company. It shows the company’s income and…

Q: Thorpe Corporation purchases a new delivery truck and signs a note payable at the truckdealership…

A: Asset: Asset means any property or things owned by company.

Q: Questions related to the Statement of Profit or Loss a. Revenue is the income generated from normal…

A: SOLUTION-A EMIRATES IS AN INTERNATIONAL AIRLINE COMPANY . IT IS AN AIR TRAVEL SERVICE PROVIDER . IT…

Q: Debit Balances Credit Balances 11 Cash 10,990 12 Accounts Receivable

A: The entries have been mentioned below.

Q: Purchased stationery on credit from P.Radebe for R100.What effect will it have on the accounting…

A: As per accounting equation, assets equal to sum of liabilities and equity.

Q: Using your understanding of adjustments to a merchandise corporation from the video in lesson one,…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: balance for the unearned revenue from points as of yearend

A: Unearned revenue is the revenue that is not yet earned. It is a current liability having credit…

Q: Identify the letter for the principle or assumption from A through F in the blank space next to each…

A:

Q: What is the purpose of making profit and loss account and what accounting items will be reported in…

A: The financial statements of the company are the records that summarizes the transactions made by the…

Q: Prepare the adjusting entry necessary when brochures costing PKR 2 million are mailed. c. In its…

A: Adjusting entries Adjusting journal entries is the fourth process in the accounting cycle. Adjusting…

Q: This question is asking to prepare an adjusted trial balance. I'm not sure where income tax payable,…

A: Trial balance is a summary of ledger balances. It is used for preparing financial representation.

Q: The company receives a $500,000 payment from a client. Half of this payment is for services that the…

A: This question deals with the impact of the transaction on the asset liability and equity section of…

Q: Select one: a. debit to Income Summary for $79,500. b. debit to Income Summary for $6,500. C. credit…

A: AnsweR: Option a

Q: Identify which of the following items would appear on a balance sheet with either "Yes" or "No". a.…

A: Introduction: Balance sheet: All assets and liabilities are reported in Balance sheet. It tells the…

Q: What I Can Do Given the following amount of the expenses and revenue, solve for the profit using the…

A: Profit=Total Income-Total expenses

Q: Provincial Imports, Inc. for Next Year (Judgmental Method) for example how can I find account…

A: Performa income statement and balance sheet are prepared to have an idea about next year’s…

Q: How much depreciation expense is to be recorded for the year ended 2021? (present answer with 2…

A: Right of use Asset is recorded with the same amount of lease liability plus any initial direct cost.…

Q: if you post that transaction and run a Balance Sheet report in 2021, Accrued other expenses will be…

A: Journal: It is the first step of recording financial transactions. It is used to prepare the…

Q: The following balances appeared in the books of Santiago Traders on 1 March 2020: Land and Buildings…

A: The total amount of a plant asset's cost that has been allocated to depreciation expenditure (or…

Q: 1. The financial year of Shah Enterprise ended on 31 December 2019. Show the ledger account for the…

A: Ledger account: It is used to record the business transactions that were made during a financial…

Q: ‘For every debit, there is an equal and corresponding credit’. The relevant accounting principle for…

A: definition of dual aspect concept - The dual aspect concept states that every transaction must be…

Q: The current ratio reflects the relationship between the value of the current assets and the extent…

A: Definition: Current ratio is one type of liquidity ratios, it link between current assets and…

Q: For each of the following independent items, indicate when revenue should be recognized. a. Interest…

A:

Q: which is the effect of the following transaction on the basic accounting equation? Bought equitment…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.…

Q: Ali Mamat Enterprise Trial Balance as at 31 December 2019 Particulars Sales Purchases Salaries Motor…

A: Introduction: Balance sheet: All assets and liabilities are shown in Balance sheet. It tells the net…

Q: 1. Develop a basic "accounting equation" (Assets= Liability + Owner's Equity) for the year 2018 &…

A: Total Assets = Liabilities + Owner's Equity

Q: Record any 5 accounting transactions of your own choice for furniture business for the year 2019,…

A: Journal:- These are prepared by the companies with debit and credit sides in order to match the…

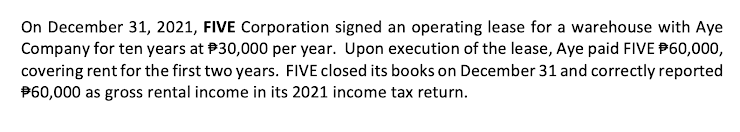

Show the solution in good accounting form. Thank you!

1. How much should be shown in FIVE's 2021 income statement as gross rental income?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major customer in exchange for used equipment. The equipment had originally cost Park 200,000 and had a book value of 20,000 on the date of the sale. At the 12% imputed interest rate for this type of loan, the present value of the note is 25,500 on January 1, 2019. Park uses the effective interest rate. What is the carrying value of the note receivable on Parks December 31, 2019, balance sheet? a. 28,560 b. 29,000 c. 32,500 d. 36,000

- Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.On January 1, 2019, Boater Company issues a 20,000 non-interest-bearing, 5-year note for equipment. Neither the fair value of the note nor the equipment is determinable. Boaters incremental borrowing rate is 9%. The asset has a useful life of 7 years. Prepare the journal entry for Boater to record the issuance of the note on January 1.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method