Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $52,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows: Item Current Assets Depreciable Assets Investment in Spirited Company Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company Proud Corporation Debit $ 255,000 518,000 133,280 23,000 148,000 53,000 Credit $ 200,000 63,000 127,880 193,000 277,000 231,000 38,400 $1,130,280 $1,130,280 Spirited Company Credit Debit $169,000 311,000 13,000 85,000 25,400 $ 78,000 43,000 192,400 87,000 57,000 146,000 $603,400 $603,400 Required: a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. (If no entry is

Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $52,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows: Item Current Assets Depreciable Assets Investment in Spirited Company Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company Proud Corporation Debit $ 255,000 518,000 133,280 23,000 148,000 53,000 Credit $ 200,000 63,000 127,880 193,000 277,000 231,000 38,400 $1,130,280 $1,130,280 Spirited Company Credit Debit $169,000 311,000 13,000 85,000 25,400 $ 78,000 43,000 192,400 87,000 57,000 146,000 $603,400 $603,400 Required: a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. (If no entry is

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 25CE

Related questions

Question

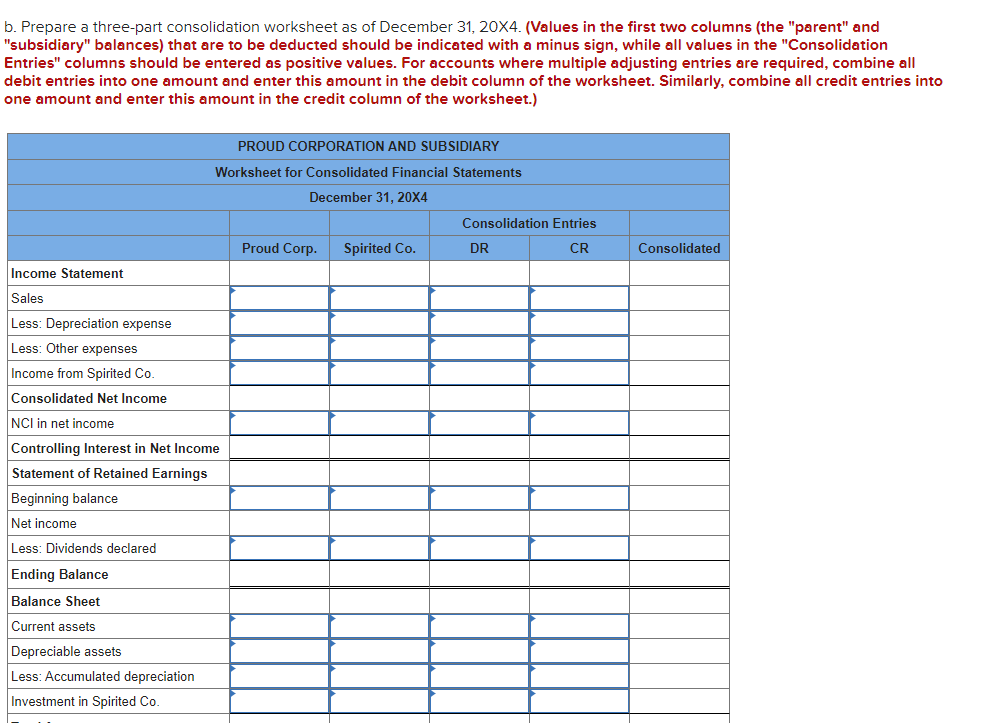

Transcribed Image Text:b. Prepare a three-part consolidation worksheet as of December 31, 20X4. (Values in the first two columns (the "parent" and

"subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation

Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all

debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into

one amount and enter this amount in the credit column of the worksheet.)

PROUD CORPORATION AND SUBSIDIARY

Worksheet for Consolidated Financial Statements

December 31, 20X4

Income Statement

Sales

Less: Depreciation expense

Less: Other expenses

Income from Spirited Co.

Consolidated Net Income

NCI in net income

Controlling Interest in Net Income

Statement of Retained Earnings

Beginning balance

Net income

Less: Dividends declared

Ending Balance

Balance Sheet

Current assets

Depreciable assets

Less: Accumulated depreciation

Investment in Spirited Co.

Proud Corp. Spirited Co.

Consolidation Entries

CR

DR

Consolidated

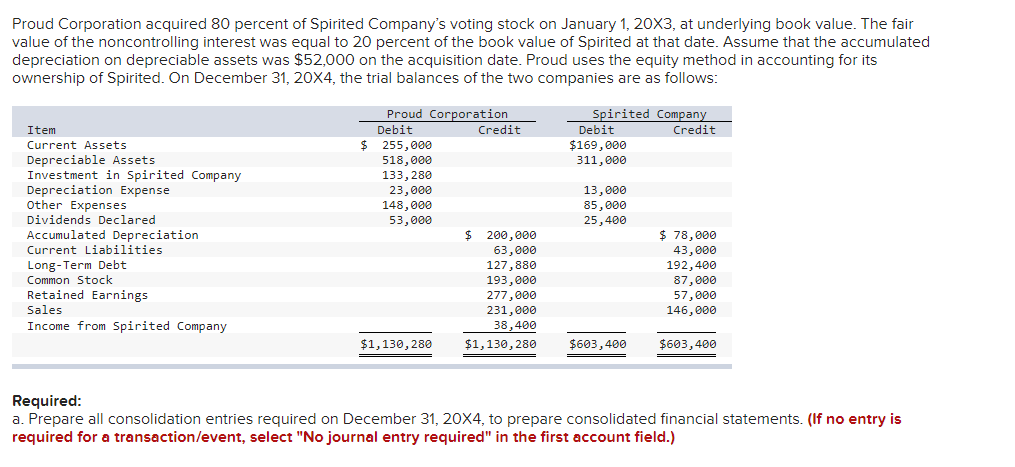

Transcribed Image Text:Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair

value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated

depreciation on depreciable assets was $52,000 on the acquisition date. Proud uses the equity method in accounting for its

ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows:

Item

Current Assets

Depreciable Assets

Investment in Spirited Company

Depreciation Expense

Other Expenses

Dividends Declared

Accumulated Depreciation

Current Liabilities

Long-Term Debt

Common Stock

Retained Earnings

Sales

Income from Spirited Company

$

Proud Corporation

Debit

255,000

518,000

133,280

23,000

148,000

53,000

Credit

$ 200,000

63,000

127,880

193,000

277,000

231,000

38,400

$1,130,280 $1,130,280

Spirited Company

Credit

Debit

$169,000

311,000

13,000

85,000

25,400

$603,400

$ 78,000

43,000

192,400

87,000

57,000

146,000

$603,400

Required:

a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning