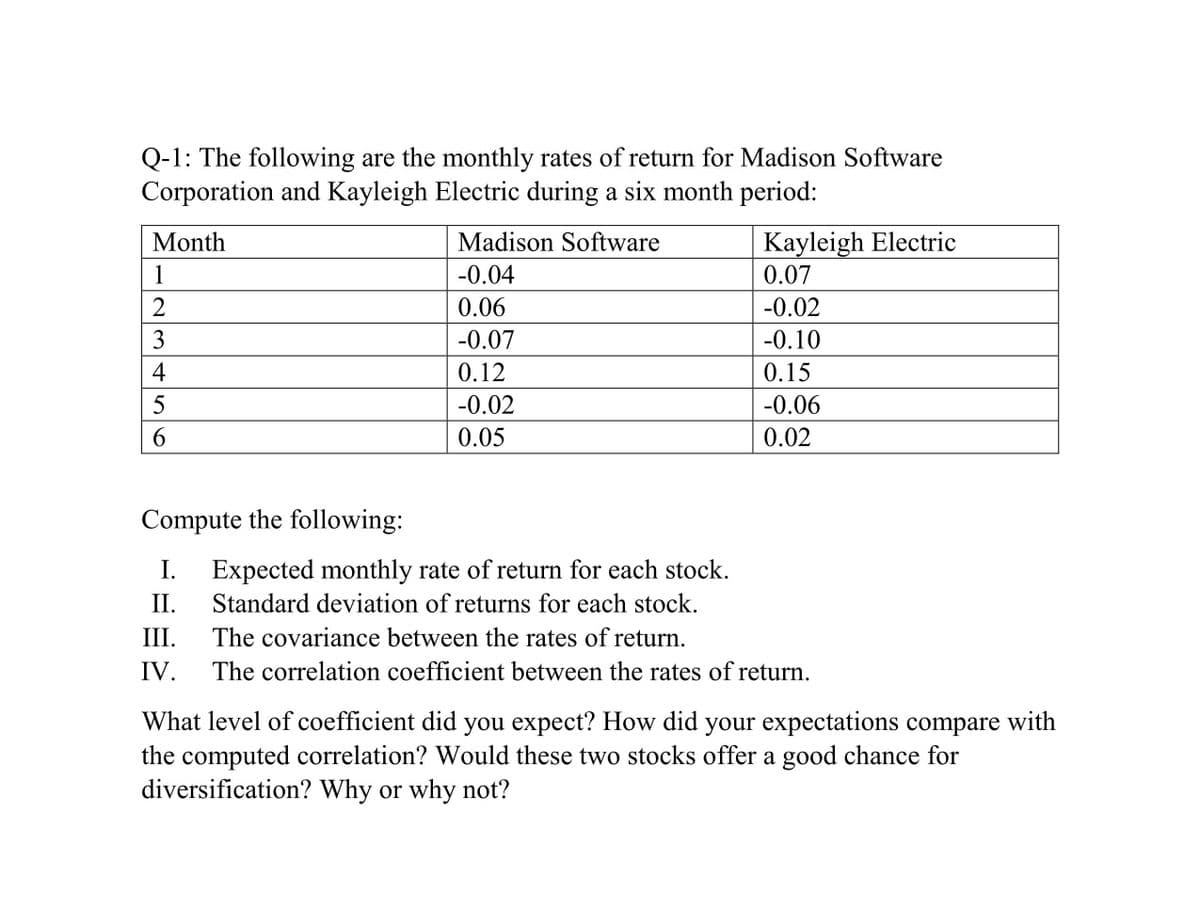

Q-1: The following are the monthly rates of return for Madison Software Corporation and Kayleigh Electric during a six month period: Month Madison Software Kayleigh Electric 1 -0.04 0.07 2 0.06 -0.02 3 -0.07 -0.10 4 0.12 0.15 5 -0.02 -0.06 6 0.05 0.02 Compute the following: I. Expected monthly rate of return for each stock. Standard deviation of returns for each stock. II. III. The covariance between the rates of return. IV. The correlation coefficient between the rates of return.

Q-1: The following are the monthly rates of return for Madison Software Corporation and Kayleigh Electric during a six month period: Month Madison Software Kayleigh Electric 1 -0.04 0.07 2 0.06 -0.02 3 -0.07 -0.10 4 0.12 0.15 5 -0.02 -0.06 6 0.05 0.02 Compute the following: I. Expected monthly rate of return for each stock. Standard deviation of returns for each stock. II. III. The covariance between the rates of return. IV. The correlation coefficient between the rates of return.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter6: Risk And Return

Section: Chapter Questions

Problem 4P: An analyst gathered daily stock returns for Feburary 1 through March 31, calculated the Fama-French...

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Q-1: The following are the monthly rates of return for Madison Software

Corporation and Kayleigh Electric during a six month period:

Month

Madison Software

Kayleigh Electric

1

-0.04

0.07

2

0.06

-0.02

3

-0.07

-0.10

4

0.12

0.15

5

-0.02

-0.06

6

0.05

0.02

Compute the following:

I. Expected monthly rate of return for each stock.

Standard deviation of returns for each stock.

II.

III.

The covariance between the rates of return.

IV.

The correlation coefficient between the rates of return.

What level of coefficient did you expect? How did your expectations compare with

the computed correlation? Would these two stocks offer a good chance for

diversification? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning