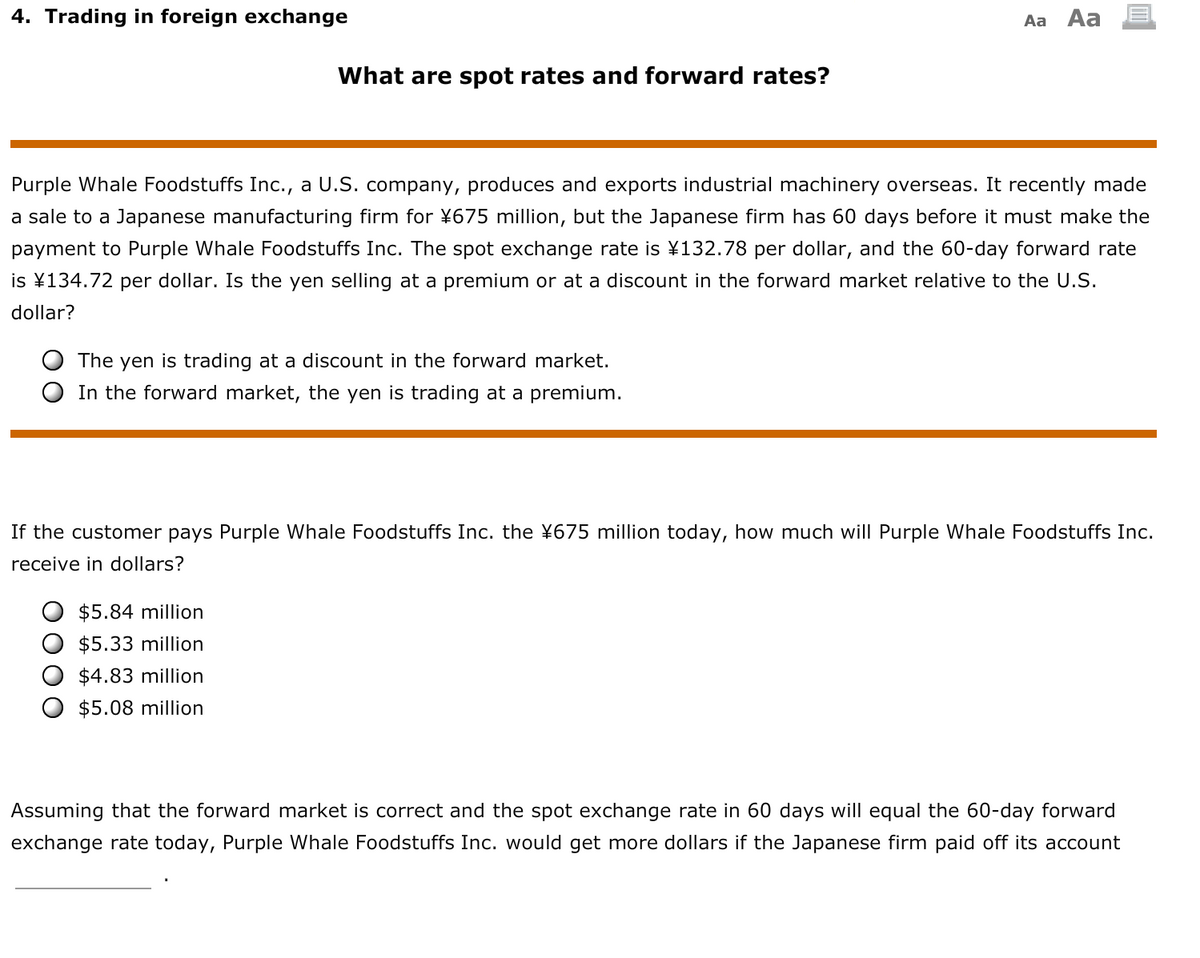

Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for ¥675 million, but the Japanese firm has 60 days before it must make the payment to Purple Whale Foodstuffs Inc. The spot exchange rate is ¥132.78 per dollar, and the 60-day forward rate s ¥134.72 per dollar. Is the yen selling at a premium or at a discount in the forward market relative to the U.S. dollar? The yen is trading at a discount in the forward market. In the forward market, the yen is trading at a premium. f the customer pays Purple Whale Foodstuffs Inc. the ¥675 million today, how much will Purple Whale Foodstuffs Inc. receive in dollars? $5.84 million $5.33 million $4.83 million $5.08 million Assuming that the forward market is correct and the spot exchange rate in 60 days will equal the 60-day forward exchange rate today, Purple Whale Foodstuffs Inc. would get more dollars if the Japanese firm paid off its account

Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for ¥675 million, but the Japanese firm has 60 days before it must make the payment to Purple Whale Foodstuffs Inc. The spot exchange rate is ¥132.78 per dollar, and the 60-day forward rate s ¥134.72 per dollar. Is the yen selling at a premium or at a discount in the forward market relative to the U.S. dollar? The yen is trading at a discount in the forward market. In the forward market, the yen is trading at a premium. f the customer pays Purple Whale Foodstuffs Inc. the ¥675 million today, how much will Purple Whale Foodstuffs Inc. receive in dollars? $5.84 million $5.33 million $4.83 million $5.08 million Assuming that the forward market is correct and the spot exchange rate in 60 days will equal the 60-day forward exchange rate today, Purple Whale Foodstuffs Inc. would get more dollars if the Japanese firm paid off its account

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 51QA

Related questions

Question

Transcribed Image Text:4. Trading in foreign exchange

Aa Aa

What are spot rates and forward rates?

Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made

a sale to a Japanese manufacturing firm for ¥675 million, but the Japanese firm has 60 days before it must make the

payment to Purple Whale Foodstuffs Inc. The spot exchange rate is ¥132.78 per dollar, and the 60-day forward rate

is ¥134.72 per dollar. Is the yen selling at a premium or at a discount in the forward market relative to the U.S.

dollar?

The yen is trading at a discount in the forward market.

In the forward market, the yen is trading at a premium.

If the customer pays Purple Whale Foodstuffs Inc. the ¥675 million today, how much will Purple Whale Foodstuffs Inc.

receive in dollars?

$5.84 million

$5.33 million

$4.83 million

$5.08 million

Assuming that the forward market is correct and the spot exchange rate in 60 days will equal the 60-day forward

exchange rate today, Purple Whale Foodstuffs Inc. would get more dollars if the Japanese firm paid off its account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning