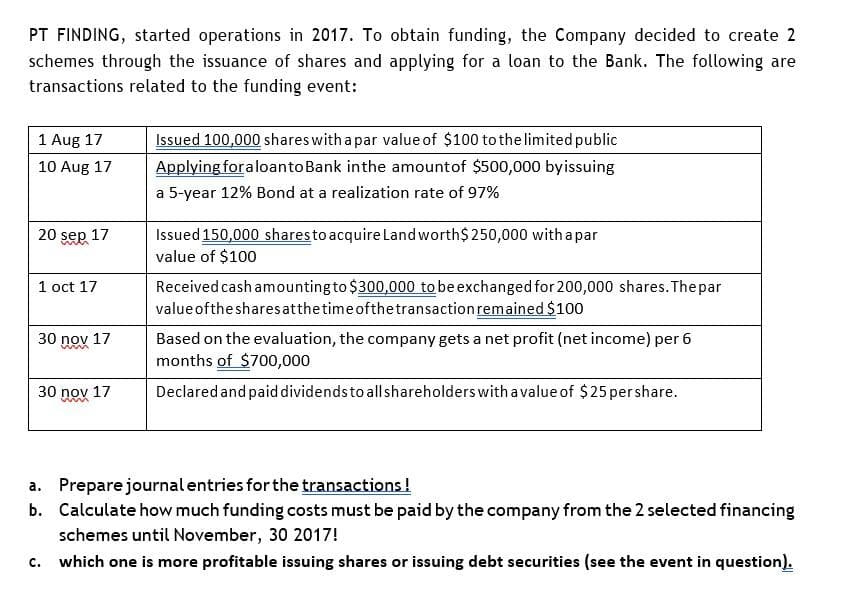

PT FINDING, started operations in 2017. To obtain funding, the Company decided to create 2 schemes through the issuance of shares and applying for a loan to the Bank. The following are transactions related to the funding event: Issued 100,000 shares with a par value of $100 to the limited public Applying foraloanto Bank inthe amountof $500,000 byissuing 1 Aug 17 10 Aug 17 a 5-year 12% Bond at a realization rate of 97% Issued 150,000 sharesto acquire Land worth$250,000 with apar value of $100 20 sep 17 Received cash amounting to $300,000 to be exchanged for 200,000 shares. Thepar valueofthesharesatthetime ofthetransaction remained $100 1 oct 17 30 nov 17 Based on the evaluation, the company gets a net profit (net income) per 6 months of $700,000 30 nov 17 Declared and paid dividendsto allshareholders with a value of $25 pershare. a. Preparejournal entries for the transactions! b. Calculate how much funding costs must be paid by the company from the 2 selected financing schemes until November, 30 2017! c. which one is more profitable issuing shares or issuing debt securities (see the event in question).

PT FINDING, started operations in 2017. To obtain funding, the Company decided to create 2 schemes through the issuance of shares and applying for a loan to the Bank. The following are transactions related to the funding event: Issued 100,000 shares with a par value of $100 to the limited public Applying foraloanto Bank inthe amountof $500,000 byissuing 1 Aug 17 10 Aug 17 a 5-year 12% Bond at a realization rate of 97% Issued 150,000 sharesto acquire Land worth$250,000 with apar value of $100 20 sep 17 Received cash amounting to $300,000 to be exchanged for 200,000 shares. Thepar valueofthesharesatthetime ofthetransaction remained $100 1 oct 17 30 nov 17 Based on the evaluation, the company gets a net profit (net income) per 6 months of $700,000 30 nov 17 Declared and paid dividendsto allshareholders with a value of $25 pershare. a. Preparejournal entries for the transactions! b. Calculate how much funding costs must be paid by the company from the 2 selected financing schemes until November, 30 2017! c. which one is more profitable issuing shares or issuing debt securities (see the event in question).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 26E: Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of...

Related questions

Question

Transcribed Image Text:PT FINDING, started operations in 2017. To obtain funding, the Company decided to create 2

schemes through the issuance of shares and applying for a loan to the Bank. The following are

transactions related to the funding event:

Issued 100,000 shares with a par value of $100 to the limited public

Applying foraloanto Bank inthe amountof $500,000 byissuing

1 Aug 17

10 Aug 17

a 5-year 12% Bond at a realization rate of 97%

Issued 150,000 sharesto acquire Landworth$ 250,000 withapar

value of $100

20 sep 17

Received cash amounting to $300,000 to beexchanged for 200,000 shares. The par

value ofthe sharesatthetime ofthetransaction remained $100

1 oct 17

30 nov 17

Based on the evaluation, the company gets a net profit (net income) per 6

months of $700,000

Declared and paid dividendsto allshareholders with avalue of $25 pershare.

30 nov 17

a. Prepare journal entries for the transactions!

b. Calculate how much funding costs must be paid by the company from the 2 selected financing

schemes until November, 30 2017!

c. which one is more profitable issuing shares or issuing debt securities (see the event in question).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning