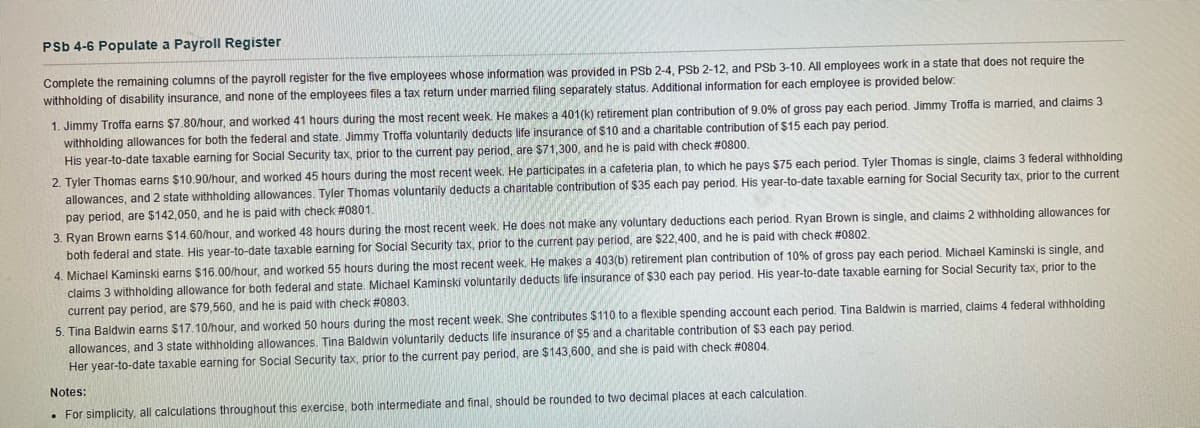

PSb 4-6 Populate a Payroll Register Complete the remaining columns of the payroll register for the five employees whose information was provided in PSb 2-4, PSb 2-12, and PSb 3-10. All employees work in a state that does not require the withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below. 1. Jimmy Troffa earns $7.80/hour, and worked 41 hours during the most recent week. He makes a 401(k) retirement plan contribution of 9.0% of gross pay each period. Jimmy Troffa is married, and claims 3 withholding allowances for both the federal and state. Jimmy Troffa voluntarily deducts life insurance of $10 and a charitable contribution of $15 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $71,300, and he is paid with check #0800. 2. Tyler Thomas earns $10.90/hour, and worked 45 hours during the most recent week. He participates in a cafeteria plan, to which he pays $75 each period. Tyler Thomas is single, claims 3 federal withholding allowances, and 2 state withholding allowances. Tyler Thomas voluntarily deducts a charitable contribution of $35 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $142,050, and he is paid with check #0801. 3. Ryan Brown earns $14.60/hour, and worked 48 hours during the most recent week. He does not make any voluntary deductions each period. Ryan Brown is single, and claims 2 withholding allowances for both federal and state. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $22,400, and he is paid with check # 0802. 4. Michael Kaminski earns $16.00/hour, and worked 55 hours during the most recent week. He makes a 403(b) retirement plan contribution of 10% of gross pay each period. Michael Kaminski is single, and claims 3 withholding allowance for both federal and state. Michael Kaminski voluntarily deducts life insurance of $30 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $79,560, and he is paid with check #0803. married, claims 4 federal withholding 5. Tina Baldwin earns $17.10/hour, and worked 50 hours during the most recent week. She contributes $110 to a flexible spending account each period. Tina Baldwin allowances, and 3 state withholding allowances. Tina Baldwin voluntarily deducts life insurance of $5 and a charitable contribution of $3 each pay period. Her year-to-date taxable earning for Social Security tax, prior to the current pay period, are $143,600, and she is paid with check #0804. Notes: . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

PSb 4-6 Populate a Payroll Register Complete the remaining columns of the payroll register for the five employees whose information was provided in PSb 2-4, PSb 2-12, and PSb 3-10. All employees work in a state that does not require the withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below. 1. Jimmy Troffa earns $7.80/hour, and worked 41 hours during the most recent week. He makes a 401(k) retirement plan contribution of 9.0% of gross pay each period. Jimmy Troffa is married, and claims 3 withholding allowances for both the federal and state. Jimmy Troffa voluntarily deducts life insurance of $10 and a charitable contribution of $15 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $71,300, and he is paid with check #0800. 2. Tyler Thomas earns $10.90/hour, and worked 45 hours during the most recent week. He participates in a cafeteria plan, to which he pays $75 each period. Tyler Thomas is single, claims 3 federal withholding allowances, and 2 state withholding allowances. Tyler Thomas voluntarily deducts a charitable contribution of $35 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $142,050, and he is paid with check #0801. 3. Ryan Brown earns $14.60/hour, and worked 48 hours during the most recent week. He does not make any voluntary deductions each period. Ryan Brown is single, and claims 2 withholding allowances for both federal and state. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $22,400, and he is paid with check # 0802. 4. Michael Kaminski earns $16.00/hour, and worked 55 hours during the most recent week. He makes a 403(b) retirement plan contribution of 10% of gross pay each period. Michael Kaminski is single, and claims 3 withholding allowance for both federal and state. Michael Kaminski voluntarily deducts life insurance of $30 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $79,560, and he is paid with check #0803. married, claims 4 federal withholding 5. Tina Baldwin earns $17.10/hour, and worked 50 hours during the most recent week. She contributes $110 to a flexible spending account each period. Tina Baldwin allowances, and 3 state withholding allowances. Tina Baldwin voluntarily deducts life insurance of $5 and a charitable contribution of $3 each pay period. Her year-to-date taxable earning for Social Security tax, prior to the current pay period, are $143,600, and she is paid with check #0804. Notes: . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter12: Preparing Payroll Records

Section: Chapter Questions

Problem 1MP

Related questions

Question

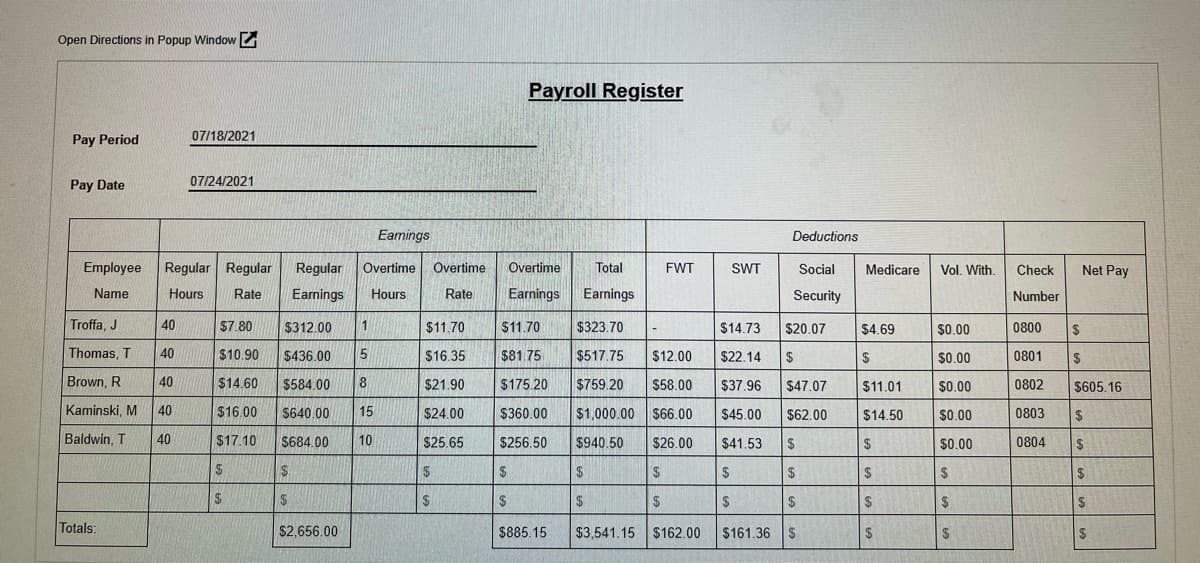

Please complete the payrolll register.

Note: this payroll register is partially done please complete the missing boxes with the right answers.

Transcribed Image Text:PSb 4-6 Populate a Payroll Register

Complete the remaining columns of the payroll register for the five employees whose information was provided in PSb 2-4, PSb 2-12, and PSb 3-10. All employees work in a state that does not require the

withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below.

1. Jimmy Troffa earns $7.80/hour, and worked 41 hours during the most recent week. He makes a 401(k) retirement plan contribution of 9.0% of gross pay each period. Jimmy Troffa is married, and claims 3

withholding allowances for both the federal and state. Jimmy Troffa voluntarily deducts life insurance of $10 and a charitable contribution of $15 each pay period.

His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $71,300, and he is paid with check #0800.

2. Tyler Thomas earns $10.90/hour, and worked 45 hours during the most recent week. He participates in a cafeteria plan, to which he pays $75 each period. Tyler Thomas is single, claims 3 federal withholding

allowances, and 2 state withholding allowances. Tyler Thomas voluntarily deducts a charitable contribution of $35 each pay period. His year-to-date taxable earning for Social Security tax, prior to the current

pay period, are $142,050, and he is paid with check #0801.

3. Ryan Brown earns $14.60/hour, and worked 48 hours during the most recent week. He does not make any voluntary deductions each period. Ryan Brown is single, and claims 2 withholding allowances for

both federal and state. His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $22,400, and he is paid with check #0802.

4. Michael Kaminski earns $16.00/hour, and worked 55 hours during the most recent week. He makes a 403(b) retirement plan contribution of 10% of gross pay each period. Michael Kaminski is single, and

claims 3 withholding allowance for both federal and state. Michael Kaminski voluntarily deducts life insurance of $30 each pay period. His year-to-date taxable earning for Social Security tax, prior to the

current pay period, are $79,560, and he is paid with check # 0803.

5. Tina Baldwin earns $17.10/hour, and worked 50 hours during the most recent week. She contributes $110 to a flexible spending account each period. Tina Baldwin is married, claims 4 federal withholding

allowances, and 3 state withholding allowances. Tina Baldwin voluntarily deducts life insurance of $5 and a charitable contribution of $3 each pay period.

Her year-to-date taxable earning for Social Security tax, prior to the current pay period, are $143,600, and she is paid with check #0804.

Notes:

. For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Transcribed Image Text:Open Directions in Popup Window

Pay Period

Pay Date

Employee

Name

Troffa, J

Thomas, T

Brown, R

Kaminski, M

Baldwin, T

Totals:

40

40

Regular Regular

Hours Rate

40

07/18/2021

40

40

07/24/2021

$7.80

$10.90

$14.60

$16.00

$17.10

$

$

Earnings

Regular Overtime Overtime

Earnings Hours

Rate

$312.00

1

$436.00 5

$584.00 8

$640.00 15

$684.00 10

$

$

$2,656.00

$11.70

$16.35

$21.90

$24.00

$25.65

$

$

Payroll Register

Overtime Total

Earnings Earnings

$11.70

$81.75

$175.20

$360.00

$256.50

$

$

$885.15

$

$

FWT

-

SWT

$323.70

$14.73

$517.75 $12.00 $22.14

$759.20 $58.00 $37.96 $47.07

$1,000.00 $66.00

$940.50 $26.00

$

$45.00 $62.00

$41.53

$

$3,541.15 $162.00

Deductions

$

$

Social

Security

$20.07

$

$

$

$

$161.36 $

Medicare

$4.69

$

$11.01

$14.50

$

GA GA GA

$

$

Vol. With.

$0.00

$0.00

$0.00

$0.00

$0.00

$

$

$

Check

Number

0800

0801

0802

0803

0804

Net Pay

$

$

$605.16

$

$

$

SASA

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning