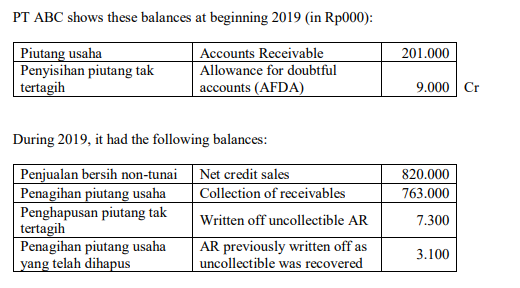

PT ABC shows these balances at beginning 2019 (in Rp000): Piutang usaha Penyisihan piutang tak tertagih Accounts Receivable Allowance for doubtful accounts (AFDA) 201.000 9.000 Cr During 2019, it had the following balances: Penjualan bersih non-tunai | Net credit sales Penagihan piutang usaha Penghapusan piutang tak tertagih Penagihan piutang usaha _yang telah dihapus 820.000 Collection of receivables 763.000 Written off uncollectible AR 7.300 AR previously written off as uncollectible was recovered 3.100

PT ABC shows these balances at beginning 2019 (in Rp000): Piutang usaha Penyisihan piutang tak tertagih Accounts Receivable Allowance for doubtful accounts (AFDA) 201.000 9.000 Cr During 2019, it had the following balances: Penjualan bersih non-tunai | Net credit sales Penagihan piutang usaha Penghapusan piutang tak tertagih Penagihan piutang usaha _yang telah dihapus 820.000 Collection of receivables 763.000 Written off uncollectible AR 7.300 AR previously written off as uncollectible was recovered 3.100

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

4. Determine the ending balance of

Receivable

5. What is the net realizable value of the

receivables at the end of 2019?

6. The company has a notes receivable of

Rp24,000 at January 15, 2019 for 3 months at

10% interest rate. Prepare

April 15, 2019, on its due date.

Transcribed Image Text:PT ABC shows these balances at beginning 2019 (in Rp000):

Piutang usaha

Penyisihan piutang tak

tertagih

Accounts Receivable

Allowance for doubtful

accounts (AFDA)

201.000

9.000 Cr

During 2019, it had the following balances:

Penjualan bersih non-tunai | Net credit sales

Penagihan piutang usaha

Penghapusan piutang tak

tertagih

Penagihan piutang usaha

_yang telah dihapus

820.000

Collection of receivables

763.000

Written off uncollectible AR

7.300

AR previously written off as

uncollectible was recovered

3.100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College