Public Corporation acquired 90 percent of Station Company's voting common stock on January 1, 20X1, for $502,200. At the time of the combination, Station reported common stock outstanding of $123,000 and retained earnings of $390,000, and the fair value of the noncontrolling interest was $55,800. The book value of Station's net assets approximated market value except for patents that had a market value of $45,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Station reported net income of $65,000 and paid dividends of $23,000 during 20x1. Required: a. What balance did Public report as its investment in Station at December 31, 20X1, assuming Public uses the equity method in accounting for its investment? Balance in investment account

Public Corporation acquired 90 percent of Station Company's voting common stock on January 1, 20X1, for $502,200. At the time of the combination, Station reported common stock outstanding of $123,000 and retained earnings of $390,000, and the fair value of the noncontrolling interest was $55,800. The book value of Station's net assets approximated market value except for patents that had a market value of $45,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Station reported net income of $65,000 and paid dividends of $23,000 during 20x1. Required: a. What balance did Public report as its investment in Station at December 31, 20X1, assuming Public uses the equity method in accounting for its investment? Balance in investment account

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 25CE

Related questions

Question

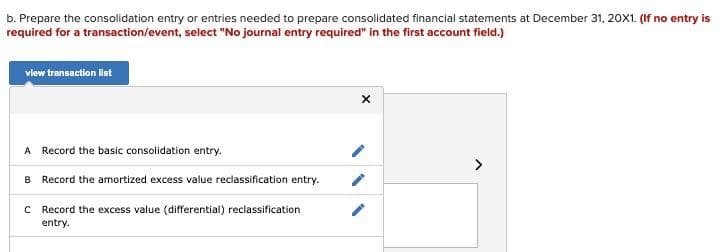

Transcribed Image Text:b. Prepare the consolidation entry or entries needed to prepare consolidated financial statements at December 31, 20X1. (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field.)

view transaction lat

A Record the basic consolidation entry.

>

B Record the amortized excess value reclassification entry.

C Record the excess value (differential) reclassification

entry.

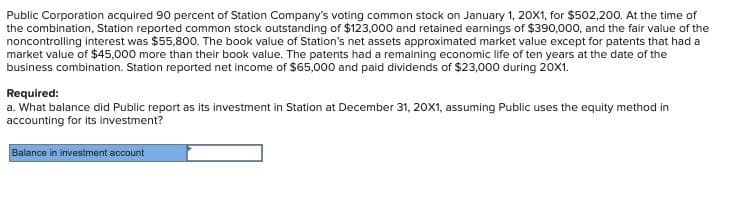

Transcribed Image Text:Public Corporation acquired 90 percent of Station Company's voting common stock on January 1, 20X1, for $502,200. At the time of

the combination, Station reported common stock outstanding of $123,000 and retained earnings of $390,000, and the fair value of the

noncontrolling interest was $55,800. The book value of Station's net assets approximated market value except for patents that had a

market value of $45,000 more than their book value. The patents had a remaining economic life of ten years at the date of the

business combination. Station reported net income of $65,000 and paid dividends of $23,000 during 20x1.

Required:

a. What balance did Public report as its investment in Station at December 31, 20X1, assuming Public uses the equity method in

accounting for its investment?

Balance in investment account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning