Cupcakes - R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. O (Click the icon to view additional information.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements. Requirement a. Compute the carrying value of Cupcakes -R- Us's equipment. The carrying value of the baking equipment at the end of twe Years in

Cupcakes - R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. O (Click the icon to view additional information.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements. Requirement a. Compute the carrying value of Cupcakes -R- Us's equipment. The carrying value of the baking equipment at the end of twe Years in

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 9P

Related questions

Question

6

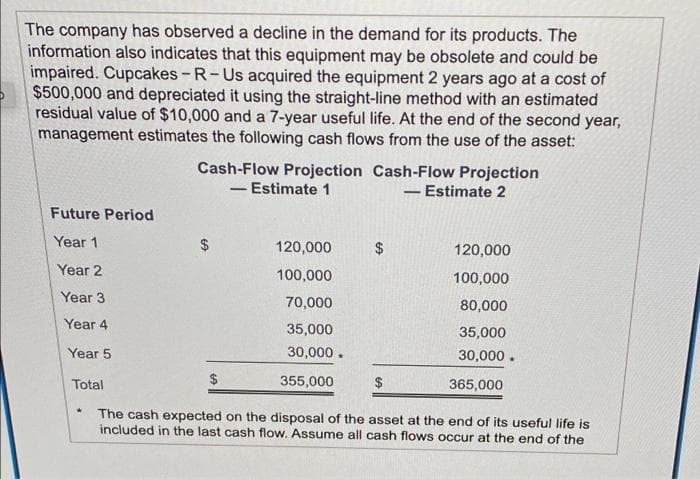

Transcribed Image Text:The company has observed a decline in the demand for its products. The

information also indicates that this equipment may be obsolete and could be

impaired. Cupcakes - R-Us acquired the equipment 2 years ago at a cost of

$500,000 and depreciated it using the straight-line method with an estimated

residual value of $10,000 and a 7-year useful life. At the end of the second year,

management estimates the following cash flows from the use of the asset:

Cash-Flow Projection Cash-Flow Projection

- Estimate 2

Estimate 1

-

Future Period

Year 1

$

120,000

$

120,000

Year 2

100,000

100,000

Year 3

70,000

80,000

Year 4

35,000

35,000

Year 5

30,000 .

30,000.

Total

$

355,000

$

365,000

The cash expected on the disposal of the asset at the end of its useful life is

included in the last cash flow. Assume all cash flows occur at the end of the

Transcribed Image Text:Part 1 of 8

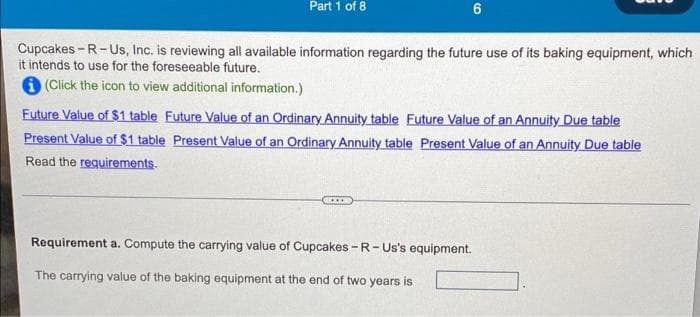

Cupcakes - R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which

it intends to use for the foreseeable future.

6 (Click the icon to view additional information.)

Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table

Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table

Read the requirements.

Requirement a. Compute the carrying value of Cupcakes - R- Us's equipment.

The carrying value of the baking equipment at the end of two years is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning